Mortgage interest and property taxes are two of the most significant expenses associated with homeownership. The Internal Revenue Service (IRS) requires lenders to report mortgage interest and property taxes on Form 1098, which is used to calculate mortgage interest and property tax deductions on tax returns. However, there are several hidden points not reported on Form 1098 that homeowners should be aware of to maximize their tax deductions.

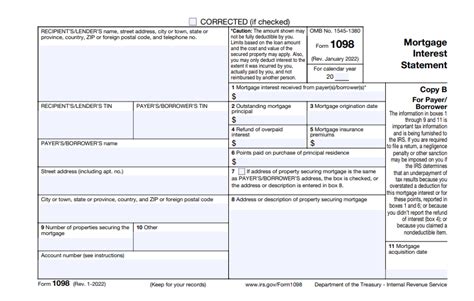

Understanding Form 1098

Form 1098 is a crucial document for homeowners, as it reports the amount of mortgage interest and property taxes paid during the tax year. The form is typically provided by lenders and is used to calculate mortgage interest and property tax deductions on tax returns. However, Form 1098 only reports the total amount of mortgage interest and property taxes paid, without providing a detailed breakdown of the individual components.

Hidden Points Not Reported on Form 1098

There are several hidden points not reported on Form 1098 that homeowners should be aware of to maximize their tax deductions. Some of these hidden points include:

- Mortgage insurance premiums: Mortgage insurance premiums are not reported on Form 1098, but they can be deducted as mortgage interest. Homeowners who pay mortgage insurance premiums should keep records of these payments to claim the deduction.

- Property tax escrow payments: Property tax escrow payments are not reported on Form 1098, but they can be deducted as property taxes. Homeowners who make property tax escrow payments should keep records of these payments to claim the deduction.

- Home equity loan interest: Home equity loan interest is not reported on Form 1098, but it can be deducted as mortgage interest. Homeowners who have a home equity loan should keep records of the interest payments to claim the deduction.

- Private mortgage insurance (PMI): Private mortgage insurance (PMI) premiums are not reported on Form 1098, but they can be deducted as mortgage interest. Homeowners who pay PMI premiums should keep records of these payments to claim the deduction.

- Mortgage points: Mortgage points are not reported on Form 1098, but they can be deducted as mortgage interest. Homeowners who pay mortgage points should keep records of these payments to claim the deduction.

- Home improvement loan interest: Home improvement loan interest is not reported on Form 1098, but it can be deducted as mortgage interest. Homeowners who have a home improvement loan should keep records of the interest payments to claim the deduction.

How to Claim Hidden Points Not Reported on Form 1098

To claim hidden points not reported on Form 1098, homeowners should keep detailed records of their mortgage interest and property tax payments. This includes:

- Mortgage statements: Homeowners should keep mortgage statements to track mortgage interest payments.

- Property tax bills: Homeowners should keep property tax bills to track property tax payments.

- Escrow statements: Homeowners should keep escrow statements to track property tax escrow payments.

- Loan documents: Homeowners should keep loan documents to track home equity loan interest and mortgage points.

- Insurance premiums: Homeowners should keep records of mortgage insurance premiums and PMI premiums.

Homeowners should also consult with a tax professional to ensure they are claiming all eligible deductions.

Benefits of Claiming Hidden Points Not Reported on Form 1098

Claiming hidden points not reported on Form 1098 can result in significant tax savings for homeowners. By claiming these deductions, homeowners can reduce their taxable income and lower their tax liability. Additionally, claiming these deductions can also help homeowners to:

- Increase their refund: Claiming hidden points not reported on Form 1098 can result in a larger tax refund.

- Reduce their tax bill: Claiming hidden points not reported on Form 1098 can result in a lower tax bill.

- Increase their cash flow: Claiming hidden points not reported on Form 1098 can result in increased cash flow, which can be used for other expenses or investments.

Common Mistakes to Avoid When Claiming Hidden Points Not Reported on Form 1098

When claiming hidden points not reported on Form 1098, homeowners should avoid common mistakes, such as:

- Not keeping accurate records: Homeowners should keep accurate records of their mortgage interest and property tax payments.

- Not claiming all eligible deductions: Homeowners should claim all eligible deductions, including mortgage interest, property taxes, and mortgage insurance premiums.

- Not consulting with a tax professional: Homeowners should consult with a tax professional to ensure they are claiming all eligible deductions.

By avoiding these common mistakes, homeowners can ensure they are claiming all eligible deductions and maximizing their tax savings.

We hope this article has provided valuable information on hidden points not reported on Form 1098. If you have any questions or comments, please feel free to share them below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.

What is Form 1098?

+Form 1098 is a document provided by lenders that reports the amount of mortgage interest and property taxes paid during the tax year.

What are some hidden points not reported on Form 1098?

+Some hidden points not reported on Form 1098 include mortgage insurance premiums, property tax escrow payments, home equity loan interest, private mortgage insurance (PMI) premiums, mortgage points, and home improvement loan interest.

How can I claim hidden points not reported on Form 1098?

+To claim hidden points not reported on Form 1098, homeowners should keep detailed records of their mortgage interest and property tax payments, and consult with a tax professional to ensure they are claiming all eligible deductions.