Filing taxes can be a daunting task, especially for small business owners and individuals with complex financial situations. In Ohio, the IT 1140 form is a crucial part of the tax filing process, but it can be overwhelming for those who are unfamiliar with it. In this article, we will delve into the world of the Ohio IT 1140 form, exploring its purpose, benefits, and step-by-step instructions for filing.

The Ohio IT 1140 form is a vital document for businesses and individuals who need to report their annual income and expenses to the state government. The form is used to calculate the taxpayer's liability for the Ohio Commercial Activity Tax (CAT) and to report any applicable credits or deductions. Understanding the IT 1140 form and its requirements is essential for ensuring compliance with Ohio tax laws and avoiding potential penalties.

What is the Ohio IT 1140 Form?

The Ohio IT 1140 form is an annual return that must be filed by businesses and individuals who have a taxable presence in the state of Ohio. The form is used to report the taxpayer's commercial activity, which includes gross receipts from sales, services, and other business activities. The form also requires taxpayers to report any applicable deductions, credits, and tax liability.

Benefits of Filing the Ohio IT 1140 Form

Filing the Ohio IT 1140 form provides several benefits to taxpayers, including:

- Compliance with Ohio tax laws: Filing the form ensures that taxpayers are in compliance with Ohio tax laws and regulations, avoiding potential penalties and fines.

- Accurate tax liability calculation: The form helps taxpayers calculate their accurate tax liability, ensuring that they are not overpaying or underpaying their taxes.

- Eligibility for credits and deductions: The form allows taxpayers to claim applicable credits and deductions, reducing their tax liability and increasing their refund.

Step-by-Step Instructions for Filing the Ohio IT 1140 Form

Filing the Ohio IT 1140 form can be a complex process, but it can be broken down into several manageable steps. Here's a step-by-step guide to help taxpayers navigate the process:

Filing Requirements

Before filing the Ohio IT 1140 form, taxpayers must ensure that they meet the necessary filing requirements. These requirements include:

- Having a taxable presence in the state of Ohio

- Having gross receipts from sales, services, and other business activities

- Being registered with the Ohio Department of Taxation

Gathering Necessary Documents

To file the Ohio IT 1140 form, taxpayers will need to gather several necessary documents, including:

- Federal tax return (Form 1040 or Form 1120)

- Business financial statements (balance sheet and income statement)

- Sales and use tax returns

- Any applicable credits or deductions

Calculating Gross Receipts

Gross receipts are the total amount of money received from sales, services, and other business activities. Taxpayers must calculate their gross receipts accurately to ensure compliance with Ohio tax laws. The following steps can help taxpayers calculate their gross receipts:

- Identify all business activities that generate revenue

- Calculate the total amount of revenue generated from each activity

- Add up the total amount of revenue from all activities

Completing the Ohio IT 1140 Form

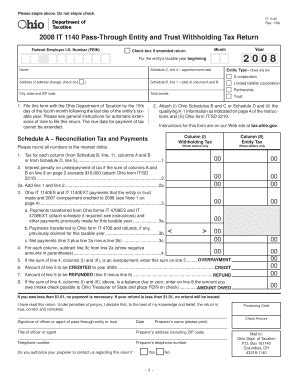

Once taxpayers have gathered all the necessary documents and calculated their gross receipts, they can complete the Ohio IT 1140 form. The form consists of several sections, including:

- Business information

- Gross receipts

- Deductions and credits

- Tax liability calculation

Taxpayers must carefully complete each section, ensuring accuracy and compliance with Ohio tax laws.

Filing the Ohio IT 1140 Form

The Ohio IT 1140 form can be filed electronically or by mail. Taxpayers can file the form electronically through the Ohio Department of Taxation's website or by using tax preparation software. Alternatively, taxpayers can file the form by mail, using the address provided on the form.

Conclusion

Filing the Ohio IT 1140 form is a critical part of the tax filing process for businesses and individuals with a taxable presence in the state of Ohio. By understanding the form's purpose, benefits, and requirements, taxpayers can ensure compliance with Ohio tax laws and avoid potential penalties. By following the step-by-step instructions outlined in this article, taxpayers can navigate the complex process of filing the Ohio IT 1140 form with ease.

We invite you to share your thoughts and experiences with filing the Ohio IT 1140 form in the comments section below. If you have any questions or need further clarification on any of the steps outlined in this article, please don't hesitate to ask.

What is the deadline for filing the Ohio IT 1140 form?

+The deadline for filing the Ohio IT 1140 form is typically April 15th of each year, but it may vary depending on the taxpayer's specific situation.

Can I file the Ohio IT 1140 form electronically?

+Yes, taxpayers can file the Ohio IT 1140 form electronically through the Ohio Department of Taxation's website or by using tax preparation software.

What is the penalty for not filing the Ohio IT 1140 form?

+The penalty for not filing the Ohio IT 1140 form can range from 10% to 20% of the taxpayer's tax liability, depending on the circumstances.