As a Robinhood investor, understanding the tax implications of your investments is crucial to avoid any unexpected surprises during tax season. One of the most important tax documents you'll receive from Robinhood is the 1099 form. In this article, we'll delve into the world of Robinhood 1099 forms, explaining what they are, how to read them, and how to report the information on your tax return.

What is a Robinhood 1099 Form?

A Robinhood 1099 form is a tax document that reports the income you've earned from your investments on the Robinhood platform. The form is typically sent to you by January 31st of each year and covers the previous tax year. The 1099 form is used to report various types of income, including:

- Dividends

- Capital gains

- Interest

- Other income

Types of Robinhood 1099 Forms

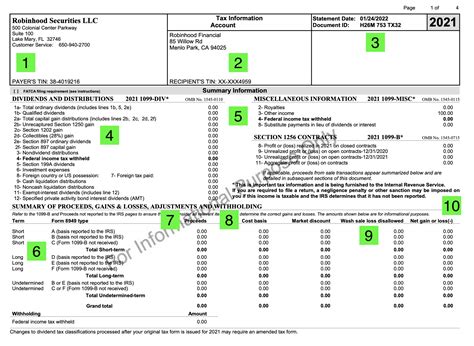

There are several types of 1099 forms that Robinhood may send to you, depending on the type of investments you hold and the income you've earned. The most common types of 1099 forms include:

- 1099-DIV: Reports dividend income

- 1099-B: Reports capital gains and losses

- 1099-INT: Reports interest income

- 1099-MISC: Reports other income, such as fees and commissions

How to Read a Robinhood 1099 Form

Reading a Robinhood 1099 form can be overwhelming, especially if you're new to investing. Here's a breakdown of the different sections of the form:

- Box 1a: Ordinary Dividends: Reports the total amount of ordinary dividends you've earned from your investments.

- Box 1b: Qualified Dividends: Reports the total amount of qualified dividends you've earned from your investments.

- Box 2a: Total Capital Gains: Reports the total amount of capital gains you've earned from selling securities.

- Box 3: Interest Income: Reports the total amount of interest income you've earned from your investments.

How to Report Robinhood 1099 Form Income on Your Tax Return

Reporting the income from your Robinhood 1099 form on your tax return is relatively straightforward. Here are the steps to follow:

- Dividend Income: Report the total amount of dividend income from Box 1a of your 1099-DIV form on Line 3a of your Form 1040.

- Capital Gains: Report the total amount of capital gains from Box 2a of your 1099-B form on Schedule D of your Form 1040.

- Interest Income: Report the total amount of interest income from Box 3 of your 1099-INT form on Line 2a of your Form 1040.

Tax Obligations for Robinhood Investors

As a Robinhood investor, you're responsible for reporting the income from your investments on your tax return. Here are some key tax obligations to keep in mind:

- Tax Brackets: Your investment income will be taxed according to your tax bracket.

- Long-Term Capital Gains: If you hold securities for more than one year, you may be eligible for long-term capital gains treatment, which can result in lower tax rates.

- Wash Sales: If you sell a security at a loss and buy a "substantially identical" security within 30 days, you may be subject to wash sale rules, which can disallow the loss.

Tips for Minimizing Tax Liability as a Robinhood Investor

Here are some tips for minimizing your tax liability as a Robinhood investor:

- Tax-Loss Harvesting: Offset gains from selling securities by selling other securities at a loss.

- Long-Term Investing: Hold securities for more than one year to qualify for long-term capital gains treatment.

- Tax-Efficient Investing: Invest in tax-efficient securities, such as index funds or ETFs.

Common Mistakes to Avoid as a Robinhood Investor

Here are some common mistakes to avoid as a Robinhood investor:

- Not Reporting Income: Failing to report income from your investments on your tax return.

- Not Keeping Accurate Records: Failing to keep accurate records of your investments, including purchases, sales, and dividends.

- Not Understanding Tax Obligations: Failing to understand your tax obligations as an investor.

As a Robinhood investor, understanding the tax implications of your investments is crucial to avoiding unexpected surprises during tax season. By following the tips and guidelines outlined in this article, you can minimize your tax liability and ensure a smooth tax filing experience.

We encourage you to comment below with any questions or concerns you may have about Robinhood 1099 forms or tax obligations as an investor. Share this article with fellow investors to help them navigate the complex world of tax obligations.

What is a Robinhood 1099 form?

+A Robinhood 1099 form is a tax document that reports the income you've earned from your investments on the Robinhood platform.

How do I report Robinhood 1099 form income on my tax return?

+Report the income from your Robinhood 1099 form on your tax return according to the instructions outlined in this article.

What are some common mistakes to avoid as a Robinhood investor?

+Common mistakes to avoid include not reporting income, not keeping accurate records, and not understanding tax obligations.