Direct Deposit Form: A Step-By-Step Guide

In today's digital age, direct deposit has become a popular payment method for individuals and businesses alike. It offers a convenient, efficient, and secure way to transfer funds directly into a recipient's bank account. However, to set up direct deposit, you'll need to fill out a direct deposit form. In this article, we'll take you through a step-by-step guide on how to complete a direct deposit form, highlighting its importance, benefits, and key information you need to provide.

Direct deposit forms are commonly used by employers to pay employees, by governments to distribute benefits, and by businesses to pay vendors or contractors. The form typically requires the recipient's bank account information, which is then used to deposit funds electronically. This payment method eliminates the need for paper checks, reducing the risk of lost or stolen payments.

The direct deposit form is a crucial document that ensures seamless and accurate transactions. It's essential to complete the form accurately to avoid any delays or issues with your payments. In this guide, we'll walk you through the process of filling out a direct deposit form, explaining each section and providing tips to help you avoid common mistakes.

What is a Direct Deposit Form?

A direct deposit form is a document that provides your bank account information to the payer, allowing them to deposit funds directly into your account. The form typically includes your name, address, bank account number, routing number, and account type. This information is used to create an electronic payment record, which is then processed through the Automated Clearing House (ACH) network.

Benefits of Direct Deposit

Direct deposit offers several benefits, including:

• Convenience: Direct deposit eliminates the need to physically visit a bank or wait for a check to clear. • Efficiency: Funds are deposited directly into your account, reducing the risk of lost or stolen payments. • Security: Direct deposit reduces the risk of identity theft and fraud associated with paper checks. • Time-saving: Direct deposit saves time and effort, as you don't need to deposit a check or wait for it to clear.

How to Complete a Direct Deposit Form

To complete a direct deposit form, you'll need to provide the following information:

- Name and Address: Your full name and mailing address, as they appear on your bank account records.

- Bank Account Information: Your bank account number, routing number, and account type (checking or savings).

- Account Type: Indicate whether your account is a checking or savings account.

- Bank Name and Address: The name and address of your bank, including the branch location if applicable.

- Authorization: Sign and date the form to authorize the direct deposit.

Step-by-Step Instructions

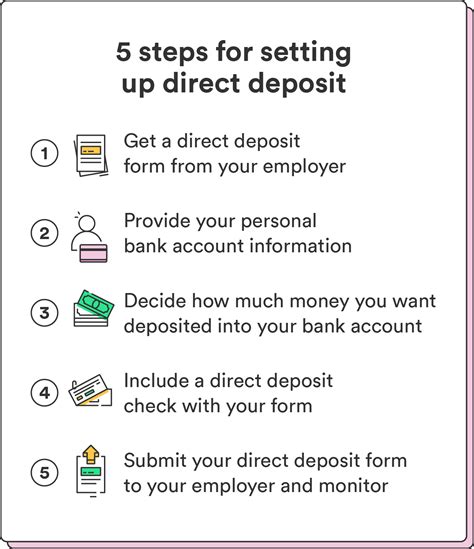

Here's a step-by-step guide to completing a direct deposit form:

- Read the Form Carefully: Review the form to ensure you understand what information is required.

- Provide Accurate Information: Double-check your bank account information to ensure accuracy.

- Fill Out the Form Legibly: Complete the form in black ink, using legible handwriting.

- Sign and Date the Form: Sign and date the form to authorize the direct deposit.

- Attach Required Documents: Attach a voided check or bank statement to verify your bank account information.

Common Mistakes to Avoid

When completing a direct deposit form, avoid the following common mistakes:

• Inaccurate Bank Account Information: Double-check your bank account number, routing number, and account type. • Incorrect Name and Address: Ensure your name and address match your bank account records. • Incomplete Form: Complete all required sections of the form to avoid delays or issues with your payments.

Tips for Filling Out a Direct Deposit Form

Here are some tips to help you fill out a direct deposit form:

• Use a Black Pen: Complete the form in black ink to ensure legibility. • Double-Check Your Information: Verify your bank account information to avoid errors. • Attach Required Documents: Attach a voided check or bank statement to verify your bank account information. • Keep a Copy: Keep a copy of the completed form for your records.

By following these steps and tips, you'll be able to complete a direct deposit form accurately and efficiently. Remember to double-check your information, attach required documents, and keep a copy of the completed form for your records.

We hope this guide has been helpful in explaining the direct deposit form process. If you have any further questions or concerns, please don't hesitate to reach out.

What is a direct deposit form?

+A direct deposit form is a document that provides your bank account information to the payer, allowing them to deposit funds directly into your account.

What information do I need to provide on a direct deposit form?

+You'll need to provide your name and address, bank account information (account number, routing number, and account type), and authorization to complete the form.

Why is it important to complete the direct deposit form accurately?

+Completing the form accurately ensures seamless and accurate transactions, avoiding delays or issues with your payments.