As a business owner or individual in New Jersey, you may have come across the NJ L-8 form, also known as the "Tax Clearance Certificate". This document is a crucial requirement for various business transactions, such as selling or merging a business, or obtaining certain licenses and permits. In this article, we will delve into the world of NJ L-8 forms, exploring their purpose, benefits, and the step-by-step process of obtaining one.

What is an NJ L-8 Form?

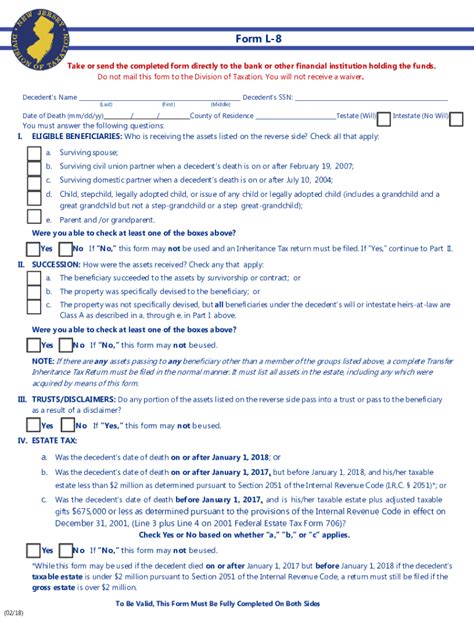

The NJ L-8 form is a tax clearance certificate issued by the New Jersey Division of Taxation, which confirms that a business or individual has paid all outstanding taxes, including income tax, sales tax, and payroll tax. This certificate is typically required when a business is changing ownership, merging with another company, or obtaining certain licenses and permits.

Why is an NJ L-8 Form Required?

The NJ L-8 form is required to ensure that all tax obligations are met before a business transaction can take place. This certificate provides assurance to the state that all taxes have been paid, and it also protects the buyer or new owner from inheriting any outstanding tax liabilities.

Benefits of Obtaining an NJ L-8 Form

Obtaining an NJ L-8 form provides several benefits, including:

- Protection from Outstanding Tax Liabilities: An NJ L-8 form ensures that the buyer or new owner is not held responsible for any outstanding tax liabilities.

- Smooth Business Transactions: Having an NJ L-8 form can facilitate business transactions, such as sales or mergers, by providing assurance that all tax obligations have been met.

- Compliance with State Regulations: Obtaining an NJ L-8 form demonstrates compliance with state regulations and tax laws.

Who Needs an NJ L-8 Form?

An NJ L-8 form is typically required for:

- Business Owners: Selling or merging a business

- Buyers: Purchasing a business or acquiring certain licenses and permits

- Individuals: Obtaining certain licenses and permits

Step-by-Step Process of Obtaining an NJ L-8 Form

To obtain an NJ L-8 form, follow these steps:

- Gather Required Documents: Collect all necessary documents, including tax returns, payment receipts, and business registration documents.

- Submit Application: Submit the application for an NJ L-8 form to the New Jersey Division of Taxation.

- Pay Outstanding Taxes: Pay any outstanding taxes, including interest and penalties.

- Wait for Processing: Wait for the application to be processed, which may take several weeks.

- Receive Certificate: Receive the NJ L-8 form, which is typically valid for 60 days.

Common Mistakes to Avoid

When applying for an NJ L-8 form, avoid the following common mistakes:

- Inaccurate or Incomplete Information: Ensure that all information is accurate and complete to avoid delays or rejections.

- Failure to Pay Outstanding Taxes: Pay all outstanding taxes, including interest and penalties, to avoid delays or rejections.

- Insufficient Documentation: Ensure that all required documents are submitted to avoid delays or rejections.

Conclusion

In conclusion, the NJ L-8 form is a crucial requirement for various business transactions in New Jersey. By understanding the purpose, benefits, and step-by-step process of obtaining an NJ L-8 form, business owners and individuals can ensure a smooth and compliant transaction.

Take Action

If you are a business owner or individual in New Jersey, ensure that you understand the requirements and process of obtaining an NJ L-8 form. Avoid common mistakes and take action to obtain this crucial certificate to facilitate your business transactions.

Share Your Thoughts

Have you experienced any challenges or successes with obtaining an NJ L-8 form? Share your thoughts and experiences in the comments below.

Get in Touch

If you have any further questions or concerns about NJ L-8 forms, please do not hesitate to reach out to us. We are here to provide guidance and support.

What is an NJ L-8 form?

+An NJ L-8 form is a tax clearance certificate issued by the New Jersey Division of Taxation, which confirms that a business or individual has paid all outstanding taxes.

Who needs an NJ L-8 form?

+An NJ L-8 form is typically required for business owners, buyers, and individuals obtaining certain licenses and permits.

How long is an NJ L-8 form valid?

+An NJ L-8 form is typically valid for 60 days.