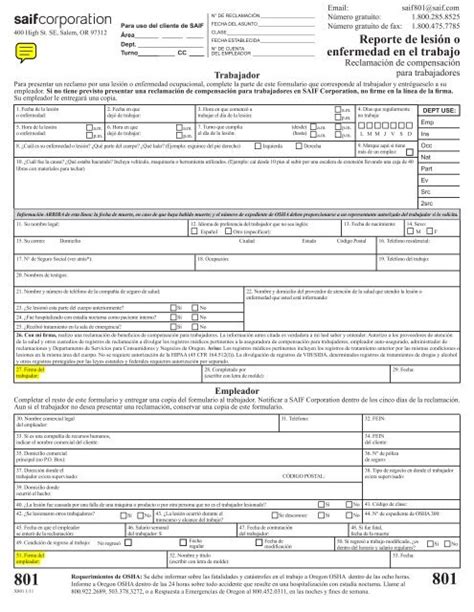

Filing taxes can be a daunting task, but with the right guidance, it can become a manageable process. The Saif 801 form, also known as the Statement of Estimated Tax, is a crucial document for individuals and businesses to estimate their tax liability for the year. In this article, we will delve into the world of the Saif 801 form and provide you with 5 essential tips to master it.

Understanding the Saif 801 Form

Before we dive into the tips, let's first understand what the Saif 801 form is and why it's important. The Saif 801 form is used to estimate an individual's or business's tax liability for the year. It's typically filed on a quarterly basis, and the due dates are April 15th, June 15th, September 15th, and January 15th of the following year. The form requires you to estimate your total tax liability, including self-employment tax, and make payments towards it.

Tip 1: Determine Your Filing Status

The first step in mastering the Saif 801 form is to determine your filing status. Your filing status will determine your tax rates, deductions, and credits. You can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Make sure to choose the correct filing status to avoid any errors or penalties.

Calculating Your Estimated Tax Liability

Calculating your estimated tax liability is a crucial step in completing the Saif 801 form. You'll need to estimate your total tax liability, including self-employment tax, for the year. You can use last year's tax return as a guide, but make sure to take into account any changes in your income, deductions, or credits.

Tip 2: Use the Correct Form and Schedule

The Saif 801 form consists of multiple schedules, and it's essential to use the correct form and schedule for your specific situation. For example, if you're self-employed, you'll need to complete Schedule C (Form 1040) to report your business income and expenses. Make sure to use the correct form and schedule to avoid any errors or penalties.

Annualizing Income and Expenses

If you have fluctuating income or expenses throughout the year, you may need to annualize your income and expenses. This means you'll need to calculate your income and expenses on a quarterly basis and make adjustments to your estimated tax liability accordingly.

Tip 3: Make Timely Payments

Making timely payments is essential to avoid any penalties or interest on your estimated tax liability. You can make payments online, by phone, or by mail. Make sure to keep a record of your payments, including the date and amount paid.

Tip 4: Keep Accurate Records

Keeping accurate records is essential to complete the Saif 801 form accurately. Make sure to keep records of your income, expenses, and tax-related documents, such as W-2s and 1099s. You may also need to keep records of your business income and expenses, including invoices, receipts, and bank statements.

Avoiding Penalties and Interest

Penalties and interest can add up quickly if you don't make timely payments or file your Saif 801 form accurately. To avoid penalties and interest, make sure to:

- Make timely payments

- File your Saif 801 form accurately and on time

- Keep accurate records

- Respond promptly to any notices or letters from the IRS

Tip 5: Seek Professional Help

If you're unsure about completing the Saif 801 form or need help with your estimated tax liability, consider seeking professional help. A tax professional can help you navigate the process and ensure you're in compliance with all tax laws and regulations.

Conclusion: Mastering the Saif 801 Form**

Mastering the Saif 801 form requires attention to detail, accurate record-keeping, and timely payments. By following these 5 essential tips, you can ensure you're in compliance with all tax laws and regulations and avoid any penalties or interest. Remember to seek professional help if you're unsure about any aspect of the process.

What is the Saif 801 form?

+The Saif 801 form is a Statement of Estimated Tax, used to estimate an individual's or business's tax liability for the year.

When is the Saif 801 form due?

+The Saif 801 form is due on a quarterly basis, with due dates of April 15th, June 15th, September 15th, and January 15th of the following year.

What happens if I don't make timely payments?

+If you don't make timely payments, you may be subject to penalties and interest on your estimated tax liability.