As a resident of North Carolina, understanding the NC 40 tax form is crucial for accurate and timely filing of your state income tax return. The NC 40 form is the standard form used by the North Carolina Department of Revenue to report an individual's income tax liability. In this comprehensive guide, we will walk you through the ins and outs of the NC 40 tax form, helping you navigate the complexities of state income tax filing.

What is the NC 40 Tax Form?

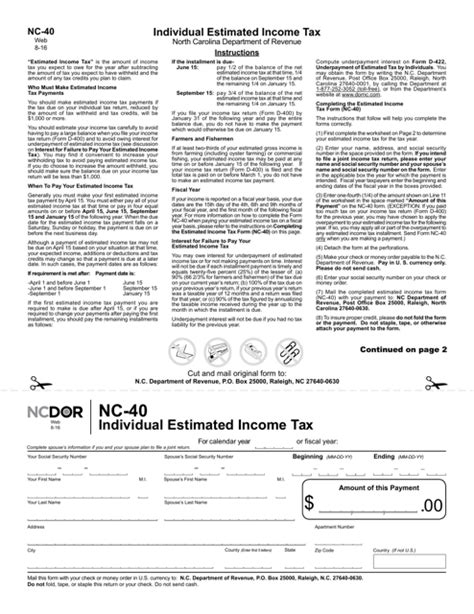

The NC 40 tax form is the primary form used by the North Carolina Department of Revenue to report an individual's income tax liability. It is used to calculate the amount of state income tax owed by the taxpayer and to report any taxes withheld from their income. The form is typically filed annually, with a deadline of April 15th for most taxpayers.

Who Needs to File the NC 40 Tax Form?

You are required to file the NC 40 tax form if you are a resident of North Carolina and have income that is subject to state income tax. This includes:

- Residents with taxable income exceeding $0

- Non-residents with income from North Carolina sources

- Estates and trusts with income from North Carolina sources

Components of the NC 40 Tax Form

The NC 40 tax form consists of several sections, each designed to gather specific information about your income, deductions, and credits. The main components of the form include:

Section 1: Income

In this section, you will report your total income from all sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Business income

- Other income

Section 2: Adjustments to Income

In this section, you will report any adjustments to your income, including:

- Alimony paid

- Student loan interest

- Educator expenses

- Other adjustments

Section 3: Taxable Income

In this section, you will calculate your taxable income by subtracting your adjustments from your total income.

Section 4: Tax Liability

In this section, you will calculate your tax liability using the North Carolina income tax tables or the tax rate schedule.

Section 5: Credits

In this section, you will report any credits you are eligible for, including:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education Credits

- Other credits

Section 6: Payments and Refunds

In this section, you will report any payments you have made towards your tax liability and calculate any refund due to you.

Filing the NC 40 Tax Form

You can file the NC 40 tax form electronically or by mail. E-filing is the preferred method, as it is faster and more accurate. You can e-file using tax software or through the North Carolina Department of Revenue's website.

Deadlines and Penalties

The deadline for filing the NC 40 tax form is April 15th for most taxpayers. If you fail to file your return by the deadline, you may be subject to penalties and interest on any tax due.

Amending the NC 40 Tax Form

If you need to make changes to your NC 40 tax form after it has been filed, you can file an amended return using Form NC 40X. You will need to complete the form and attach any supporting documentation, such as corrected W-2 forms or additional receipts.

Tips and Reminders

- Make sure to file your NC 40 tax form on time to avoid penalties and interest.

- Keep accurate records of your income and expenses to ensure accurate reporting.

- Take advantage of credits and deductions you are eligible for to reduce your tax liability.

- Consider consulting a tax professional or using tax software to ensure accurate and timely filing.

Conclusion

Filing the NC 40 tax form can be a complex and time-consuming process, but with this comprehensive guide, you are well on your way to understanding the ins and outs of state income tax filing in North Carolina. Remember to file your return on time, keep accurate records, and take advantage of credits and deductions to reduce your tax liability.

What is the deadline for filing the NC 40 tax form?

+The deadline for filing the NC 40 tax form is April 15th for most taxpayers.

Can I e-file the NC 40 tax form?

+What is the penalty for late filing of the NC 40 tax form?

+The penalty for late filing of the NC 40 tax form is 5% of the tax due, plus interest on any unpaid tax.