As a seller on Poshmark, you're likely no stranger to the world of online commerce. With millions of active users, Poshmark has become a go-to platform for buying and selling gently used clothing and accessories. But as your sales grow, so do your tax responsibilities. That's where the Poshmark 1099-K form comes in. In this article, we'll break down the essential facts about the Poshmark 1099-K form, so you can stay on top of your tax obligations and focus on growing your business.

What is a 1099-K Form?

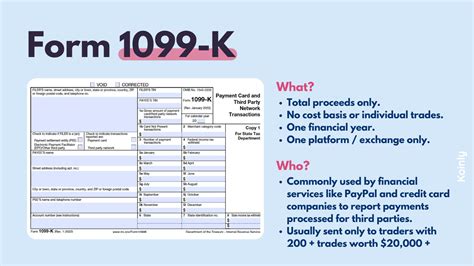

A 1099-K form is a tax document used by payment processors, like Poshmark, to report payment card and third-party network transactions to the Internal Revenue Service (IRS). It's also known as the Payment Card and Third Party Network Transactions form. As a seller on Poshmark, you'll receive a 1099-K form if you've earned more than $20,000 in gross payments and had more than 200 transactions in a calendar year.

Why is the 1099-K Form Important?

The 1099-K form is essential for several reasons:

- It helps the IRS track your income and ensure you're reporting it accurately on your tax return.

- It provides a record of your transactions, which can be useful for accounting and bookkeeping purposes.

- It helps Poshmark comply with IRS regulations and avoid potential penalties.

How Does Poshmark Report 1099-K Information?

Poshmark reports 1099-K information to the IRS on your behalf. Here's how it works:

- Poshmark tracks your transactions throughout the year, including sales, fees, and refunds.

- If you meet the threshold requirements (more than $20,000 in gross payments and more than 200 transactions), Poshmark generates a 1099-K form.

- The form is then submitted to the IRS and a copy is sent to you, usually by January 31st of each year.

What Information is Included on the 1099-K Form?

The 1099-K form includes the following information:

- Your name, address, and taxpayer identification number (TIN)

- Poshmark's name, address, and TIN

- The total amount of gross payments you received during the calendar year

- The number of transactions you had during the calendar year

How to Use the 1099-K Form for Tax Purposes

As a seller on Poshmark, you'll need to report your income from the platform on your tax return. Here's how to use the 1099-K form for tax purposes:

- Report the gross payments shown on the 1099-K form on Schedule C (Form 1040), which is the form for self-employment income and expenses.

- Calculate your net earnings from self-employment by subtracting business expenses from your gross income.

- Report your net earnings from self-employment on Schedule SE (Form 1040), which is the form for self-employment tax.

Tips for Accurate Tax Reporting

To ensure accurate tax reporting, keep the following tips in mind:

- Keep accurate records of your transactions, including sales, fees, and refunds.

- Reconcile your 1099-K form with your own records to ensure accuracy.

- Consult with a tax professional or accountant if you're unsure about how to report your income.

Common Mistakes to Avoid

When it comes to the 1099-K form and tax reporting, there are several common mistakes to avoid:

- Failing to report income: Make sure to report all income from Poshmark on your tax return, even if you don't receive a 1099-K form.

- Inaccurate record-keeping: Keep accurate records of your transactions to ensure accurate tax reporting.

- Not reconciling the 1099-K form: Reconcile your 1099-K form with your own records to ensure accuracy.

Additional Resources

For more information on the 1099-K form and tax reporting, check out the following resources:

- IRS Publication 525: Taxable and Nontaxable Income

- IRS Form 1040: U.S. Individual Income Tax Return

- Poshmark's Seller Help Center: Tax Information

By understanding the 1099-K form and its role in tax reporting, you can ensure accurate and compliant tax filing as a Poshmark seller. Stay on top of your tax obligations and focus on growing your business with confidence.

We hope this article has provided you with valuable insights into the Poshmark 1099-K form. If you have any further questions or concerns, please don't hesitate to comment below or share this article with your fellow sellers.

What is the threshold for receiving a 1099-K form from Poshmark?

+To receive a 1099-K form from Poshmark, you must have earned more than $20,000 in gross payments and had more than 200 transactions in a calendar year.

What information is included on the 1099-K form?

+The 1099-K form includes your name, address, and taxpayer identification number (TIN), Poshmark's name, address, and TIN, the total amount of gross payments you received during the calendar year, and the number of transactions you had during the calendar year.

How do I use the 1099-K form for tax purposes?

+Report the gross payments shown on the 1099-K form on Schedule C (Form 1040), which is the form for self-employment income and expenses. Calculate your net earnings from self-employment by subtracting business expenses from your gross income, and report your net earnings from self-employment on Schedule SE (Form 1040), which is the form for self-employment tax.