Recurring payments have become a staple in modern commerce, allowing businesses to automate transactions and improve cash flow. For companies using QuickBooks, managing recurring payments can be streamlined with the right tools and knowledge. One essential component in this process is the Recurring Payment Authorization Form. In this article, we will delve into the world of QuickBooks and explore how to make the most of recurring payment authorization forms, enhancing your financial management capabilities.

Understanding Recurring Payment Authorization Forms

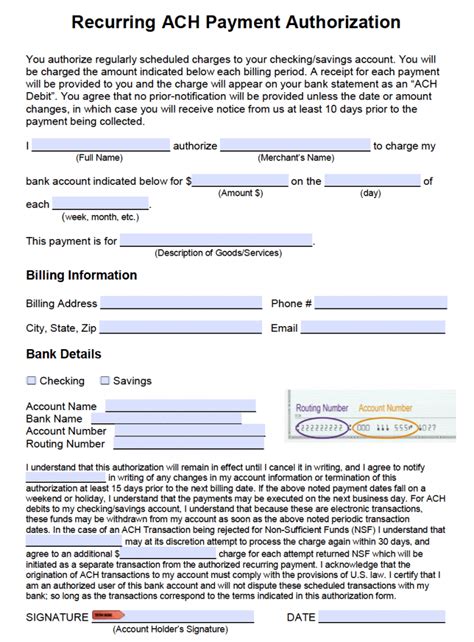

Before diving into the specifics of using these forms in QuickBooks, it's crucial to understand their purpose. A Recurring Payment Authorization Form is a document that customers sign to allow a merchant to charge their credit card or bank account for recurring payments over a period of time. This form is essential for compliance with payment card industry (PCI) standards and helps prevent disputes and chargebacks.

Benefits of Using Recurring Payment Authorization Forms

There are several benefits to incorporating recurring payment authorization forms into your business operations:

• Improved Cash Flow: By automating payments, you can ensure timely receipts, which can help in budgeting and forecasting. • Reduced Administrative Burden: Automating recurring payments means less manual work for your staff, reducing the chance of errors and freeing up time for more strategic tasks. • Enhanced Customer Experience: Offering the convenience of recurring payments can improve customer satisfaction and loyalty.

Setting Up Recurring Payments in QuickBooks

QuickBooks offers robust features for managing recurring payments. Here's how to set up a recurring payment in QuickBooks:

- Navigate to the Customer Center: Go to the Customer Center in QuickBooks to manage customer information and transactions.

- Create a Recurring Payment Template: Set up a recurring payment template that outlines the payment schedule, amount, and payment method.

- Assign the Template to a Customer: Once the template is created, assign it to the relevant customer. This will automate the payment process according to the template specifications.

Integrating Recurring Payment Authorization Forms with QuickBooks

To ensure compliance and protect your business from potential disputes, it's essential to have customers sign a recurring payment authorization form. Here's how you can integrate these forms with QuickBooks:

• Digital Signature Tools: Utilize digital signature tools like DocuSign or Adobe Sign to create and send recurring payment authorization forms electronically. These services often integrate directly with QuickBooks, making it seamless to attach signed forms to customer records. • Manual Upload: If you prefer or need to use paper forms, ensure they are securely stored and easily accessible. You can scan and upload these documents to QuickBooks or your preferred document management system.

Best Practices for Managing Recurring Payment Authorization Forms

- Clear Communication: Ensure that the recurring payment authorization form clearly outlines the payment schedule, amount, and any terms or conditions.

- Secure Storage: Store signed authorization forms securely, either digitally or physically, to protect customer data and comply with PCI standards.

- Regular Reviews: Regularly review and update recurring payment authorization forms to reflect any changes in payment schedules or amounts.

Common Challenges and Solutions

Despite the benefits, managing recurring payment authorization forms can present challenges. Here are some common issues and solutions:

Challenge: Obtaining Signed Authorization Forms from Customers

Solution: Offer digital signature options and clear communication on the importance of these forms for secure, automated payments.

Challenge: Ensuring Compliance with PCI Standards

Solution: Implement secure storage practices for authorization forms, whether digital or physical, and regularly review your processes to ensure compliance.

Conclusion: Streamlining Financial Management with Recurring Payment Authorization Forms

Recurring payment authorization forms are a vital component of managing automated transactions, offering businesses a way to streamline financial management, improve customer satisfaction, and enhance cash flow. By understanding the importance of these forms, setting up recurring payments in QuickBooks, and integrating them seamlessly into your financial management process, you can ensure a smoother, more efficient financial operation.

We invite you to share your experiences or questions about using recurring payment authorization forms in QuickBooks. Whether you're looking to improve your financial management capabilities or have insights to share, your comments are valuable. Feel free to comment below, share this article with your network, or take the first step in optimizing your recurring payment processes today.

What is a Recurring Payment Authorization Form?

+A Recurring Payment Authorization Form is a document signed by customers to allow merchants to charge their credit card or bank account for recurring payments over a period of time.

How do I set up recurring payments in QuickBooks?

+To set up recurring payments in QuickBooks, navigate to the Customer Center, create a recurring payment template, and assign it to the relevant customer.

Why are recurring payment authorization forms important for compliance?

+Recurring payment authorization forms are crucial for compliance with payment card industry (PCI) standards and help prevent disputes and chargebacks.