As a resident of Ohio, it's essential to understand the importance of filing taxes accurately and on time. One of the critical forms required for Ohio residents is the Rita Ohio Form 37, also known as the Ohio Individual Income Tax Return. Filling out this form can be a daunting task, especially for those who are new to tax filing or have complex financial situations. In this article, we will guide you through five ways to fill out the Rita Ohio Form 37 accurately and efficiently.

Understanding the Rita Ohio Form 37

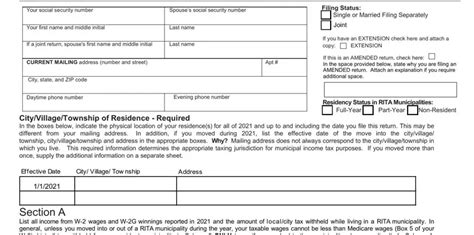

The Rita Ohio Form 37 is used to report an individual's income, deductions, and credits to the Ohio Department of Taxation. The form consists of multiple sections, including income, adjustments, deductions, credits, and tax calculations. It's crucial to understand the various components of the form to ensure accurate completion.

Benefits of Accurate Filing

Filing the Rita Ohio Form 37 accurately and on time can provide several benefits, including:

- Avoiding penalties and fines

- Receiving refunds or credits in a timely manner

- Reducing the risk of audits and examinations

- Ensuring compliance with Ohio tax laws

Method 1: E-Filing with Tax Preparation Software

One of the most convenient and efficient ways to fill out the Rita Ohio Form 37 is by using tax preparation software. These programs, such as TurboTax or H&R Block, guide you through the filing process and perform calculations automatically. E-filing with tax preparation software can also reduce errors and ensure accurate completion.

- Benefits:

- Convenient and easy to use

- Automatic calculations and error checking

- Fast refund processing

- Drawbacks:

- May require subscription or fees

- Limited support for complex tax situations

Popular Tax Preparation Software

Some popular tax preparation software options for e-filing the Rita Ohio Form 37 include:

- TurboTax

- H&R Block

- TaxAct

- Credit Karma Tax

Method 2: Manual Filing with Paper Forms

For those who prefer a more traditional approach, manual filing with paper forms is still an option. You can obtain the Rita Ohio Form 37 from the Ohio Department of Taxation website or by contacting your local tax office. Manual filing requires careful attention to detail and accurate calculations to avoid errors.

- Benefits:

- No software or subscription fees

- Suitable for simple tax situations

- Environmentally friendly option

- Drawbacks:

- Time-consuming and labor-intensive

- Prone to errors and inaccuracies

- May require additional forms and schedules

Tips for Manual Filing

To ensure accurate manual filing, follow these tips:

- Use black ink and write clearly

- Make sure to sign and date the form

- Attach all required schedules and forms

- Double-check calculations and entries

Method 3: Hiring a Tax Professional

For those with complex tax situations or limited time, hiring a tax professional can be an excellent option. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have extensive knowledge and experience with tax laws and regulations.

- Benefits:

- Expert guidance and support

- Accurate and efficient filing

- Representation in case of audits or examinations

- Drawbacks:

- May require higher fees

- Limited availability in rural areas

Qualities to Look for in a Tax Professional

When hiring a tax professional, look for the following qualities:

- Experience with Ohio tax laws and regulations

- Professional certifications (CPA, EA, or ATP)

- Good communication and interpersonal skills

- Ability to explain complex tax concepts in simple terms

Method 4: Using the Ohio Department of Taxation Website

The Ohio Department of Taxation website offers a range of resources and tools to help with filling out the Rita Ohio Form 37. You can access the form, instructions, and FAQs, as well as submit your return electronically.

- Benefits:

- Convenient and easy to use

- Access to resources and guidance

- Fast and secure submission

- Drawbacks:

- Limited support for complex tax situations

- May require additional software or plugins

Additional Resources on the Ohio Department of Taxation Website

The Ohio Department of Taxation website provides additional resources, including:

- Taxpayer service centers

- Tax forms and instructions

- FAQs and guides

- Electronic filing options

Method 5: Using a Tax Preparation Service

Tax preparation services, such as H&R Block or Jackson Hewitt, offer a range of services, including tax preparation and filing. These services often have experienced tax professionals who can guide you through the process and ensure accurate completion.

- Benefits:

- Convenient and easy to use

- Access to experienced tax professionals

- Fast and secure submission

- Drawbacks:

- May require fees or subscriptions

- Limited availability in rural areas

Choosing the Right Tax Preparation Service

When selecting a tax preparation service, consider the following factors:

- Experience with Ohio tax laws and regulations

- Professional certifications (CPA, EA, or ATP)

- Good communication and interpersonal skills

- Ability to explain complex tax concepts in simple terms

What is the deadline for filing the Rita Ohio Form 37?

+The deadline for filing the Rita Ohio Form 37 is typically April 15th of each year.

Can I file the Rita Ohio Form 37 electronically?

+What are the penalties for late filing or inaccurate completion of the Rita Ohio Form 37?

+The penalties for late filing or inaccurate completion of the Rita Ohio Form 37 can include fines, interest, and even audits or examinations.

In conclusion, filling out the Rita Ohio Form 37 requires careful attention to detail and accurate calculations. By choosing the right method, whether it's e-filing with tax preparation software, manual filing with paper forms, hiring a tax professional, using the Ohio Department of Taxation website, or utilizing a tax preparation service, you can ensure accurate and efficient completion of the form. Remember to stay organized, follow instructions carefully, and seek guidance when needed to avoid errors and penalties.