As a part-year resident of New York City, navigating the complex world of tax filing can be a daunting task. With multiple forms to fill out and various rules to follow, it's easy to feel overwhelmed. However, with the right guidance, you can ensure that you're taking advantage of all the deductions and credits available to you.

Living in New York City, even if only part-time, comes with its own set of unique tax implications. From the city's income tax to the state's complex tax laws, it's essential to understand how to file your taxes correctly. In this comprehensive guide, we'll walk you through the process of filing your part-year resident tax return, including the necessary forms, deductions, and credits.

Understanding Part-Year Residency

Before diving into the world of tax filing, it's crucial to understand what it means to be a part-year resident of New York City. According to the New York State Department of Taxation and Finance, a part-year resident is someone who:

- Lives in New York City for only part of the year

- Maintains a permanent home in another state or country

- Spends at least 30 days in New York City, but less than 183 days

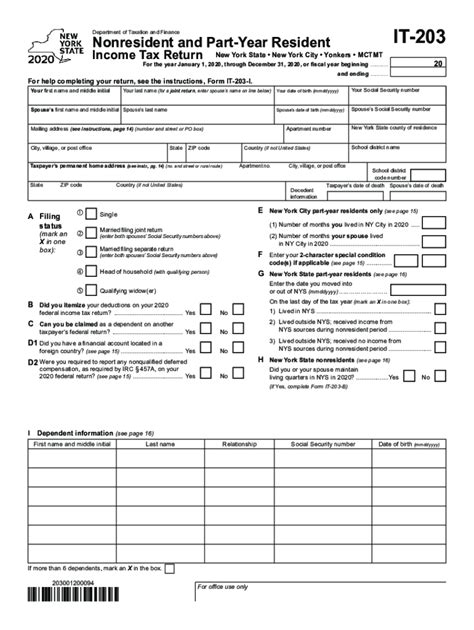

As a part-year resident, you'll need to file a New York State income tax return (Form IT-201) and a New York City income tax return (Form NYC-1120).

Gathering Necessary Documents

Before starting the tax filing process, it's essential to gather all necessary documents. These may include:

- W-2 forms from your employer(s)

- 1099 forms for freelance work or other income

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

Filing Form IT-201

The New York State income tax return, Form IT-201, is used to report your income earned while living in New York State. As a part-year resident, you'll need to complete the following sections:

- Section 1: Residency Information

- Section 2: Income

- Section 3: Deductions

- Section 4: Credits

Be sure to claim any applicable deductions, such as the standard deduction or itemized deductions.

Filing Form NYC-1120

The New York City income tax return, Form NYC-1120, is used to report your income earned while living in New York City. As a part-year resident, you'll need to complete the following sections:

- Section 1: Residency Information

- Section 2: Income

- Section 3: Deductions

- Section 4: Credits

Be sure to claim any applicable deductions, such as the standard deduction or itemized deductions.

Deductions and Credits

As a part-year resident, you may be eligible for various deductions and credits. Some of these include:

- Standard Deduction: A fixed amount that can be deducted from your taxable income

- Itemized Deductions: Expenses such as mortgage interest, charitable donations, and medical expenses

- Earned Income Tax Credit (EITC): A credit for low-to-moderate-income working individuals and families

- Child Tax Credit: A credit for families with dependent children

Tips for Filing

- File electronically: Filing your taxes electronically can help reduce errors and speed up the processing time.

- Use tax software: Tax software can help guide you through the filing process and ensure accuracy.

- Consult a tax professional: If you're unsure about any part of the filing process, consider consulting a tax professional.

Common Mistakes to Avoid

- Failing to report all income

- Not claiming applicable deductions and credits

- Not filing on time

- Not keeping accurate records

By avoiding these common mistakes, you can ensure that your tax filing process goes smoothly and that you're taking advantage of all the deductions and credits available to you.

Conclusion

Filing your part-year resident tax return in New York City can be a complex process, but with the right guidance, you can ensure that you're in compliance with all tax laws and regulations. By gathering necessary documents, filing the correct forms, and claiming applicable deductions and credits, you can reduce your tax liability and avoid any potential penalties. Remember to file electronically, use tax software, and consult a tax professional if needed.

Frequently Asked Questions

What is a part-year resident of New York City?

+A part-year resident of New York City is someone who lives in the city for only part of the year, maintains a permanent home in another state or country, and spends at least 30 days in the city, but less than 183 days.

What forms do I need to file as a part-year resident of New York City?

+You'll need to file a New York State income tax return (Form IT-201) and a New York City income tax return (Form NYC-1120).

What deductions and credits am I eligible for as a part-year resident of New York City?

+You may be eligible for various deductions and credits, including the standard deduction, itemized deductions, Earned Income Tax Credit (EITC), and Child Tax Credit.

Note: This article is for informational purposes only and should not be considered as tax advice. It's always best to consult a tax professional or the New York State Department of Taxation and Finance for specific guidance on filing your part-year resident tax return.