Pacific Guardian Life Insurance Company, a leading provider of life insurance and other financial services, offers a range of products designed to help individuals and families protect their loved ones and secure their financial future. One of the essential documents that policyholders may need to complete is the Pacific Guardian Life TDI form. In this article, we will delve into the details of the Pacific Guardian Life TDI form, its importance, and provide a comprehensive guide on how to complete it.

What is the Pacific Guardian Life TDI Form?

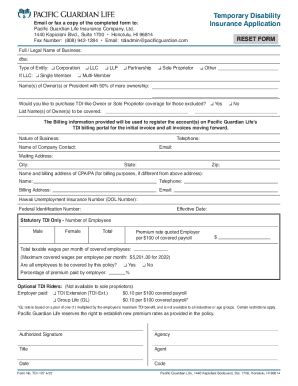

The Pacific Guardian Life TDI form, also known as the Total Disability Income form, is a document that policyholders may need to complete when applying for disability benefits under their life insurance policy. The form is designed to gather information about the policyholder's medical condition, occupation, and income, which will be used to determine their eligibility for disability benefits.

Why is the Pacific Guardian Life TDI Form Important?

The Pacific Guardian Life TDI form is a critical document that plays a significant role in the disability benefits application process. By completing the form accurately and thoroughly, policyholders can ensure that their application is processed efficiently and that they receive the benefits they are entitled to.

Who Needs to Complete the Pacific Guardian Life TDI Form?

Policyholders who are applying for disability benefits under their life insurance policy will need to complete the Pacific Guardian Life TDI form. This may include individuals who have become disabled due to illness or injury and are unable to work.

How to Complete the Pacific Guardian Life TDI Form

Completing the Pacific Guardian Life TDI form requires careful attention to detail and accuracy. Here are some steps to follow:

Step 1: Gather Required Documents

Before starting to complete the form, policyholders should gather all required documents, including:

- Their life insurance policy documents

- Medical records and reports

- Proof of income

- Proof of occupation

Step 2: Fill Out the Form

The Pacific Guardian Life TDI form typically consists of several sections, including:

- Section 1: Policyholder Information

- Section 2: Medical Information

- Section 3: Occupational Information

- Section 4: Income Information

Policyholders should fill out each section carefully and accurately, providing all required information.

Step 3: Sign and Date the Form

Once the form is complete, policyholders should sign and date it.

Step 4: Submit the Form

The completed form should be submitted to Pacific Guardian Life Insurance Company, along with all required supporting documents.

Tips for Completing the Pacific Guardian Life TDI Form

- Read the form carefully before starting to complete it.

- Use black ink to complete the form.

- Make sure to sign and date the form.

- Keep a copy of the completed form for your records.

Pacific Guardian Life TDI Form FAQs

What is the purpose of the Pacific Guardian Life TDI form?

+The Pacific Guardian Life TDI form is used to gather information about the policyholder's medical condition, occupation, and income, which will be used to determine their eligibility for disability benefits.

Who needs to complete the Pacific Guardian Life TDI form?

+Policyholders who are applying for disability benefits under their life insurance policy will need to complete the Pacific Guardian Life TDI form.

What documents do I need to complete the Pacific Guardian Life TDI form?

+Policyholders will need to provide their life insurance policy documents, medical records and reports, proof of income, and proof of occupation.

By following the steps outlined in this guide, policyholders can ensure that they complete the Pacific Guardian Life TDI form accurately and thoroughly, which will help to facilitate the disability benefits application process. If you have any further questions or concerns, please don't hesitate to reach out to Pacific Guardian Life Insurance Company directly.

We hope this comprehensive guide has been helpful in explaining the Pacific Guardian Life TDI form and its importance. If you have any thoughts or feedback, please share them with us in the comments section below.