New Mexico is known for its stunning natural beauty, rich cultural heritage, and unique blend of Native American, Spanish, and Mexican influences. When it comes to taxes, the Land of Enchantment has its own set of rules and regulations. For individuals and businesses operating in New Mexico, understanding the tax filing process is crucial to avoid penalties and ensure compliance with state laws. In this comprehensive guide, we'll delve into the world of New Mexico Pit-1 forms, exploring what they are, how to file them, and the benefits of timely tax compliance.

What is the New Mexico Pit-1 Form?

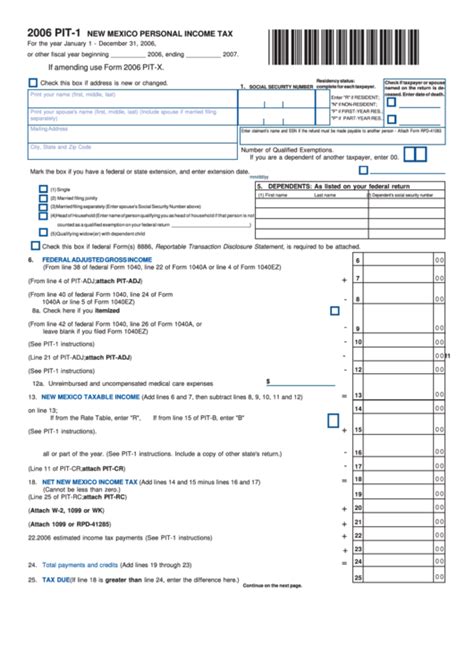

The New Mexico Pit-1 form is a tax return document used by the state's Taxation and Revenue Department to report individual income tax. The form is designed for residents and non-residents who earned income in New Mexico during the tax year. The Pit-1 form is similar to the federal Form 1040, but it's specifically tailored to meet New Mexico's tax laws and regulations.

Who Needs to File the Pit-1 Form?

Not everyone needs to file the Pit-1 form. According to the New Mexico Taxation and Revenue Department, you must file a return if you meet the following conditions:

- You're a resident of New Mexico and your gross income exceeds the threshold for your filing status (e.g., single, married, head of household).

- You're a non-resident with income earned in New Mexico, and your gross income exceeds the threshold for your filing status.

- You have a tax liability, even if your gross income is below the threshold.

- You want to claim a refund for overpaid taxes.

How to File the Pit-1 Form

Filing the Pit-1 form can be done electronically or by mail. The New Mexico Taxation and Revenue Department recommends e-filing, as it's faster, more accurate, and environmentally friendly. To e-file, you'll need to:

- Gather required documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

- Choose a tax preparation software or use the New Mexico Taxation and Revenue Department's online filing system.

- Complete the Pit-1 form, ensuring accuracy and completeness.

- Submit your return electronically.

If you prefer to file by mail, you can download the Pit-1 form from the New Mexico Taxation and Revenue Department's website or pick one up from a local office. Make sure to sign and date the form, then mail it to the address provided on the form.

Benefits of Timely Tax Compliance

Filing your Pit-1 form on time is essential to avoid penalties, interest, and other consequences. Some benefits of timely tax compliance include:

- Avoiding late fees and penalties

- Ensuring accurate tax calculation and payment

- Receiving a refund, if applicable

- Maintaining a good tax compliance record

- Reducing the risk of an audit

Tips for Filing the Pit-1 Form

To ensure a smooth filing experience, follow these tips:

- Gather all required documents before starting the filing process.

- Double-check your math and ensure accuracy.

- Take advantage of tax credits and deductions available in New Mexico.

- Consider consulting a tax professional if you're unsure about any aspect of the filing process.

New Mexico Tax Credits and Deductions

New Mexico offers various tax credits and deductions to help reduce your tax liability. Some popular options include:

- The Low-Income Comprehensive Tax Rebate (LICTR)

- The Working Families Tax Credit (WFTC)

- The New Mexico Film Production Tax Credit

- The Solar Market Development Tax Credit

Common Mistakes to Avoid

When filing your Pit-1 form, be mindful of common mistakes that can lead to delays or penalties:

- Inaccurate or incomplete information

- Failure to report all income

- Not claiming eligible tax credits and deductions

- Missing deadlines or not filing on time

Additional Resources

For more information on the New Mexico Pit-1 form and tax filing process, consult the following resources:

- New Mexico Taxation and Revenue Department:

- IRS:

- New Mexico Tax Professionals Association:

Conclusion: Stay on Top of Your New Mexico Taxes

Filing your Pit-1 form is a crucial part of meeting your tax obligations in New Mexico. By understanding the tax filing process, taking advantage of available credits and deductions, and avoiding common mistakes, you can ensure timely tax compliance and minimize the risk of penalties. Stay informed, stay compliant, and take control of your New Mexico taxes today!

Invite to Engage:

We hope this guide has provided valuable insights into the world of New Mexico Pit-1 forms. If you have any questions, comments, or concerns, please don't hesitate to share them in the comments section below. Your feedback is essential to helping us improve our content and better serve the tax needs of New Mexico residents and businesses.

FAQ Section:

What is the deadline for filing the Pit-1 form?

+The deadline for filing the Pit-1 form is typically April 15th of each year, unless you file for an extension.

Can I e-file my Pit-1 form?

+Yes, you can e-file your Pit-1 form through the New Mexico Taxation and Revenue Department's online filing system or through approved tax preparation software.

What happens if I miss the filing deadline?

+If you miss the filing deadline, you may be subject to penalties, interest, and other consequences. It's essential to file as soon as possible to minimize any negative impacts.