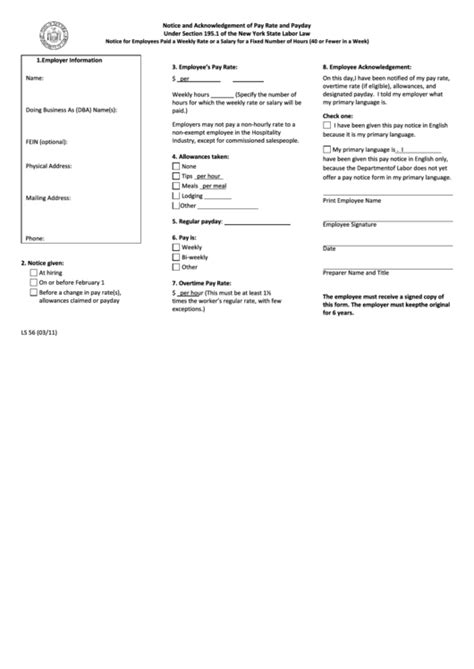

As an employer, it is essential to comply with labor laws and regulations to ensure a smooth and legally compliant employment relationship with your employees. One crucial aspect of this compliance is providing employees with a Notice and Acknowledgement of Pay Rate and Payday Form. This document serves as proof that employees have been informed about their pay rate, payday, and other essential terms of their employment.

Importance of Notice and Acknowledgement of Pay Rate and Payday Form

The Notice and Acknowledgement of Pay Rate and Payday Form is a critical document that benefits both employers and employees. For employers, it provides a paper trail that demonstrates compliance with labor laws, reducing the risk of disputes and lawsuits. For employees, it ensures transparency and clarity regarding their compensation and payday, helping them plan their finances accordingly.

What is Included in the Notice and Acknowledgement of Pay Rate and Payday Form?

The Notice and Acknowledgement of Pay Rate and Payday Form typically includes the following essential information:

- Employee's name and address

- Pay rate (hourly, salary, or commission-based)

- Payday schedule (e.g., weekly, bi-weekly, monthly)

- Payment method (e.g., direct deposit, check, or cash)

- Any deductions or withholdings (e.g., taxes, benefits, or garnishments)

- Acknowledgement of receipt of the notice by the employee

Benefits of Using a Notice and Acknowledgement of Pay Rate and Payday Form

Using a Notice and Acknowledgement of Pay Rate and Payday Form provides several benefits to employers, including:

- Compliance with labor laws and regulations

- Reduced risk of disputes and lawsuits

- Improved employee relations and trust

- Clear documentation of pay rates and paydays

- Simplified payroll processing and record-keeping

Consequences of Non-Compliance

Failure to provide employees with a Notice and Acknowledgement of Pay Rate and Payday Form can result in severe consequences, including:

- Fines and penalties for non-compliance

- Lawsuits and disputes over pay rates and paydays

- Damage to employer-employee relationships and reputation

- Increased risk of audits and inspections by labor authorities

Best Practices for Implementing a Notice and Acknowledgement of Pay Rate and Payday Form

To ensure effective implementation of a Notice and Acknowledgement of Pay Rate and Payday Form, follow these best practices:

- Use a standardized template to ensure consistency and compliance

- Provide the form to all employees, including new hires and existing staff

- Obtain employee acknowledgement and signature on the form

- Keep a record of the form and employee acknowledgement for at least three years

- Review and update the form regularly to ensure compliance with changing labor laws and regulations

Conclusion

In conclusion, providing employees with a Notice and Acknowledgement of Pay Rate and Payday Form is a critical aspect of employment compliance. By understanding the importance and benefits of this document, employers can ensure a smooth and legally compliant employment relationship with their employees. Remember to use a standardized template, provide the form to all employees, and keep a record of the form and employee acknowledgement.

We encourage you to share your thoughts and experiences regarding the Notice and Acknowledgement of Pay Rate and Payday Form in the comments section below. Have you implemented this document in your workplace? What benefits or challenges have you encountered? Share your insights and help others improve their employment compliance.

What is the purpose of a Notice and Acknowledgement of Pay Rate and Payday Form?

+The purpose of a Notice and Acknowledgement of Pay Rate and Payday Form is to provide employees with clear information about their pay rate, payday, and other essential terms of their employment, while also demonstrating employer compliance with labor laws and regulations.

What information is typically included in a Notice and Acknowledgement of Pay Rate and Payday Form?

+The form typically includes the employee's name and address, pay rate, payday schedule, payment method, any deductions or withholdings, and an acknowledgement of receipt by the employee.

What are the consequences of not providing a Notice and Acknowledgement of Pay Rate and Payday Form to employees?

+Failure to provide the form can result in fines and penalties for non-compliance, lawsuits and disputes over pay rates and paydays, damage to employer-employee relationships and reputation, and increased risk of audits and inspections by labor authorities.