Completing regulatory forms correctly is a crucial aspect of maintaining compliance in various industries. The REG 262 form, specifically, is a critical document that requires attention to detail to avoid errors and potential penalties. In this article, we will delve into the importance of accurate form completion, provide an overview of the REG 262 form, and offer five ways to ensure you complete it correctly.

The REG 262 form is a widely used document in the financial services industry, particularly in the United Kingdom. It is a crucial tool for firms to report their financial transactions and maintain regulatory compliance. The form is used to report transactions related to client money and assets, and its accuracy is essential to ensure the integrity of financial markets.

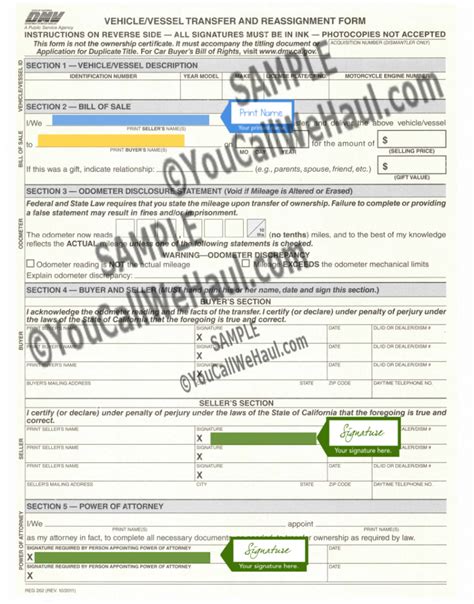

Understanding the REG 262 Form

The REG 262 form is a lengthy document that requires careful completion. It consists of multiple sections, each focusing on specific aspects of financial transactions. The form is designed to capture detailed information about client money and assets, including transaction types, amounts, and dates.

Key Components of the REG 262 Form

- Section 1: Firm details and transaction types

- Section 2: Client money and asset transactions

- Section 3: Reconciliation of client money and assets

- Section 4: Additional information and declarations

5 Ways to Complete the REG 262 Form Correctly

Completing the REG 262 form correctly requires attention to detail, a thorough understanding of the form's requirements, and a systematic approach. Here are five ways to ensure accurate completion:

1. Read the Instructions Carefully

Before starting to complete the form, read the instructions carefully. The instructions provide essential guidance on the form's requirements, including the types of transactions to be reported, the format for reporting, and the deadlines for submission.

2. Gather All Necessary Information

Gather all necessary information before starting to complete the form. This includes client details, transaction records, and financial statements. Ensure that all information is accurate and up-to-date to avoid errors.

3. Use the Correct Format

Use the correct format for reporting transactions. The REG 262 form requires specific formatting for dates, amounts, and transaction types. Ensure that all information is reported in the correct format to avoid errors.

4. Reconcile Client Money and Assets

Reconcile client money and assets carefully. This involves verifying that the client money and assets reported on the form match the firm's financial records. Any discrepancies must be investigated and resolved before submitting the form.

5. Review and Verify the Form

Review and verify the form carefully before submitting it. Check for errors, completeness, and accuracy. Ensure that all required sections are completed, and all information is consistent throughout the form.

Best Practices for REG 262 Form Completion

In addition to the five ways to complete the REG 262 form correctly, here are some best practices to follow:

- Use a systematic approach to complete the form

- Use a checklist to ensure all sections are completed

- Verify information against financial records

- Use a secure and reliable method for submitting the form

- Maintain a record of submission

Common Errors to Avoid

Common errors to avoid when completing the REG 262 form include:

- Incomplete or missing information

- Incorrect formatting or dates

- Discrepancies in client money and assets

- Failure to reconcile client money and assets

- Late submission or non-submission

Conclusion

Completing the REG 262 form correctly is crucial for maintaining regulatory compliance in the financial services industry. By following the five ways to complete the form correctly and adhering to best practices, firms can ensure accurate and timely submission. Remember to review and verify the form carefully, and avoid common errors to ensure compliance.

We encourage you to share your experiences and tips for completing the REG 262 form correctly. Your feedback is valuable in helping others navigate this complex process.

What is the purpose of the REG 262 form?

+The REG 262 form is used to report transactions related to client money and assets, and to maintain regulatory compliance in the financial services industry.

What are the key components of the REG 262 form?

+The key components of the REG 262 form include firm details and transaction types, client money and asset transactions, reconciliation of client money and assets, and additional information and declarations.

What are common errors to avoid when completing the REG 262 form?

+Common errors to avoid include incomplete or missing information, incorrect formatting or dates, discrepancies in client money and assets, failure to reconcile client money and assets, and late submission or non-submission.