In the realm of tax compliance, various forms and regulations govern the interactions between employers, employees, and the government. Among these, the Rji Form NY holds significant importance for New York-based employers. Understanding the intricacies of this form can help streamline compliance and avoid any potential issues. Let's delve into the essential facts about the Rji Form NY that you need to know.

What is the Rji Form NY?

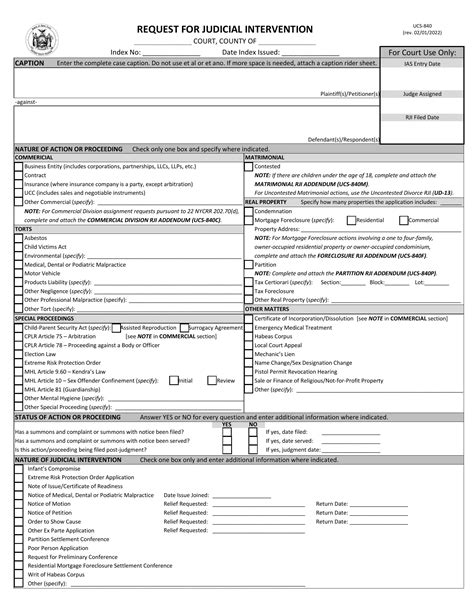

The Rji Form NY, also known as the Request for Judgment (Income Execution) form, is a critical document used by the New York State Department of Taxation and Finance. Employers in New York use this form to report income and wages earned by their employees. The primary purpose of the Rji Form NY is to facilitate the withholding and reporting of state income taxes.

Key Components of the Rji Form NY

The Rji Form NY comprises several essential sections that employers must complete accurately:

- Employee Information: This section requires the employee's name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Employer Information: Employers must provide their business name, address, and Federal Employer Identification Number (FEIN).

- Wage and Tax Information: This section details the employee's wages, including the amount of New York State income tax withheld.

- Certification: Employers must sign and date the form to certify the accuracy of the information provided.

Why is the Rji Form NY Important?

The Rji Form NY plays a vital role in ensuring compliance with New York State tax regulations. By accurately completing and submitting this form, employers can:

- Avoid Penalties: Failure to file the Rji Form NY or provide accurate information can result in significant penalties and fines.

- Maintain Compliance: Employers can ensure they are meeting their tax obligations and avoiding any potential issues with the state.

- Support Employee Tax Compliance: The Rji Form NY helps employees fulfill their tax obligations by providing necessary documentation for their tax returns.

Common Challenges and Solutions

Employers may encounter challenges when completing the Rji Form NY. To overcome these, consider the following solutions:

- Seek Professional Guidance: Consult with a tax professional or accountant to ensure accurate completion of the form.

- Utilize Online Resources: The New York State Department of Taxation and Finance website offers guidance and resources to help employers navigate the process.

- Double-Check Information: Verify employee and employer information to avoid errors and potential penalties.

Best Practices for Filing the Rji Form NY

To ensure a smooth and efficient process, follow these best practices when filing the Rji Form NY:

- File Electronically: Submit the form electronically through the New York State Department of Taxation and Finance website to reduce errors and processing time.

- Verify Employee Information: Confirm employee details to ensure accuracy and avoid potential issues.

- Maintain Records: Keep accurate records of filed forms and supporting documentation for future reference.

Tips for Employers

To ensure compliance and avoid common pitfalls, consider the following tips:

- Stay Up-to-Date: Familiarize yourself with changes to tax regulations and updates to the Rji Form NY.

- Seek Support: Reach out to tax professionals or the New York State Department of Taxation and Finance for guidance and support.

- Prioritize Accuracy: Double-check information to ensure accuracy and avoid potential penalties.

Conclusion and Next Steps

In conclusion, the Rji Form NY is a critical document for New York-based employers. By understanding the essential facts and best practices outlined above, employers can ensure compliance with state tax regulations and avoid potential issues. To further support your tax compliance efforts, consider consulting with a tax professional or seeking guidance from the New York State Department of Taxation and Finance.

If you have any questions or need further clarification on the Rji Form NY, please don't hesitate to comment below. Share your experiences and tips for navigating the process, and let's work together to ensure compliance and success.

What is the purpose of the Rji Form NY?

+The Rji Form NY is used by employers in New York to report income and wages earned by their employees and to facilitate the withholding and reporting of state income taxes.

What are the key components of the Rji Form NY?

+The key components of the Rji Form NY include employee information, employer information, wage and tax information, and certification.

Why is the Rji Form NY important?

+The Rji Form NY is important because it helps employers avoid penalties, maintain compliance with state tax regulations, and support employee tax compliance.