Arizona is known for its beautiful landscapes, warm climate, and relaxed atmosphere. It's also a popular destination for retirees and individuals looking to relocate. When it comes to managing property, one essential tool to consider is a beneficiary deed form, also known as a "transfer on death" (TOD) deed. This document allows property owners to transfer ownership of their real estate to a beneficiary without the need for probate. In this article, we'll guide you through the process of creating an Arizona beneficiary deed form, highlighting the 5 key steps to make it easy and straightforward.

What is a Beneficiary Deed Form?

A beneficiary deed form, also known as a "transfer on death" (TOD) deed, is a type of deed that allows property owners to transfer ownership of their real estate to a beneficiary without the need for probate. This means that when the property owner passes away, the beneficiary will automatically inherit the property, avoiding the lengthy and costly probate process.

Benefits of Using a Beneficiary Deed Form

Using a beneficiary deed form can provide several benefits, including:

• Avoiding probate: By transferring ownership of the property directly to the beneficiary, you can avoid the probate process, which can be lengthy and costly. • Reducing estate taxes: Since the property is transferred directly to the beneficiary, it may reduce estate taxes. • Maintaining control: As the property owner, you maintain control over the property until your passing. • Flexibility: You can change or revoke the beneficiary deed at any time during your lifetime.

Step 1: Determine the Type of Property

Before creating a beneficiary deed form, you need to determine the type of property you own. This can be a single-family home, condominium, townhouse, or other types of real estate. It's essential to identify the property's characteristics, such as its location, size, and any liens or mortgages attached to it.

Common Types of Property in Arizona

Arizona has various types of property, including:

• Single-family homes • Condominiums • Townhouses • Duplexes • Commercial property

Step 2: Identify the Beneficiary

Once you've determined the type of property, you need to identify the beneficiary. This can be an individual, trust, or organization that will inherit the property upon your passing. It's essential to ensure that the beneficiary is clearly identified and that their name and address are correctly listed on the deed.

Common Beneficiaries in Arizona

Common beneficiaries in Arizona include:

• Family members (spouse, children, grandchildren) • Friends • Charitable organizations • Trusts (revocable or irrevocable)

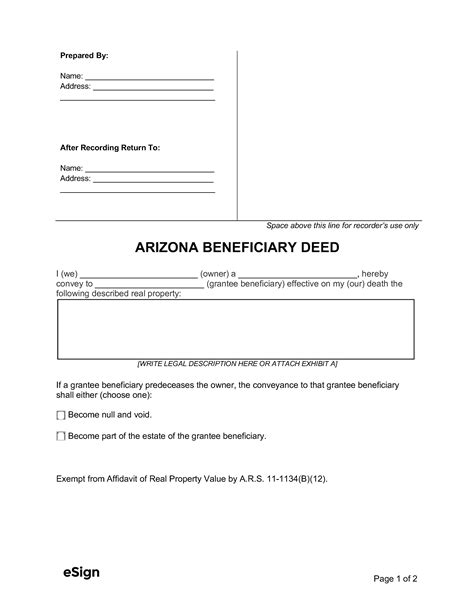

Step 3: Prepare the Beneficiary Deed Form

With the property type and beneficiary identified, you can now prepare the beneficiary deed form. This document should include the following information:

• Property description • Beneficiary's name and address • Grantor's (your) name and address • Signature and notarization

Required Information for an Arizona Beneficiary Deed Form

The following information is required for an Arizona beneficiary deed form:

• Property description (including address and parcel number) • Beneficiary's name and address • Grantor's (your) name and address • Signature and notarization • Acknowledgment of the deed

Step 4: Sign and Notarize the Deed

Once the beneficiary deed form is prepared, you need to sign and notarize it. This ensures that the document is authentic and valid. You can sign the deed in the presence of a notary public, who will verify your identity and witness your signature.

Notarization Requirements in Arizona

In Arizona, the following notarization requirements apply:

• The notary public must be present during the signing of the deed. • The notary public must verify the grantor's identity. • The notary public must witness the grantor's signature. • The notary public must sign and date the deed.

Step 5: Record the Deed

Finally, you need to record the beneficiary deed form with the county recorder's office. This ensures that the document is publicly recorded and provides notice to potential buyers or creditors. You can record the deed in person or by mail, and it's essential to ensure that the document is correctly recorded to avoid any issues.

Recording Requirements in Arizona

In Arizona, the following recording requirements apply:

• The deed must be recorded with the county recorder's office. • The deed must be accompanied by the required recording fees. • The deed must be correctly indexed and recorded.

What is a beneficiary deed form?

+A beneficiary deed form, also known as a "transfer on death" (TOD) deed, is a type of deed that allows property owners to transfer ownership of their real estate to a beneficiary without the need for probate.

How do I determine the type of property I own?

+You can determine the type of property you own by checking your property title or deed. You can also consult with a real estate agent or attorney if you're unsure.

Can I change or revoke a beneficiary deed?

+Yes, you can change or revoke a beneficiary deed at any time during your lifetime. However, it's essential to follow the correct procedures and seek the advice of an attorney if necessary.

Now that you've completed the 5 key steps to create an Arizona beneficiary deed form, you can rest assured that your property will be transferred to your beneficiary without the need for probate. Remember to seek the advice of an attorney if you have any questions or concerns. By following these steps, you can ensure that your property is transferred smoothly and efficiently.