As a non-resident Indian, managing your finances in India can be a daunting task. With the various types of bank accounts available, it can be confusing to choose the right one. One such account that is popular among NRIs is the NRE account. But what is an NRE account, and how does it benefit you? In this article, we will delve into the details of an NRE account, its benefits, and how it can help you manage your finances in India.

What is an NRE Account?

An NRE account, also known as a Non-Resident External account, is a type of savings account that is designed specifically for non-resident Indians. This account allows NRIs to manage their income earned outside India and park their foreign earnings in India. The account is maintained in Indian rupees, and the interest earned on the deposits is tax-free.

How Does an NRE Account Work?

An NRE account works similarly to a regular savings account, with a few additional features. Here are the key aspects of an NRE account:

- Eligibility: Only non-resident Indians can open an NRE account. This includes Indians who are living abroad for work, education, or any other purpose.

- Currency: The account is maintained in Indian rupees.

- Deposits: NRIs can deposit their foreign earnings into the account.

- Withdrawals: Withdrawals can be made in Indian rupees, and the account holder can repatriate the funds back to their foreign account.

- Interest: The interest earned on the deposits is tax-free.

- Joint Account: NRE accounts can be opened jointly with another NRI or a resident Indian.

Benefits of an NRE Account

There are several benefits of opening an NRE account:

- Tax-Free Interest: The interest earned on the deposits is tax-free, making it an attractive option for NRIs.

- Repatriation: NRIs can repatriate the funds back to their foreign account, making it easy to manage their finances.

- Convenience: NRE accounts can be managed online, making it easy to access and manage the account from anywhere in the world.

- Joint Account: NRE accounts can be opened jointly with another NRI or a resident Indian, making it easy to manage family finances.

- Flexibility: NRE accounts offer flexibility in terms of deposits and withdrawals, making it easy to manage finances.

Types of NRE Accounts

There are several types of NRE accounts available, including:

- NRE Savings Account: This is a basic savings account that earns interest on the deposits.

- NRE Fixed Deposit: This is a time deposit that earns a higher interest rate than a savings account.

- NRE Recurring Deposit: This is a deposit account that allows NRIs to deposit a fixed amount regularly.

How to Open an NRE Account

Opening an NRE account is a straightforward process:

- Choose a Bank: Select a bank that offers NRE accounts and has a good reputation.

- Gather Documents: Gather the required documents, including proof of identity, proof of address, and proof of NRI status.

- Fill Application Form: Fill the application form and submit it to the bank.

- Fund the Account: Fund the account with the minimum required amount.

NRE Account vs NRO Account

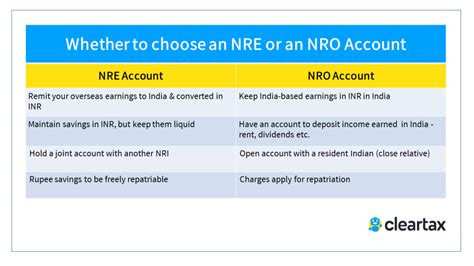

NRE and NRO accounts are both designed for non-resident Indians, but there are key differences between the two:

- Purpose: NRE accounts are designed for NRIs who want to manage their foreign earnings in India, while NRO accounts are designed for NRIs who want to manage their income earned in India.

- Taxation: NRE accounts are tax-free, while NRO accounts are subject to taxation.

- Repatriation: NRE accounts allow repatriation of funds, while NRO accounts do not.

Conclusion

In conclusion, an NRE account is a great option for non-resident Indians who want to manage their foreign earnings in India. With its tax-free interest, repatriation benefits, and flexibility, it is an attractive option for NRIs. However, it is essential to understand the benefits and limitations of an NRE account before opening one.

We hope this article has provided you with a comprehensive understanding of NRE accounts. If you have any questions or comments, please feel free to share them below.

What is the minimum balance required to open an NRE account?

+The minimum balance required to open an NRE account varies from bank to bank. Some banks may require a minimum balance of ₹10,000, while others may require ₹25,000 or more.

Can I open an NRE account jointly with a resident Indian?

+Yes, you can open an NRE account jointly with a resident Indian. However, the resident Indian will not have any control over the account, and the account will be managed solely by the NRI account holder.

What is the interest rate offered on NRE accounts?

+The interest rate offered on NRE accounts varies from bank to bank. Some banks may offer an interest rate of 4% per annum, while others may offer 6% per annum or more.