Direct deposit is a convenient and efficient way to receive payments, and NCSECU (North Carolina State Employees' Credit Union) offers a simple enrollment process for its members. In this article, we will guide you through the easy steps to enroll and set up direct deposit with NCSECU.

Benefits of Direct Deposit with NCSECU

Direct deposit with NCSECU offers several benefits, including:

- Convenience: No need to visit a branch or ATM to deposit your paycheck or other regular payments.

- Faster access to funds: Your money is deposited directly into your account, making it available for use immediately.

- Reduced risk of lost or stolen checks: Direct deposit eliminates the risk of lost or stolen checks, ensuring that your payments are secure.

- Environmentally friendly: By reducing the need for paper checks, direct deposit is an eco-friendly option.

Who is Eligible for NCSECU Direct Deposit?

To be eligible for NCSECU direct deposit, you must:

- Be a member of NCSECU

- Have a valid checking or savings account with NCSECU

- Provide the required enrollment information, including your account number and routing number

Types of Payments Eligible for Direct Deposit

NCSECU accepts various types of payments for direct deposit, including:

- Payroll

- Social Security benefits

- Retirement benefits

- Tax refunds

- Other regular payments

How to Enroll in NCSECU Direct Deposit

To enroll in NCSECU direct deposit, follow these easy steps:

- Gather required information: You will need your NCSECU account number, routing number, and the name and address of your employer or the payer.

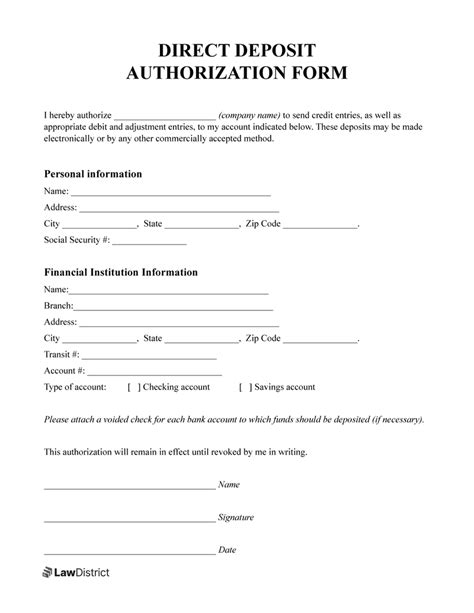

- Obtain a direct deposit form: You can download the NCSECU direct deposit form from the NCSECU website or pick one up at a branch.

- Complete the form: Fill out the form with the required information and sign it.

- Submit the form: Return the completed form to your employer or the payer, or submit it to NCSECU via fax or mail.

Setting Up Direct Deposit with NCSECU

Once you have enrolled in NCSECU direct deposit, you can set up the service by:

- Logging in to your online banking account: Access your NCSECU online banking account to verify that the direct deposit is set up correctly.

- Verifying your account information: Ensure that your account number and routing number are correct.

- Setting up notifications: You can set up notifications to alert you when a direct deposit is made to your account.

Common Issues with NCSECU Direct Deposit

If you encounter any issues with your NCSECU direct deposit, you can:

- Contact NCSECU customer service: Reach out to NCSECU customer service for assistance with resolving the issue.

- Check your account information: Verify that your account information is correct and up-to-date.

- Verify the status of your direct deposit: Check the status of your direct deposit to ensure that it is processing correctly.

Conclusion

Enrolling and setting up direct deposit with NCSECU is a straightforward process that offers numerous benefits, including convenience, faster access to funds, and reduced risk of lost or stolen checks. By following the easy steps outlined in this article, you can start enjoying the advantages of direct deposit with NCSECU.

We encourage you to share your experiences with NCSECU direct deposit in the comments below. If you have any questions or need further assistance, please don't hesitate to ask.

What is the NCSECU direct deposit form?

+The NCSECU direct deposit form is a document that you must complete and submit to enroll in direct deposit with NCSECU.

How long does it take to set up direct deposit with NCSECU?

+The setup process typically takes a few days to a week, depending on the processing time of your employer or the payer.

Can I set up direct deposit with NCSECU online?

+Yes, you can set up direct deposit with NCSECU online through your online banking account.