The world of online payment processing has revolutionized the way businesses and individuals manage their financial transactions. Among the numerous payment processing options available, Automated Clearing House (ACH) payments have gained significant popularity due to their convenience, cost-effectiveness, and security. Wells Fargo, a leading financial institution, offers ACH payment processing services to its customers. In this article, we will delve into the details of Wells Fargo ACH authorization form and explore the benefits, working mechanisms, and steps involved in secure payment processing.

What is ACH Payment Processing?

ACH payment processing refers to the electronic transfer of funds between banks through the Automated Clearing House network. This network is a batch processing system that facilitates the transfer of funds between financial institutions. ACH payments are commonly used for direct deposit of payroll, bill payments, and e-commerce transactions.

Benefits of ACH Payment Processing

ACH payment processing offers several benefits to businesses and individuals, including:

- Cost-effectiveness: ACH payments are generally cheaper than credit card transactions, with lower fees and no interest charges.

- Convenience: ACH payments can be initiated online or through mobile devices, making it easier to manage financial transactions.

- Security: ACH payments are considered a secure payment method, as they are regulated by the National Automated Clearing House Association (NACHA) and the Federal Reserve.

- Efficiency: ACH payments are processed in batches, reducing the need for manual processing and minimizing errors.

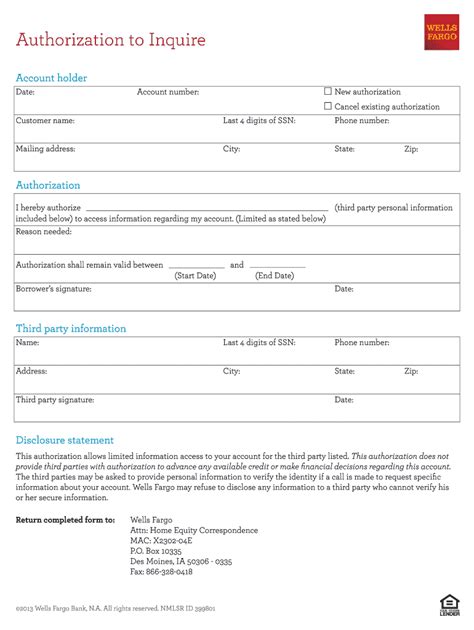

Wells Fargo ACH Authorization Form

To initiate ACH payments through Wells Fargo, customers need to complete an ACH authorization form. This form authorizes Wells Fargo to debit or credit the customer's account for ACH transactions. The form typically requires the following information:

- Customer name and account number

- Routing number and bank account type

- Authorization for debit or credit transactions

- Transaction amount and frequency

How to Complete the Wells Fargo ACH Authorization Form

To complete the Wells Fargo ACH authorization form, follow these steps:

- Download the ACH authorization form from the Wells Fargo website or obtain a copy from a Wells Fargo branch.

- Fill in the required information, including customer name, account number, routing number, and bank account type.

- Specify the authorization for debit or credit transactions, including the transaction amount and frequency.

- Sign and date the form.

- Return the completed form to Wells Fargo via mail, fax, or email.

Secure Payment Processing with Wells Fargo

Wells Fargo takes security seriously, and its ACH payment processing services are designed to protect customers' financial information. Here are some measures Wells Fargo takes to ensure secure payment processing:

- Encryption: Wells Fargo uses encryption technology to protect customer data and ensure secure transmission of financial information.

- Authentication: Wells Fargo uses multi-factor authentication to verify customer identities and prevent unauthorized access to accounts.

- Monitoring: Wells Fargo continuously monitors ACH transactions for suspicious activity and notifies customers of any potential security threats.

Benefits of Secure Payment Processing

Secure payment processing offers several benefits to businesses and individuals, including:

- Reduced risk of fraud and identity theft

- Protection of financial information

- Compliance with regulatory requirements

- Enhanced customer trust and confidence

Conclusion

In conclusion, Wells Fargo ACH authorization form is a secure and convenient way to manage financial transactions. By completing the form, customers can authorize Wells Fargo to debit or credit their accounts for ACH transactions. With its robust security measures and compliance with regulatory requirements, Wells Fargo provides a secure payment processing environment for its customers. Whether you are a business or an individual, Wells Fargo ACH payment processing services can help you streamline your financial transactions and reduce costs.

Call to Action

If you are interested in learning more about Wells Fargo ACH payment processing services or would like to complete an ACH authorization form, please visit the Wells Fargo website or contact a Wells Fargo representative.

FAQ

What is ACH payment processing?

+ACH payment processing refers to the electronic transfer of funds between banks through the Automated Clearing House network.

What are the benefits of ACH payment processing?

+ACH payment processing offers several benefits, including cost-effectiveness, convenience, security, and efficiency.

How do I complete the Wells Fargo ACH authorization form?

+To complete the Wells Fargo ACH authorization form, follow the steps outlined in this article, including downloading the form, filling in the required information, and returning the completed form to Wells Fargo.