Maricopa County, Arizona, is a vast and growing region, attracting many people to its vibrant cities and scenic landscapes. When it comes to managing and transferring property in Maricopa County, one crucial tool is the Beneficiary Deed Form. This document allows property owners to ensure their wishes are respected upon their passing, enabling a smooth transition of assets to their beneficiaries. Here, we will delve into seven key tips for understanding and utilizing the Maricopa County Beneficiary Deed Form effectively.

Understanding Beneficiary Deed Forms

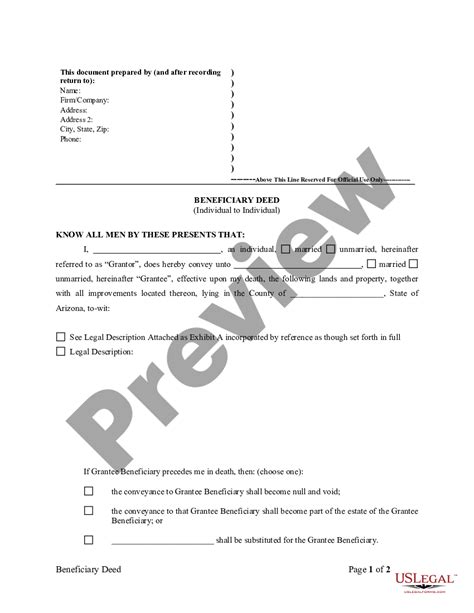

Beneficiary Deed Forms are estate planning tools that allow individuals to pass on their real estate properties to beneficiaries without the need for probate. This document specifies who should inherit the property upon the owner's death. Unlike a traditional will, a Beneficiary Deed does not distribute the property until the owner's passing, allowing for changes in the deed during the owner's lifetime.

Why Use a Beneficiary Deed Form in Maricopa County?

- Probate Avoidance: Beneficiary Deeds help bypass probate, a lengthy and often costly process that can delay the transfer of property.

- Flexibility: Until the owner's death, the deed can be modified or revoked.

- Clear Intentions: It clearly communicates the owner's wishes, reducing potential disputes among beneficiaries.

Tips for Using the Maricopa County Beneficiary Deed Form

1. Understand the Purpose

Recognize that the Beneficiary Deed Form is a way to plan for the future distribution of your property without the need for probate. It's essential to understand its purpose and limitations before proceeding.

2. Choose Beneficiaries Wisely

Select beneficiaries carefully, considering relationships, financial needs, and your overall estate plan. You can name individuals, trusts, or entities as beneficiaries, providing flexibility in your estate planning.

3. Consider Joint Ownership

Before creating a Beneficiary Deed, consider the implications of joint ownership. Jointly owned properties often transfer automatically to the surviving owner, which might impact your estate plan.

4. Consult an Attorney

Estate planning can be complex. Consulting with an attorney specializing in estate law in Maricopa County can ensure your Beneficiary Deed Form is completed correctly and aligns with your broader estate plan.

5. Review and Update

Regularly review your Beneficiary Deed to ensure it reflects your current wishes. Changes in personal circumstances, such as divorce or the birth of children, may necessitate updates to your deed.

6. File the Deed Correctly

After completing the Beneficiary Deed Form, it's crucial to file it with the Maricopa County Recorder's Office. Proper filing ensures the deed becomes part of the public record, making it easier for your wishes to be respected upon your passing.

7. Combine with Other Estate Planning Tools

A Beneficiary Deed Form should be part of a comprehensive estate plan. Consider combining it with a will, trusts, and powers of attorney to ensure all aspects of your estate are covered.

Final Thoughts

The Maricopa County Beneficiary Deed Form is a valuable tool for anyone looking to manage their property's future distribution effectively. By understanding its purpose, considering key factors, and integrating it into a broader estate plan, individuals can ensure their wishes are respected and their loved ones are protected.

Encouragement for Further Engagement

Now that you've gained insight into the Maricopa County Beneficiary Deed Form, take the next step in securing your estate's future. Whether it's consulting an attorney, reviewing your current estate plan, or simply learning more about the process, every step forward is a step closer to peace of mind. Share this article with friends or family who may benefit from this information, and don't hesitate to ask questions in the comments below.

What is a Beneficiary Deed Form used for?

+A Beneficiary Deed Form is used to pass on real estate properties to beneficiaries without the need for probate, ensuring a smooth transition of assets.

How do I file a Beneficiary Deed Form in Maricopa County?

+After completing the Beneficiary Deed Form, it must be filed with the Maricopa County Recorder's Office to become part of the public record.

Can I change my Beneficiary Deed Form?

+Yes, until the owner's death, the Beneficiary Deed can be modified or revoked, providing flexibility in estate planning.