Filing a tax return can be a daunting task, especially when dealing with missing or lost refunds. The Internal Revenue Service (IRS) provides Form 3911, also known as the Taxpayer Statement Regarding Refund, to help taxpayers resolve issues related to their tax refunds. Completing this form correctly is crucial to ensure a successful resolution. In this article, we will guide you through the 7 steps to complete Form 3911 successfully.

Understanding the Purpose of Form 3911

Form 3911 is used to report missing or lost refunds, as well as to resolve issues related to a taxpayer's refund. The form is typically used when a taxpayer has not received their refund within a reasonable timeframe or when there is an issue with the refund amount.

Step 1: Gather Required Information

Before starting to fill out Form 3911, gather all the necessary information to ensure accuracy. This includes:

- Your name and Social Security number (or Individual Taxpayer Identification Number)

- The tax year and type of tax return (e.g., Form 1040, Form 1040A, etc.)

- The amount of the refund you are expecting

- The date you filed your tax return

- The method you used to file your tax return (e.g., e-file, mail, etc.)

The Benefits of Accurate Information

Providing accurate information is essential to ensure that your issue is resolved quickly and efficiently. Inaccurate information can lead to delays or even rejection of your request.

Step 2: Download and Complete Form 3911

You can download Form 3911 from the IRS website or obtain it by calling the IRS at 1-800-829-1040. Complete the form legibly and accurately, using black ink.

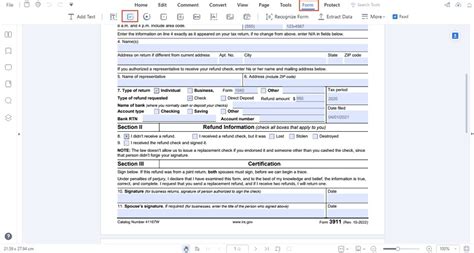

Understanding the Form 3911 Sections

The form is divided into sections, each requiring specific information. The sections include:

- Section 1: Taxpayer Information

- Section 2: Refund Information

- Section 3: Reason for Filing

Step 3: Fill Out Section 1 - Taxpayer Information

In this section, provide your name, Social Security number (or Individual Taxpayer Identification Number), and address.

Step 4: Fill Out Section 2 - Refund Information

In this section, provide the tax year, type of tax return, and the amount of the refund you are expecting.

The Importance of Refund Information

Providing accurate refund information is crucial to ensure that your issue is resolved correctly.

Step 5: Fill Out Section 3 - Reason for Filing

In this section, explain the reason for filing Form 3911. Be clear and concise, providing as much detail as possible.

Step 6: Attach Supporting Documentation

Attach any supporting documentation, such as a copy of your tax return, to Form 3911. This will help the IRS to process your request more efficiently.

The Benefits of Supporting Documentation

Attaching supporting documentation can help to expedite the processing of your request.

Step 7: Mail or Fax Form 3911

Mail or fax Form 3911 to the IRS address or fax number listed in the instructions. Make sure to keep a copy of the form and supporting documentation for your records.

Tips for a Successful Form 3911 Submission

- Use black ink to complete the form

- Make sure to sign and date the form

- Attach all supporting documentation

- Keep a copy of the form and supporting documentation for your records

By following these 7 steps, you can complete Form 3911 successfully and resolve issues related to your tax refund. Remember to provide accurate information, attach supporting documentation, and keep a copy of the form and supporting documentation for your records.

Additional Tips and Reminders

- Use the correct address and fax number when submitting Form 3911

- Make sure to follow the instructions carefully

- If you have any questions or concerns, contact the IRS at 1-800-829-1040

Getting Help with Form 3911

If you need help with completing Form 3911, you can:

- Contact the IRS at 1-800-829-1040

- Visit the IRS website at

- Consult with a tax professional

Share Your Experience

We would love to hear about your experience with completing Form 3911. Share your tips and advice in the comments section below.

What is Form 3911 used for?

+Form 3911 is used to report missing or lost refunds, as well as to resolve issues related to a taxpayer's refund.

What information do I need to gather before completing Form 3911?

+You will need to gather your name and Social Security number (or Individual Taxpayer Identification Number), the tax year and type of tax return, the amount of the refund you are expecting, the date you filed your tax return, and the method you used to file your tax return.

What happens if I provide inaccurate information on Form 3911?

+Inaccurate information can lead to delays or even rejection of your request. It is essential to provide accurate information to ensure a successful resolution.