As the tax season approaches, many individuals are searching for ways to obtain a printable 1040 SR form. The 1040 SR form, also known as the U.S. Income Tax Return for Seniors, is a simplified version of the standard 1040 form designed for seniors aged 65 and above. If you're looking for a printable 1040 SR form, here are five ways to get one:

Understanding the 1040 SR Form

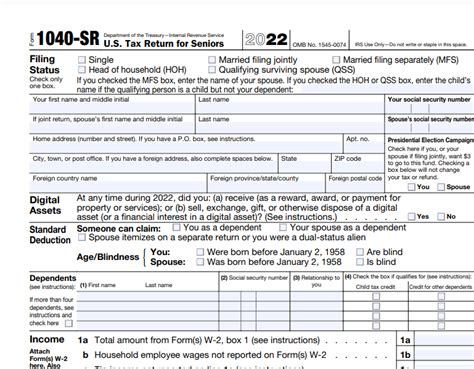

Before we dive into the ways to get a printable 1040 SR form, it's essential to understand what this form is and who it's designed for. The 1040 SR form is a two-page form that simplifies the tax filing process for seniors. It eliminates the need to report investment income, deductions, and other complex tax information, making it easier for seniors to file their taxes.

1. Download from the IRS Website

The most straightforward way to get a printable 1040 SR form is to download it from the IRS website. To do this:

- Visit the IRS website at

- Click on the "Forms and Publications" tab

- Search for "1040 SR" in the search bar

- Click on the "1040 SR" link to download the form

You can also find the 1040 SR form by visiting the IRS website and navigating to the "Forms and Publications" section. Once you've downloaded the form, you can print it out and fill it out by hand.

2. Order by Phone or Mail

If you don't have access to a computer or prefer to receive a physical copy of the 1040 SR form, you can order one by phone or mail. To order by phone:

- Call the IRS at 1-800-829-3676

- Let the representative know you need a copy of the 1040 SR form

- Provide your name and mailing address

To order by mail:

- Write a letter to the IRS requesting a copy of the 1040 SR form

- Include your name and mailing address

- Mail the letter to the IRS address listed on their website

Please note that ordering by phone or mail may take several weeks to receive, so plan accordingly.

3. Visit a Local Library or Post Office

Many local libraries and post offices offer free tax forms, including the 1040 SR form. To find a location near you:

- Visit the IRS website and use their "Free Tax Forms" tool

- Enter your zip code and select the type of form you need (1040 SR)

- Get a list of nearby locations that offer free tax forms

Keep in mind that availability and selection may vary depending on the location.

4. Contact a Tax Professional

If you're working with a tax professional or using tax preparation software, they may be able to provide you with a printable 1040 SR form. Many tax professionals and software providers offer access to tax forms as part of their services.

- Contact your tax professional and ask if they have a printable 1040 SR form available

- Check your tax preparation software to see if they offer a downloadable 1040 SR form

5. Visit a Local IRS Office

If you're having trouble finding a printable 1040 SR form or need assistance with your taxes, you can visit a local IRS office. IRS offices often have a selection of tax forms available, including the 1040 SR form.

- Visit the IRS website to find a local IRS office near you

- Call the office to confirm they have a printable 1040 SR form available

- Visit the office during business hours to pick up a copy of the form

Getting a printable 1040 SR form is easier than ever, with multiple options available to suit your needs. Whether you prefer to download and print the form, order by phone or mail, or visit a local library or IRS office, you can get the form you need to file your taxes with confidence.

We invite you to share your thoughts on this article. Have you had trouble finding a printable 1040 SR form in the past? What methods have you used to obtain the form? Share your experiences and tips with us in the comments below!

Who is eligible to file the 1040 SR form?

+The 1040 SR form is designed for seniors aged 65 and above. If you're 65 or older, you may be eligible to file this form.

Can I e-file the 1040 SR form?

+Yes, you can e-file the 1040 SR form using tax preparation software or by working with a tax professional.

What is the deadline for filing the 1040 SR form?

+The deadline for filing the 1040 SR form is typically April 15th, but it may vary depending on your state and local tax laws.