If you're considering rescinding a reaffirmation agreement, it's essential to understand the process and the implications involved. A reaffirmation agreement is a contract between a debtor and a creditor that reaffirms a debt that would otherwise be discharged in bankruptcy. However, circumstances may change, and you may need to rescind this agreement. In this article, we'll delve into the Notice of Rescission of Reaffirmation Agreement Form, its purpose, and the steps involved in the process.

Understanding Reaffirmation Agreements

Before we dive into the Notice of Rescission of Reaffirmation Agreement Form, let's briefly discuss reaffirmation agreements. When you file for bankruptcy, most of your debts are discharged, meaning you're no longer liable for them. However, some debts, such as car loans or mortgages, are secured by collateral. In these cases, the creditor may request that you sign a reaffirmation agreement, which confirms that you'll continue to make payments on the debt.

Why Rescind a Reaffirmation Agreement?

There are several reasons why you may want to rescind a reaffirmation agreement. Perhaps your financial situation has changed, and you can no longer afford the payments. Maybe you've discovered that the creditor has not fulfilled their obligations under the agreement. Whatever the reason, rescinding a reaffirmation agreement can provide you with a fresh start.

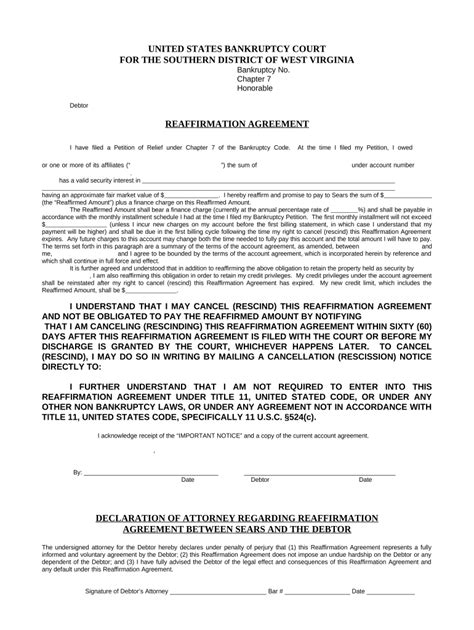

The Notice of Rescission of Reaffirmation Agreement Form

The Notice of Rescission of Reaffirmation Agreement Form is a document that notifies the creditor that you're rescinding the reaffirmation agreement. This form is typically filed with the bankruptcy court and served on the creditor. The form must include the following information:

- Your name and address

- The creditor's name and address

- The case number and court where the bankruptcy was filed

- A statement indicating that you're rescinding the reaffirmation agreement

- The date of the reaffirmation agreement

- The date of the rescission

Steps to Rescind a Reaffirmation Agreement

To rescind a reaffirmation agreement, follow these steps:

- Review your reaffirmation agreement: Carefully review the agreement to understand the terms and conditions.

- Determine the reason for rescission: Identify the reason for rescinding the agreement, such as financial hardship or the creditor's failure to fulfill their obligations.

- Complete the Notice of Rescission of Reaffirmation Agreement Form: Fill out the form, ensuring that you include all the required information.

- File the form with the bankruptcy court: Submit the form to the bankruptcy court where your case was filed.

- Serve the creditor: Serve the creditor with a copy of the form, either by mail or in person.

- Wait for the creditor's response: The creditor may respond to the rescission, either by accepting it or objecting to it.

Consequences of Rescinding a Reaffirmation Agreement

Rescinding a reaffirmation agreement can have significant consequences. If the creditor accepts the rescission, the debt will be discharged, and you'll no longer be liable for it. However, if the creditor objects to the rescission, they may request that the court reinstate the agreement.

Additionally, rescinding a reaffirmation agreement may impact your credit score. The creditor may report the rescission to the credit bureaus, which could negatively affect your credit score.

Alternatives to Rescinding a Reaffirmation Agreement

Before rescinding a reaffirmation agreement, consider alternative options:

- Modify the agreement: You may be able to negotiate with the creditor to modify the terms of the agreement, such as reducing the monthly payments.

- Request a temporary hardship: If you're experiencing financial difficulties, you may be able to request a temporary hardship, which allows you to suspend payments for a specified period.

- Seek bankruptcy counseling: A bankruptcy counselor can help you explore options and determine the best course of action.

Conclusion and Next Steps

Rescinding a reaffirmation agreement can provide you with a fresh start, but it's essential to understand the process and the implications involved. If you're considering rescinding a reaffirmation agreement, take the time to review the agreement, determine the reason for rescission, and complete the Notice of Rescission of Reaffirmation Agreement Form.

If you have any questions or concerns, don't hesitate to reach out to a bankruptcy attorney or counselor. They can provide you with personalized guidance and help you navigate the process.

We hope this article has provided you with a comprehensive understanding of the Notice of Rescission of Reaffirmation Agreement Form and the steps involved in rescinding a reaffirmation agreement. If you have any feedback or suggestions, please leave a comment below.

What is a reaffirmation agreement?

+A reaffirmation agreement is a contract between a debtor and a creditor that reaffirms a debt that would otherwise be discharged in bankruptcy.

Why would I want to rescind a reaffirmation agreement?

+You may want to rescind a reaffirmation agreement if your financial situation has changed, or if the creditor has not fulfilled their obligations under the agreement.

What is the Notice of Rescission of Reaffirmation Agreement Form?

+The Notice of Rescission of Reaffirmation Agreement Form is a document that notifies the creditor that you're rescinding the reaffirmation agreement.