As a taxpayer in Illinois, you're likely familiar with the RUT-50 form, which is used to report and pay taxes on vehicles purchased or leased outside of the state. Filling out this form can be a bit overwhelming, but don't worry, we've got you covered. In this article, we'll walk you through five ways to fill out the RUT-50 form Illinois correctly.

What is the RUT-50 Form?

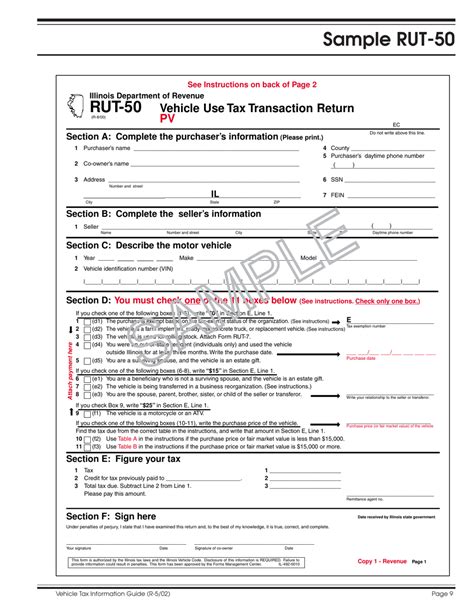

The RUT-50 form is a tax form used by the Illinois Department of Revenue to collect taxes on vehicles purchased or leased outside of the state. The form is used to report and pay taxes on vehicles that are not subject to Illinois sales tax, such as vehicles purchased from a private party or vehicles leased from a company.

Method 1: Fill Out the Form Online

One of the easiest ways to fill out the RUT-50 form is to do it online. The Illinois Department of Revenue website allows you to fill out the form electronically and submit it online. To do this, follow these steps:

- Go to the Illinois Department of Revenue website ()

- Click on the "Forms" tab and select "RUT-50"

- Fill out the form electronically, making sure to provide all required information

- Submit the form online and pay the required tax

Benefits of Filling Out the Form Online

Filling out the RUT-50 form online has several benefits, including:

- Convenience: You can fill out the form from the comfort of your own home, 24/7

- Accuracy: The online form will help ensure that you provide all required information

- Speed: You'll receive confirmation of submission immediately

Method 2: Fill Out the Form by Hand

If you prefer to fill out the form by hand, you can download and print the RUT-50 form from the Illinois Department of Revenue website. To do this, follow these steps:

- Go to the Illinois Department of Revenue website ()

- Click on the "Forms" tab and select "RUT-50"

- Download and print the form

- Fill out the form by hand, making sure to provide all required information

- Mail the completed form to the Illinois Department of Revenue

Benefits of Filling Out the Form by Hand

Filling out the RUT-50 form by hand has several benefits, including:

- No need for internet access

- Ability to review and revise the form before submitting it

- Option to mail the form to the Illinois Department of Revenue

Method 3: Use Tax Preparation Software

Another way to fill out the RUT-50 form is to use tax preparation software, such as TurboTax or H&R Block. These programs will guide you through the process of filling out the form and ensure that you provide all required information. To do this, follow these steps:

- Purchase and download tax preparation software

- Follow the program's instructions to fill out the RUT-50 form

- Review and revise the form as necessary

- Submit the form electronically or by mail

Benefits of Using Tax Preparation Software

Using tax preparation software to fill out the RUT-50 form has several benefits, including:

- Accuracy: The software will help ensure that you provide all required information

- Convenience: You can fill out the form from the comfort of your own home

- Speed: You'll receive confirmation of submission immediately

Method 4: Visit a Taxpayer Assistance Center

If you need help filling out the RUT-50 form, you can visit a Taxpayer Assistance Center (TAC) in person. TACs are located throughout Illinois and provide free assistance with tax-related issues. To do this, follow these steps:

- Find a TAC near you by visiting the Illinois Department of Revenue website ()

- Visit the TAC and provide all required information and documentation

- A representative will help you fill out the RUT-50 form and answer any questions you may have

Benefits of Visiting a TAC

Visiting a TAC to fill out the RUT-50 form has several benefits, including:

- Personalized assistance: You'll receive one-on-one help from a tax professional

- Accuracy: The representative will help ensure that you provide all required information

- Convenience: You can get help in person, rather than over the phone or online

Method 5: Hire a Tax Professional

Finally, you can hire a tax professional to fill out the RUT-50 form for you. This can be especially helpful if you're unsure about how to fill out the form or if you have complex tax issues. To do this, follow these steps:

- Find a tax professional in your area by searching online or asking for referrals

- Provide the tax professional with all required information and documentation

- The tax professional will fill out the RUT-50 form and submit it on your behalf

Benefits of Hiring a Tax Professional

Hiring a tax professional to fill out the RUT-50 form has several benefits, including:

- Expertise: The tax professional will have extensive knowledge of tax laws and regulations

- Convenience: You won't have to worry about filling out the form yourself

- Accuracy: The tax professional will help ensure that you provide all required information

What is the deadline for filing the RUT-50 form?

+The deadline for filing the RUT-50 form is within 30 days of purchasing or leasing a vehicle.

What is the penalty for not filing the RUT-50 form?

+The penalty for not filing the RUT-50 form is 5% of the tax due, plus a late payment fee.

Can I file the RUT-50 form electronically?

+Yes, you can file the RUT-50 form electronically through the Illinois Department of Revenue website.

In conclusion, filling out the RUT-50 form Illinois is a necessary step for taxpayers who have purchased or leased a vehicle outside of the state. By following one of the five methods outlined above, you can ensure that you fill out the form correctly and avoid any penalties. Remember to provide all required information and documentation, and don't hesitate to seek help if you need it.