Making a difference in the lives of those in need is a noble endeavor, and one of the most effective ways to do so is through donations to reputable organizations like the Salvation Army. When it comes to donating to the Salvation Army, having a clear and concise record of your donations is crucial for tax purposes and to ensure that your generosity is accurately accounted for. This is where a Salvation Army itemized donation form comes in – a vital tool that helps donors like you keep track of their charitable giving.

The Salvation Army is one of the largest and most respected charitable organizations in the world, providing a wide range of services to those in need, including disaster relief, food and shelter, rehabilitation programs, and more. By donating to the Salvation Army, you are supporting these critical initiatives and making a tangible difference in the lives of countless individuals and families. Whether you're donating gently used clothing, household items, or financial resources, every contribution counts, and having a detailed record of your donations can be incredibly valuable.

In this article, we'll delve into the importance of using a Salvation Army itemized donation form, explore the benefits of doing so, and provide a comprehensive guide on how to fill out the form accurately. We'll also cover some frequently asked questions and offer tips on how to maximize your donations and make the most of your charitable giving.

Understanding the Salvation Army Itemized Donation Form

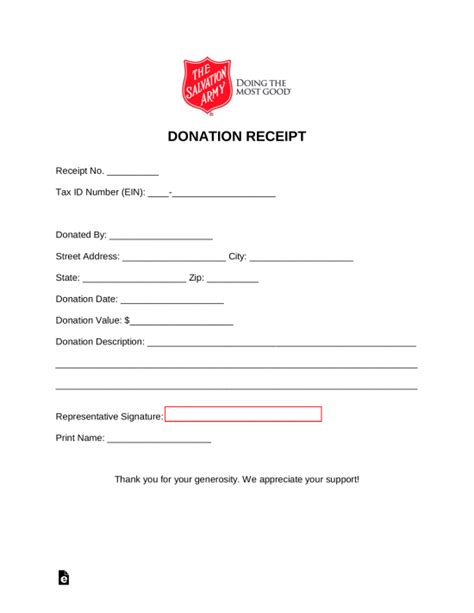

The Salvation Army itemized donation form is a document that allows donors to record and itemize their charitable donations. The form typically includes fields for donors to list the type and quantity of items donated, their estimated value, and the date of donation. This information is crucial for tax purposes, as donors may be eligible to claim a tax deduction for their charitable contributions.

Using an itemized donation form provides several benefits, including:

- Accurate record-keeping: By keeping a detailed record of your donations, you can ensure that you're accurately reporting your charitable giving and taking advantage of available tax deductions.

- Increased transparency: Itemizing your donations helps the Salvation Army and other charitable organizations maintain transparency and accountability in their financial reporting.

- Simplified tax preparation: Having a clear and concise record of your donations can make tax preparation easier and less stressful, as you'll have all the necessary information at your fingertips.

How to Fill Out a Salvation Army Itemized Donation Form

Filling out a Salvation Army itemized donation form is a straightforward process that requires some basic information. Here's a step-by-step guide to help you get started:

- Date of donation: Record the date you made the donation.

- Type of item: Describe the type of item you donated (e.g., clothing, household goods, furniture).

- Quantity: Enter the number of items you donated.

- Estimated value: Provide an estimated value for each item or group of items. You can use online resources or consult with a tax professional to determine the fair market value of your donations.

- Total value: Calculate the total value of your donations.

Tips for Maximizing Your Donations

To make the most of your charitable giving, consider the following tips:

- Keep receipts and records: Keep receipts and records of your donations, including the itemized donation form, to ensure that you have a clear and concise record of your charitable giving.

- Donate high-quality items: Donate items that are in good condition and have a high value to maximize the impact of your donations.

- Consult with a tax professional: Consult with a tax professional to ensure that you're taking advantage of available tax deductions and following all applicable tax laws and regulations.

Frequently Asked Questions

What is the Salvation Army itemized donation form?

+The Salvation Army itemized donation form is a document that allows donors to record and itemize their charitable donations.

Why is it important to use an itemized donation form?

+Using an itemized donation form provides accurate record-keeping, increased transparency, and simplified tax preparation.

How do I fill out a Salvation Army itemized donation form?

+Fill out the form by recording the date of donation, type of item, quantity, estimated value, and total value of your donations.

Conclusion

Making a difference in the lives of those in need is a rewarding and fulfilling experience, and using a Salvation Army itemized donation form is an essential part of the charitable giving process. By following the tips and guidelines outlined in this article, you can ensure that your donations are accurately recorded and that you're taking advantage of available tax deductions. Remember to keep receipts and records of your donations, donate high-quality items, and consult with a tax professional to maximize the impact of your charitable giving. Together, we can make a difference in the lives of those who need it most.