Understanding the Importance of Filing a NYS Tax Extension

The New York State tax extension form is a crucial document for individuals and businesses that need more time to file their tax returns. The state of New York requires taxpayers to file their tax returns by a specific deadline, usually on April 15th for individual taxpayers and March 15th for businesses. However, if taxpayers are unable to meet this deadline, they can file for a 6-month extension using the NYS tax extension form. This extension allows taxpayers to file their tax returns by October 15th for individuals and September 15th for businesses.

Filing a NYS tax extension form is essential for taxpayers who need more time to gather their tax documents, resolve any tax-related issues, or seek the help of a tax professional. Failure to file a tax extension or pay any owed taxes by the deadline can result in penalties, interest, and other consequences. In this article, we will guide you through the process of filing a NYS tax extension form and provide valuable information on the benefits and requirements of filing an extension.

Benefits of Filing a NYS Tax Extension

Filing a NYS tax extension form provides several benefits to taxpayers. Some of the most significant advantages include:

- Avoiding Penalties and Interest: By filing a tax extension, taxpayers can avoid penalties and interest on their tax debt. The state of New York charges a penalty of 5% of the tax debt for each month or part of a month that the return is late.

- More Time to Gather Documents: A tax extension provides taxpayers with additional time to gather their tax documents, resolve any tax-related issues, or seek the help of a tax professional.

- Reducing Stress and Pressure: Filing a tax extension can help reduce stress and pressure associated with meeting the tax filing deadline.

- Allowing for More Accurate Filings: With more time to file, taxpayers can ensure that their tax returns are accurate and complete, reducing the risk of errors or audits.

Who Can File a NYS Tax Extension

The NYS tax extension form is available to individual taxpayers and businesses that need more time to file their tax returns. The following types of taxpayers can file a NYS tax extension:

- Individual Taxpayers: Individuals who need more time to file their personal income tax returns can file a NYS tax extension form.

- Businesses: Businesses, including corporations, partnerships, and sole proprietorships, can file a NYS tax extension form to extend the deadline for filing their business tax returns.

- Trusts and Estates: Trusts and estates can also file a NYS tax extension form to extend the deadline for filing their fiduciary income tax returns.

How to File a NYS Tax Extension

Filing a NYS tax extension form is a straightforward process that can be completed online or by mail. Here are the steps to file a NYS tax extension:

- Determine Your Eligibility: Before filing a NYS tax extension, determine if you are eligible to file an extension. Check the NYS Department of Taxation and Finance website for more information.

- Gather Required Documents: Gather all required documents, including your tax identification number, tax year, and payment information.

- File Online: File your NYS tax extension form online through the NYS Department of Taxation and Finance website. You will need to create an account and provide your tax information.

- Pay Any Owed Taxes: Pay any owed taxes by the original deadline to avoid penalties and interest.

- Mail Your Extension Form: If you prefer to file by mail, complete the NYS tax extension form and mail it to the NYS Department of Taxation and Finance.

NYS Tax Extension Form IT-370

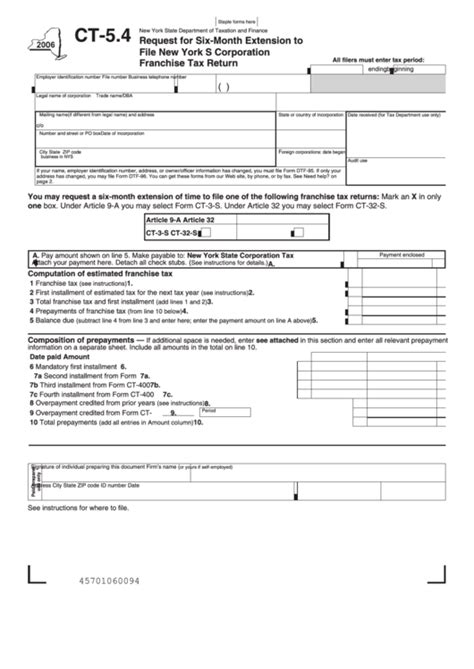

The NYS tax extension form IT-370 is used by individual taxpayers to request a 6-month extension to file their personal income tax returns. The form requires taxpayers to provide their tax identification number, tax year, and payment information.NYS Tax Extension Form CT-5

The NYS tax extension form CT-5 is used by businesses to request a 6-month extension to file their business tax returns. The form requires businesses to provide their tax identification number, tax year, and payment information.Consequences of Not Filing a NYS Tax Extension

Failure to file a NYS tax extension form or pay any owed taxes by the deadline can result in serious consequences, including:

- Penalties and Interest: The state of New York charges a penalty of 5% of the tax debt for each month or part of a month that the return is late.

- Loss of Refund: If you fail to file a tax return or pay any owed taxes, you may lose your refund.

- Audit and Examination: The NYS Department of Taxation and Finance may audit or examine your tax return, which can result in additional taxes, penalties, and interest.

Conclusion

Filing a NYS tax extension form is a straightforward process that provides taxpayers with additional time to file their tax returns. By understanding the benefits and requirements of filing an extension, taxpayers can avoid penalties and interest, reduce stress and pressure, and ensure accurate filings. If you need more time to file your tax returns, consider filing a NYS tax extension form today.What is the deadline for filing a NYS tax extension?

+The deadline for filing a NYS tax extension is the same as the original tax filing deadline. For individual taxpayers, the deadline is usually April 15th, and for businesses, the deadline is usually March 15th.

Can I file a NYS tax extension online?

+Yes, you can file a NYS tax extension online through the NYS Department of Taxation and Finance website. You will need to create an account and provide your tax information.

What are the consequences of not filing a NYS tax extension?

+Failure to file a NYS tax extension form or pay any owed taxes by the deadline can result in penalties and interest, loss of refund, and audit and examination by the NYS Department of Taxation and Finance.