Pennsylvania is one of the most populous states in the United States, with a large number of registered vehicles on its roads. If you're a vehicle owner in Pennsylvania, you may need to file various forms with the state's Department of Motor Vehicles (DMV) for different purposes. One such form is the Pennsylvania MV-4ST form, also known as the Vehicle Sales and Use Tax Return/Remittance Form. In this article, we'll provide a comprehensive, step-by-step guide to help you understand and fill out the Pennsylvania MV-4ST form correctly.

The Pennsylvania MV-4ST form is used to report and pay sales tax on the purchase of a vehicle. This form is typically used by vehicle owners who have purchased a vehicle from a dealer or an individual. The form requires you to provide detailed information about the vehicle, the sale, and the tax owed.

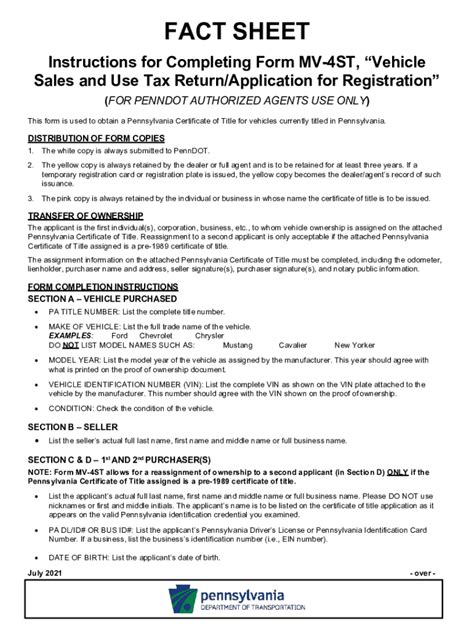

What is the Pennsylvania MV-4ST Form?

The Pennsylvania MV-4ST form is a multi-part form that consists of four sections: Sales and Use Tax Return, Tax Computation Schedule, Sales and Use Tax Remittance, and Certification. The form requires you to provide information about the vehicle, the sale, and the tax owed.

Who Needs to File the Pennsylvania MV-4ST Form?

You need to file the Pennsylvania MV-4ST form if you're a vehicle owner who has purchased a vehicle from a dealer or an individual and owes sales tax on the purchase. This includes:

- Individuals who purchase a vehicle from a dealer

- Individuals who purchase a vehicle from an individual

- Dealers who sell vehicles and need to report and pay sales tax

- Leasing companies who lease vehicles and need to report and pay sales tax

How to Fill Out the Pennsylvania MV-4ST Form

Filling out the Pennsylvania MV-4ST form requires you to provide detailed information about the vehicle, the sale, and the tax owed. Here's a step-by-step guide to help you fill out the form correctly:

Section 1: Sales and Use Tax Return

- Provide the vehicle's year, make, and vehicle identification number (VIN)

- Provide the date of sale and the sale price

- Provide the dealer's or seller's name and address

- Provide the buyer's name and address

- Calculate the sales tax owed

Section 2: Tax Computation Schedule

- Calculate the sales tax rate based on the vehicle's purchase price

- Calculate the total sales tax owed

- Provide any applicable exemptions or deductions

Section 3: Sales and Use Tax Remittance

- Provide the total amount of sales tax owed

- Provide the payment method (check or money order)

- Sign and date the form

Section 4: Certification

- Certify that the information provided is accurate and complete

- Sign and date the form

What Documents Do I Need to File with the Pennsylvania MV-4ST Form?

When filing the Pennsylvania MV-4ST form, you'll need to include the following documents:

- A copy of the vehicle's title

- A copy of the bill of sale

- A copy of the dealer's or seller's invoice

- Proof of payment (check or money order)

How to File the Pennsylvania MV-4ST Form

You can file the Pennsylvania MV-4ST form in person or by mail. Here are the steps to follow:

- Fill out the form correctly and include all required documents

- Take the form and documents to your local DMV office or mail them to the address listed on the form

- Make sure to include payment for the sales tax owed

- Keep a copy of the form and documents for your records

What are the Penalties for Not Filing the Pennsylvania MV-4ST Form?

If you fail to file the Pennsylvania MV-4ST form or pay the sales tax owed, you may be subject to penalties and fines. These can include:

- Late fees and interest on the sales tax owed

- Penalties for failure to file the form

- Fines for failure to pay the sales tax owed

FAQs

What is the deadline for filing the Pennsylvania MV-4ST form?

+The deadline for filing the Pennsylvania MV-4ST form is typically within 20 days of the sale.

How much sales tax do I owe on a vehicle purchase in Pennsylvania?

+The sales tax rate in Pennsylvania is 6% of the vehicle's purchase price.

Can I file the Pennsylvania MV-4ST form online?

+No, the Pennsylvania MV-4ST form must be filed in person or by mail.

In conclusion, the Pennsylvania MV-4ST form is an important document that vehicle owners need to file with the state's DMV to report and pay sales tax on a vehicle purchase. By following the steps outlined in this article, you can fill out the form correctly and avoid any penalties or fines. Remember to include all required documents and payment for the sales tax owed. If you have any questions or concerns, don't hesitate to reach out to your local DMV office for assistance.