Tax season is upon us, and for many North Carolina residents, that means navigating the complexities of the NC Form D-400. This form is used to report individual income tax, and while it may seem daunting at first, with the right guidance, you can complete it with ease. In this article, we'll walk you through five ways to make the process smoother and less stressful.

Completing the NC Form D-400 is a crucial step in meeting your tax obligations, and it's essential to get it right to avoid any potential penalties or delays in receiving your refund. By following these tips, you'll be well on your way to a hassle-free tax filing experience.

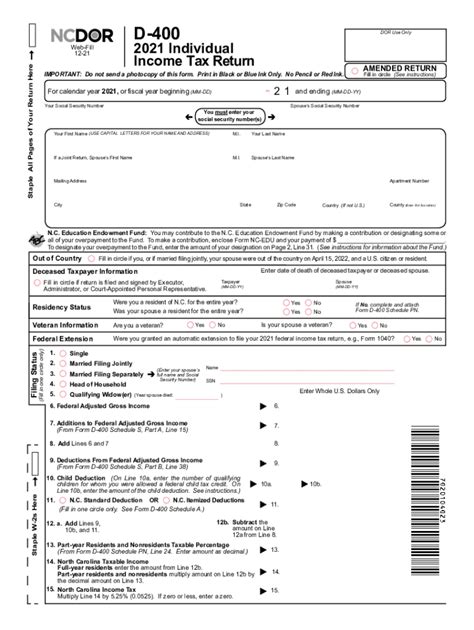

Understanding the NC Form D-400

Before we dive into the tips, let's take a brief look at what the NC Form D-400 entails. This form is used to report an individual's income tax for the state of North Carolina. It's a comprehensive form that requires you to report various types of income, deductions, and credits. The form is typically filed annually, and the deadline is usually April 15th.

Gathering Necessary Documents

To complete the NC Form D-400 with ease, it's essential to gather all the necessary documents before starting the process. This includes:

- W-2 forms from your employer(s)

- 1099 forms for freelance work or other income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

- Any other relevant tax-related documents

Having all these documents in one place will make it easier to fill out the form accurately and efficiently.

Tips for Completing the NC Form D-400

Now that we've covered the basics, let's move on to the tips for completing the NC Form D-400.

Tip 1: Use Tax Preparation Software

One of the easiest ways to complete the NC Form D-400 is by using tax preparation software. These programs, such as TurboTax or H&R Block, guide you through the process step-by-step and perform calculations for you. They also ensure that you're taking advantage of all the deductions and credits you're eligible for.

Tip 2: Take Advantage of Free Resources

The North Carolina Department of Revenue offers free resources to help you complete the NC Form D-400. These resources include instructional videos, guides, and worksheets. You can also contact their customer service department if you have any questions or concerns.

Tip 3: Itemize Your Deductions

Itemizing your deductions can help you save money on your taxes. This involves keeping track of expenses throughout the year and listing them on the NC Form D-400. Some common itemized deductions include:

- Medical expenses

- Charitable donations

- Mortgage interest

- Property taxes

Make sure to keep receipts and records for all your itemized deductions.

Tip 4: Claim All Eligible Credits

In addition to deductions, there are various credits you may be eligible for. These credits can provide a dollar-for-dollar reduction in your tax liability. Some common credits include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education Credits

- Retirement Savings Contributions Credit

Tip 5: Double-Check Your Work

Finally, it's essential to double-check your work before submitting the NC Form D-400. This includes reviewing your math calculations, ensuring all information is accurate, and verifying that you've included all necessary documents.

By following these tips, you'll be able to complete the NC Form D-400 with ease and confidence. Remember to stay organized, take advantage of free resources, and double-check your work to ensure a smooth tax filing experience.

Conclusion: Simplifying the NC Form D-400 Process

Completing the NC Form D-400 doesn't have to be a daunting task. By gathering necessary documents, using tax preparation software, taking advantage of free resources, itemizing deductions, claiming eligible credits, and double-checking your work, you can make the process much easier. Remember to stay calm, take your time, and don't hesitate to seek help if you need it.

We hope this article has provided you with the guidance and support you need to complete the NC Form D-400 with ease. If you have any further questions or concerns, feel free to comment below or share this article with friends and family who may find it helpful.

What is the deadline for filing the NC Form D-400?

+The deadline for filing the NC Form D-400 is usually April 15th.

Can I file the NC Form D-400 electronically?

+Yes, you can file the NC Form D-400 electronically through the North Carolina Department of Revenue's website or through tax preparation software.

What is the penalty for late filing of the NC Form D-400?

+The penalty for late filing of the NC Form D-400 is 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.