As we navigate the complexities of life, it's essential to consider the well-being of our loved ones, even after we're gone. Estate planning is a crucial aspect of ensuring that our assets are distributed according to our wishes, and one often overlooked tool is the payable on death (POD) form. In this article, we'll delve into the world of PNC payable on death forms, exploring their benefits, working mechanisms, and steps to create one.

What is a Payable on Death (POD) Form?

A payable on death (POD) form, also known as a transfer on death (TOD) or beneficiary designation, is a simple estate planning tool that allows you to designate a beneficiary to receive a specific asset, such as a bank account, retirement account, or even real estate, upon your passing. This designation supersedes your will, ensuring that the asset is transferred directly to the beneficiary without going through probate.

Benefits of Using a POD Form

- Avoid Probate: By designating a beneficiary, you can avoid probate, which can be a lengthy and costly process.

- Simplify Estate Administration: POD forms simplify the estate administration process, as the asset is transferred directly to the beneficiary.

- Reduce Estate Taxes: In some cases, using a POD form can reduce estate taxes, as the asset is not considered part of the estate.

- Flexibility: POD forms can be revoked or changed at any time, allowing you to adjust your beneficiary designations as needed.

How Does a POD Form Work?

When you create a POD form, you're essentially creating a contract between you and the financial institution holding the asset. This contract designates a beneficiary to receive the asset upon your passing. The process typically involves:

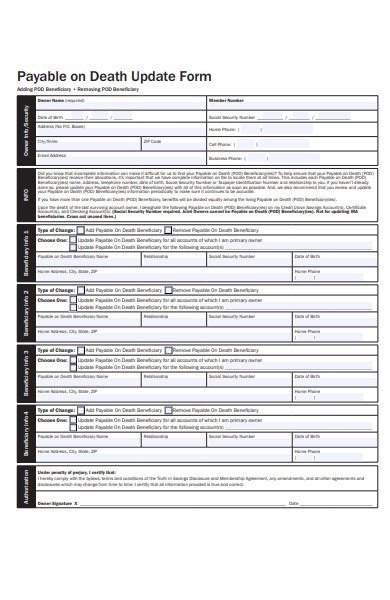

- Completing a Form: You'll need to complete a POD form, which can usually be obtained from the financial institution or online.

- Designating a Beneficiary: You'll designate a beneficiary to receive the asset, which can be an individual, trust, or charity.

- Signing and Notarizing: You'll sign and notarize the form, which will be kept on file by the financial institution.

- Updating Records: The financial institution will update their records to reflect the beneficiary designation.

Creating a PNC Payable on Death Form

If you're a PNC Bank customer, creating a payable on death form is a relatively straightforward process. Here are the steps:

- Contact PNC Bank: Reach out to PNC Bank's customer service or visit a local branch to obtain a POD form.

- Complete the Form: Fill out the POD form, designating a beneficiary and providing the required information.

- Sign and Notarize: Sign and notarize the form, which will be kept on file by PNC Bank.

- Update Records: PNC Bank will update their records to reflect the beneficiary designation.

Frequently Asked Questions

What happens if I don't have a POD form?

+If you don't have a POD form, the asset will be distributed according to your will or state intestacy laws, which may lead to probate and additional costs.

Can I change my beneficiary designation?

+Yes, you can change your beneficiary designation at any time by completing a new POD form and submitting it to the financial institution.

Are POD forms only for bank accounts?

+No, POD forms can be used for various assets, including retirement accounts, real estate, and even vehicles.

As we've explored the world of payable on death forms, it's clear that this simple estate planning tool can provide peace of mind and ensure that your assets are distributed according to your wishes. By understanding the benefits, working mechanisms, and steps to create a POD form, you can take control of your estate planning and secure the future of your loved ones.

We invite you to share your thoughts and experiences with payable on death forms in the comments below. Have you used a POD form in your estate planning? Do you have any questions or concerns about the process? Share your insights and help others navigate this important aspect of estate planning.