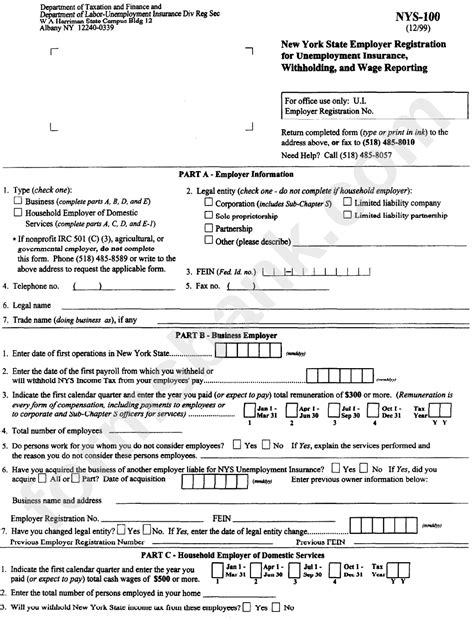

As an employer in New York, you're likely familiar with the complexities of tax compliance. One crucial form you'll need to navigate is the NYS-100, also known as the New York State Employer's Registration for Unemployment Insurance and Withholding Tax. This form is essential for registering your business with the state and fulfilling your tax obligations. In this comprehensive guide, we'll delve into the world of NYS-100, exploring its importance, requirements, and step-by-step instructions for completion.

Understanding the NYS-100 Form

The NYS-100 form is a dual-purpose registration that enables employers to register for both Unemployment Insurance (UI) and Withholding Tax (WT) with the New York State Department of Labor. This form is mandatory for all employers in New York, including those who have never had employees before. By registering, you'll be able to fulfill your tax obligations, report employment data, and access various state-provided services.

Why is the NYS-100 Form Important?

Completing the NYS-100 form is crucial for several reasons:

- Compliance: Registering with the state ensures you're meeting your tax obligations, which is essential for avoiding penalties and fines.

- Unemployment Insurance: By registering for UI, you'll be able to provide financial support to former employees who are eligible for benefits.

- Withholding Tax: Registering for WT enables you to withhold state income taxes from your employees' wages, which is required by law.

Who Needs to Complete the NYS-100 Form?

The following entities must complete the NYS-100 form:

- New Employers: Any business or organization that has never had employees before must register with the state.

- Existing Employers: If you've previously registered with the state but have undergone a change in business structure, ownership, or name, you may need to re-register.

- Out-of-State Employers: If you're an out-of-state employer with employees working in New York, you'll need to register with the state.

NYS-100 Form Requirements

To complete the NYS-100 form, you'll need to provide the following information:

- Business Information: Your business name, address, and federal employer identification number (FEIN).

- Owner/Officer Information: The name, title, and contact information for the owner or officer responsible for tax compliance.

- Employment Information: The number of employees, payroll frequency, and employment start date.

- Withholding Tax Information: The type of withholding tax you'll be required to withhold (e.g., state income tax, local tax).

Step-by-Step Instructions for Completing the NYS-100 Form

- Download the Form: You can download the NYS-100 form from the New York State Department of Labor website.

- Complete the Form: Fill out the form accurately and thoroughly, ensuring you provide all required information.

- Sign and Date the Form: Sign and date the form, indicating that the information provided is true and accurate.

- Submit the Form: Submit the completed form to the New York State Department of Labor, either online or by mail.

NYS-100 Form Submission and Processing

Once you've submitted the NYS-100 form, the New York State Department of Labor will review and process your registration. You can expect the following:

- Registration Confirmation: You'll receive a confirmation letter or email indicating that your registration has been processed.

- UI and WT Account Numbers: You'll be assigned UI and WT account numbers, which you'll use to report employment data and pay taxes.

Common Errors to Avoid When Completing the NYS-100 Form

When completing the NYS-100 form, be sure to avoid the following common errors:

- Inaccurate Information: Ensure that all information provided is accurate and up-to-date.

- Missing Information: Make sure you provide all required information to avoid delays in processing.

- Incorrect Signatures: Ensure that the form is signed and dated correctly.

Tips for Completing the NYS-100 Form

To ensure a smooth registration process, follow these tips:

- Use the Correct Form: Ensure you're using the most up-to-date version of the NYS-100 form.

- Seek Assistance: If you're unsure about any aspect of the form, don't hesitate to seek assistance from the New York State Department of Labor or a tax professional.

- Double-Check Your Work: Carefully review the form for errors or omissions before submitting it.

By following this comprehensive guide, you'll be well on your way to successfully completing the NYS-100 form and fulfilling your tax obligations as a New York employer. Remember to take your time, ensure accuracy, and seek assistance when needed.

What is the NYS-100 form used for?

+The NYS-100 form is used for registering with the New York State Department of Labor for Unemployment Insurance (UI) and Withholding Tax (WT).

Who needs to complete the NYS-100 form?

+New employers, existing employers who have undergone a change in business structure, ownership, or name, and out-of-state employers with employees working in New York need to complete the NYS-100 form.

What information is required to complete the NYS-100 form?

+Business information, owner/officer information, employment information, and withholding tax information are required to complete the NYS-100 form.