Transferring property ownership in Minnesota can be a complex process, but understanding the role of a quitclaim deed form can simplify it. Whether you're a property owner, buyer, or simply an interested party, this comprehensive guide will walk you through the ins and outs of Minnesota quitclaim deeds.

Minnesota's property laws are designed to protect the rights of property owners, buyers, and other stakeholders. A quitclaim deed form is an essential document in this process, as it allows property owners to transfer their interests to another party. However, the intricacies of quitclaim deeds can be overwhelming, especially for those without prior experience in real estate law.

What is a Quitclaim Deed Form in Minnesota?

A quitclaim deed form in Minnesota is a document that allows a property owner (grantor) to transfer their interests in a property to another party (grantee). This type of deed is commonly used in situations where the grantor wants to relinquish their claim to the property without guaranteeing that they own it. Unlike warranty deeds, quitclaim deeds do not provide any guarantees or warranties regarding the property's title or ownership.

Types of Quitclaim Deeds in Minnesota

There are several types of quitclaim deeds used in Minnesota, including:

- Individual Quitclaim Deed: This type of deed is used when an individual wants to transfer their property interests to another party.

- Joint Quitclaim Deed: This type of deed is used when multiple parties (such as spouses or business partners) want to transfer their joint interests in a property.

- Corporate Quitclaim Deed: This type of deed is used when a corporation wants to transfer its property interests to another party.

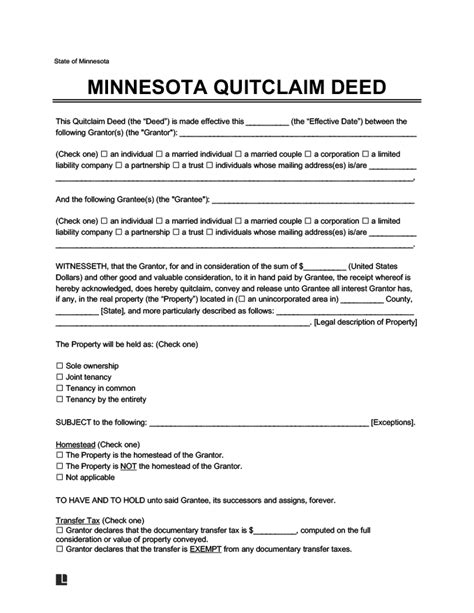

How to Fill Out a Minnesota Quitclaim Deed Form

Filling out a Minnesota quitclaim deed form requires attention to detail and a thorough understanding of the property's ownership and transfer process. Here's a step-by-step guide to help you fill out the form:

- Grantor Information: Enter the grantor's name, address, and contact information.

- Grantee Information: Enter the grantee's name, address, and contact information.

- Property Description: Provide a detailed description of the property, including the address, parcel number, and any other relevant details.

- Consideration: Specify the consideration (if any) being exchanged for the property transfer.

- Granting Clause: Use the granting clause to transfer the grantor's interests in the property to the grantee.

- Habendum Clause: Use the habendum clause to specify the estate or interest being transferred.

- Tenendum Clause: Use the tenendum clause to specify any conditions or restrictions on the property transfer.

- Warranty Clause: Since quitclaim deeds do not provide any warranties, this section is typically left blank.

- Acknowledgment: Sign and notarize the deed to acknowledge the grantor's signature.

- Recording: Record the deed with the Minnesota county recorder's office to complete the property transfer process.

Minnesota Quitclaim Deed Form Requirements

To ensure that your quitclaim deed form is valid and enforceable, make sure to comply with Minnesota's statutory requirements:

- Signature: The grantor must sign the deed in the presence of a notary public.

- Notarization: The notary public must acknowledge the grantor's signature and provide their seal or stamp.

- Recording: The deed must be recorded with the Minnesota county recorder's office within a reasonable time frame.

- Format: The deed must be formatted according to Minnesota's statutory requirements, including font size, margin, and page layout.

Benefits of Using a Minnesota Quitclaim Deed Form

Using a Minnesota quitclaim deed form provides several benefits, including:

- Simplified Property Transfer: Quitclaim deeds allow property owners to transfer their interests without the need for a warranty deed.

- Flexibility: Quitclaim deeds can be used in a variety of situations, including divorce, estate planning, and business transactions.

- Cost-Effective: Quitclaim deeds are generally less expensive than warranty deeds, as they do not require title insurance or other guarantees.

- Reduced Liability: Quitclaim deeds can help reduce the grantor's liability by transferring the property interests without providing any warranties.

Potential Drawbacks of Using a Minnesota Quitclaim Deed Form

While quitclaim deeds offer several benefits, there are also potential drawbacks to consider:

- Lack of Warranty: Quitclaim deeds do not provide any warranties or guarantees regarding the property's title or ownership.

- Limited Protection: Quitclaim deeds do not offer the same level of protection as warranty deeds, which can leave the grantee vulnerable to potential claims or disputes.

- Tax Implications: Quitclaim deeds can have tax implications, including potential gift tax or capital gains tax liabilities.

Conclusion: A Comprehensive Guide to Minnesota Quitclaim Deed Forms

In conclusion, a Minnesota quitclaim deed form is a powerful tool for transferring property ownership interests in Minnesota. By understanding the benefits, drawbacks, and requirements of quitclaim deeds, property owners and buyers can navigate the complex world of real estate law with confidence. Whether you're a seasoned real estate professional or a novice buyer, this comprehensive guide has provided you with the knowledge and resources needed to successfully complete a Minnesota quitclaim deed form.

We invite you to share your thoughts and experiences with Minnesota quitclaim deed forms in the comments section below. Have you used a quitclaim deed form in the past? What were some of the challenges or benefits you encountered? Your insights can help others navigate the complexities of real estate law in Minnesota.

What is the difference between a quitclaim deed and a warranty deed in Minnesota?

+A quitclaim deed transfers the grantor's interests in a property without providing any warranties or guarantees, whereas a warranty deed provides a guarantee that the grantor owns the property and has the right to transfer it.

Do I need to record my quitclaim deed with the Minnesota county recorder's office?

+Yes, recording your quitclaim deed with the Minnesota county recorder's office is necessary to complete the property transfer process and provide public notice of the transfer.

Can I use a quitclaim deed to transfer property interests in a divorce or estate planning situation?

+Yes, quitclaim deeds are commonly used in divorce and estate planning situations to transfer property interests without providing any warranties or guarantees.