Filling out the PTAX 340 form correctly is crucial for businesses and individuals to report their tax obligations accurately and avoid any potential penalties or fines. The PTAX 340 form is a vital document used by the Illinois Department of Revenue to collect information about tax liabilities, and it's essential to understand how to fill it out correctly to ensure compliance with the state's tax laws.

In this article, we will provide a step-by-step guide on how to fill out the PTAX 340 form correctly, highlighting the essential sections and providing tips to help you navigate the process.

Understanding the PTAX 340 Form

Before we dive into the details of filling out the PTAX 340 form, it's essential to understand the purpose of the document and the information required. The PTAX 340 form is used to report tax liabilities for businesses and individuals in Illinois, including sales tax, use tax, and other taxes.

The form consists of several sections, including:

- Business information

- Tax liability

- Payment information

- Certification

Section 1: Business Information

The first section of the PTAX 340 form requires you to provide your business information, including:

- Business name

- Address

- Federal Employer Identification Number (FEIN)

- Illinois Business Registration Number

Make sure to provide accurate and up-to-date information, as this will be used to identify your business and process your tax return.

Filling Out the PTAX 340 Form: 5 Essential Steps

Now that we have covered the basics of the PTAX 340 form, let's move on to the 5 essential steps to fill it out correctly.

Step 1: Calculate Your Tax Liability

The first step in filling out the PTAX 340 form is to calculate your tax liability. This includes determining the amount of sales tax, use tax, and other taxes you owe to the state of Illinois.

Make sure to review your business records and calculate your tax liability accurately, as underreporting or overreporting can result in penalties and fines.

Step 2: Complete the Payment Information Section

The payment information section of the PTAX 340 form requires you to provide details about how you will pay your tax liability. This includes:

- Payment method (check, electronic funds transfer, or credit card)

- Payment date

- Payment amount

Make sure to provide accurate payment information, as this will be used to process your payment and update your account.

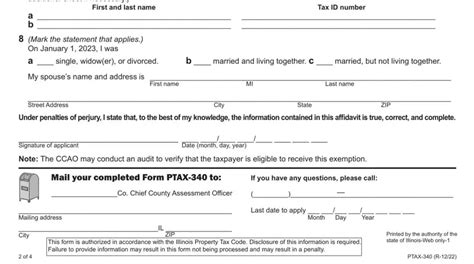

Step 3: Certify Your Return

The certification section of the PTAX 340 form requires you to sign and date your return, confirming that the information provided is accurate and complete.

Make sure to review your return carefully before signing and dating it, as this will be used to verify your identity and authenticity.

Step 4: Attach Supporting Documentation

Depending on your business type and tax liability, you may need to attach supporting documentation to your PTAX 340 form. This can include:

- Sales tax receipts

- Invoices

- Bank statements

Make sure to review the instructions carefully and attach all required documentation, as this will be used to verify your tax liability and process your return.

Step 5: Submit Your Return

The final step in filling out the PTAX 340 form is to submit your return to the Illinois Department of Revenue. You can submit your return online, by mail, or in person.

Make sure to review the instructions carefully and submit your return by the deadline to avoid any penalties or fines.

Additional Tips and Reminders

In addition to the 5 essential steps outlined above, here are some additional tips and reminders to help you fill out the PTAX 340 form correctly:

- Make sure to use the correct form version and follow the instructions carefully.

- Review your return carefully before submitting it to ensure accuracy and completeness.

- Keep a copy of your return and supporting documentation for your records.

- If you have any questions or concerns, contact the Illinois Department of Revenue for assistance.

Conclusion

Filling out the PTAX 340 form correctly is crucial for businesses and individuals to report their tax obligations accurately and avoid any potential penalties or fines. By following the 5 essential steps outlined above and reviewing the additional tips and reminders, you can ensure that your return is accurate, complete, and submitted on time.

We hope this article has provided you with the information and guidance you need to fill out the PTAX 340 form correctly. If you have any questions or concerns, please don't hesitate to contact us.

What is the PTAX 340 form used for?

+The PTAX 340 form is used to report tax liabilities for businesses and individuals in Illinois, including sales tax, use tax, and other taxes.

What is the deadline for submitting the PTAX 340 form?

+The deadline for submitting the PTAX 340 form varies depending on the tax period and type of tax. Please review the instructions carefully and submit your return by the deadline to avoid any penalties or fines.

Can I submit my PTAX 340 form online?

+Yes, you can submit your PTAX 340 form online through the Illinois Department of Revenue website. Please review the instructions carefully and follow the online submission process.