Understanding the Importance of Rut 25 Illinois Form

Filling out forms can be a daunting task, especially when it comes to government-issued documents like the Rut 25 Illinois Form. This form is specifically designed for individuals and businesses to report their vehicle usage and calculate the required taxes and fees. However, the complexity of the form can lead to errors and delays in processing, which can be frustrating and costly. In this article, we will provide you with 5 tips to help you fill out the Rut 25 Illinois Form correctly, ensuring a smooth and efficient process.

Tips for Filling Out Rut 25 Illinois Form Correctly

Filling out the Rut 25 Illinois Form requires attention to detail and a thorough understanding of the form's requirements. Here are 5 tips to help you get it right:

1. Gather Required Information

Before starting to fill out the form, make sure you have all the necessary information and documents. This includes:

- Vehicle identification number (VIN)

- Vehicle year, make, and model

- Vehicle weight and capacity

- Business name and address (if applicable)

- Federal tax identification number (if applicable)

Having all the required information readily available will save you time and reduce the likelihood of errors.

Benefits of Gathering Required Information

- Reduces errors and delays in processing

- Ensures accurate calculation of taxes and fees

- Saves time and increases efficiency

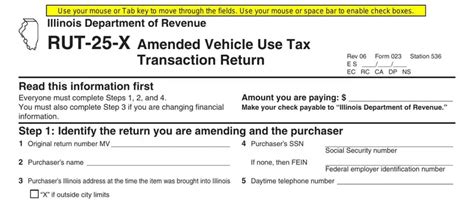

2. Understand the Form's Structure

The Rut 25 Illinois Form is divided into several sections, each with its own set of instructions and requirements. Understanding the form's structure will help you navigate it more easily and ensure that you complete all the necessary sections.

- Section 1: Vehicle Information

- Section 2: Business Information (if applicable)

- Section 3: Vehicle Usage

- Section 4: Taxes and Fees

Benefits of Understanding the Form's Structure

- Helps you navigate the form more easily

- Ensures that you complete all necessary sections

- Reduces errors and delays in processing

3. Calculate Taxes and Fees Accurately

Calculating taxes and fees is a critical part of filling out the Rut 25 Illinois Form. Make sure you understand the formulas and rates used to calculate the taxes and fees, and double-check your calculations to ensure accuracy.

- Use the Illinois Department of Revenue's tax calculator or consult with a tax professional if you're unsure

- Keep records of your calculations and supporting documentation

Benefits of Calculating Taxes and Fees Accurately

- Ensures that you pay the correct amount of taxes and fees

- Avoids penalties and fines for underpayment or overpayment

- Reduces errors and delays in processing

4. Sign and Date the Form

Once you've completed the form, make sure to sign and date it. This is an important step, as it confirms that the information provided is accurate and true.

- Use a black or blue pen to sign and date the form

- Make sure your signature is legible and matches the name on the form

Benefits of Signing and Dating the Form

- Confirms that the information provided is accurate and true

- Ensures that the form is valid and complete

- Reduces errors and delays in processing

5. Review and Proofread the Form

Finally, review and proofread the form carefully before submitting it. This is your last chance to catch any errors or omissions.

- Use a checklist to ensure that all sections are complete and accurate

- Double-check your calculations and supporting documentation

Benefits of Reviewing and Proofreading the Form

- Ensures that the form is accurate and complete

- Reduces errors and delays in processing

- Saves time and increases efficiency

Get It Right the First Time

Filling out the Rut 25 Illinois Form correctly is crucial to avoid errors and delays in processing. By following these 5 tips, you can ensure that your form is accurate, complete, and submitted on time. Remember to gather required information, understand the form's structure, calculate taxes and fees accurately, sign and date the form, and review and proofread the form carefully.

Take Action Today

Don't wait until it's too late. Take action today and fill out the Rut 25 Illinois Form correctly. If you're unsure or have questions, consult with a tax professional or contact the Illinois Department of Revenue for assistance.

What is the Rut 25 Illinois Form used for?

+The Rut 25 Illinois Form is used to report vehicle usage and calculate taxes and fees.

Who needs to fill out the Rut 25 Illinois Form?

+Individuals and businesses that own or operate vehicles in Illinois need to fill out the Rut 25 Illinois Form.

What are the consequences of filling out the Rut 25 Illinois Form incorrectly?

+Filling out the Rut 25 Illinois Form incorrectly can result in errors and delays in processing, as well as penalties and fines for underpayment or overpayment of taxes and fees.