If you're a railroad employee, you're likely familiar with the unique tax forms that come with your job. One of the most important forms you'll need to understand is the RRB 1099 form, also known as the Railroad Retirement Tax Form. In this article, we'll delve into the world of railroad retirement tax forms, explaining what the RRB 1099 form is, how it works, and what you need to know to ensure you're taking advantage of the benefits available to you.

As a railroad employee, you're part of a select group of workers who are eligible for specialized retirement benefits. The Railroad Retirement Board (RRB) is responsible for administering these benefits, which include a unique tax system that sets railroad employees apart from other workers. Understanding the RRB 1099 form is crucial to ensuring you're meeting your tax obligations and maximizing your retirement benefits.

What is the RRB 1099 Form?

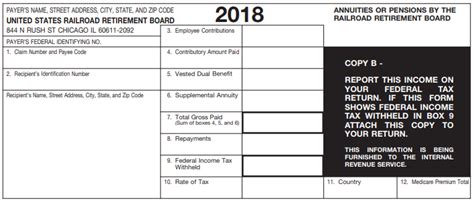

The RRB 1099 form is a tax document that reports the amount of railroad retirement benefits you received during the tax year. This form is typically mailed to you by the RRB in January or February of each year, and it's essential to review it carefully to ensure the information is accurate.

The RRB 1099 form includes important details about your railroad retirement benefits, including:

- The gross amount of benefits you received

- The amount of taxes withheld

- The amount of benefits that are taxable

- The amount of benefits that are non-taxable

How Does the RRB 1099 Form Work?

The RRB 1099 form is used to report the amount of railroad retirement benefits you received during the tax year. The form is divided into several sections, each of which provides specific information about your benefits.

- Section 1: This section reports the gross amount of benefits you received during the tax year.

- Section 2: This section reports the amount of taxes withheld from your benefits.

- Section 3: This section reports the amount of benefits that are taxable.

- Section 4: This section reports the amount of benefits that are non-taxable.

Benefits of the RRB 1099 Form

The RRB 1099 form provides several benefits to railroad employees, including:

- Accurate tax reporting: The form ensures that you're reporting the correct amount of railroad retirement benefits on your tax return.

- Tax withholding: The form allows you to adjust your tax withholding to avoid underpayment or overpayment of taxes.

- Retirement planning: The form provides valuable information about your retirement benefits, which can help you plan for your future.

Common Mistakes to Avoid

When dealing with the RRB 1099 form, it's essential to avoid common mistakes that can lead to errors or delays in processing your tax return. Some common mistakes to avoid include:

- Failing to report all benefits: Make sure to report all railroad retirement benefits you received during the tax year.

- Incorrect tax withholding: Ensure that you're withholding the correct amount of taxes from your benefits.

- Failing to file on time: File your tax return on time to avoid penalties and interest.

How to File Your RRB 1099 Form

Filing your RRB 1099 form is a straightforward process that can be completed online or by mail. Here's a step-by-step guide to help you file your form:

- Gather your documents: Collect your RRB 1099 form and any other relevant tax documents.

- Review your form: Carefully review your RRB 1099 form to ensure the information is accurate.

- Complete your tax return: Use the information on your RRB 1099 form to complete your tax return.

- File your tax return: File your tax return online or by mail, making sure to include your RRB 1099 form.

RRB 1099 Form FAQs

Here are some frequently asked questions about the RRB 1099 form:

Q: What is the deadline for filing my RRB 1099 form? A: The deadline for filing your RRB 1099 form is typically April 15th of each year.

Q: Can I file my RRB 1099 form online? A: Yes, you can file your RRB 1099 form online through the RRB website.

Q: What if I made a mistake on my RRB 1099 form? A: If you made a mistake on your RRB 1099 form, you can correct it by filing an amended tax return.

What is the RRB 1099 form used for?

+The RRB 1099 form is used to report the amount of railroad retirement benefits you received during the tax year.

How do I file my RRB 1099 form?

+You can file your RRB 1099 form online or by mail, making sure to include your RRB 1099 form with your tax return.

What if I have questions about my RRB 1099 form?

+If you have questions about your RRB 1099 form, you can contact the RRB directly for assistance.

In conclusion, the RRB 1099 form is an essential tax document that provides valuable information about your railroad retirement benefits. By understanding how the form works and avoiding common mistakes, you can ensure that you're meeting your tax obligations and maximizing your retirement benefits. If you have any questions or concerns, don't hesitate to reach out to the RRB for assistance. Share this article with your fellow railroad employees to help them understand the importance of the RRB 1099 form.