Filing taxes can be a daunting task, and navigating the numerous forms and regulations can be overwhelming. In Texas, one of the most critical forms for homeowners is the Form 50-244, also known as the Residential Homestead Exemption Application. This form is used to apply for a residential homestead exemption, which can help reduce your property taxes. In this article, we will provide you with 5 tips for filing Form 50-244 correctly, ensuring you take advantage of the exemptions you're eligible for.

What is Form 50-244?

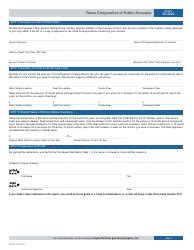

Before we dive into the tips, let's understand what Form 50-244 is. The Residential Homestead Exemption Application is a form used by the Texas Comptroller's office to determine eligibility for a residential homestead exemption. This exemption can reduce your property taxes by exempting a portion of your home's value from taxation.

Tip 1: Understand the Eligibility Criteria

To file Form 50-244 correctly, you must understand the eligibility criteria. To qualify for the residential homestead exemption, you must:

- Own and occupy the property as your primary residence

- Be a Texas resident

- Not claim a homestead exemption on any other property

It's essential to review the eligibility criteria carefully to ensure you qualify for the exemption.

Tip 2: Gather Required Documents

Before filing Form 50-244, gather all the required documents. You will need:

- A copy of your deed or other documentation showing ownership of the property

- Proof of residency, such as a driver's license or utility bills

- Social Security numbers or Individual Taxpayer Identification Numbers (ITINs) for all applicants

Having all the necessary documents will ensure a smooth filing process.

Tip 3: Complete the Form Accurately

Completing Form 50-244 accurately is crucial. Make sure to:

- Fill out the form in its entirety, leaving no blanks

- Use black ink to sign the form

- Ensure all signatures are original (no photocopies or digital signatures)

Double-check your work to avoid errors, which can delay the processing of your application.

Tip 4: File on Time

Filing Form 50-244 on time is critical. The deadline for filing is April 30th of each year, but it's recommended to file as early as possible to avoid delays. If you're filing for the first time, you may want to consider filing electronically, which can expedite the process.

Tip 5: Review and Update Your Application

Finally, it's essential to review and update your application as needed. If your circumstances change, such as a change in ownership or residency, you must update your application. Failing to do so may result in the loss of your exemption.

Additional Benefits of Filing Form 50-244

Filing Form 50-244 not only helps reduce your property taxes, but it also provides additional benefits, such as:

- Increased property value protection

- Reduced risk of property tax increases

- Potential for lower insurance rates

Conclusion

Filing Form 50-244 correctly is crucial to take advantage of the residential homestead exemption. By following these 5 tips, you'll ensure a smooth filing process and avoid common mistakes. Remember to review and update your application as needed, and don't hesitate to seek professional help if you're unsure about any aspect of the process.

We encourage you to share your experiences or ask questions about filing Form 50-244 in the comments section below. Your feedback is valuable to us, and we're here to help.

What is the deadline for filing Form 50-244?

+The deadline for filing Form 50-244 is April 30th of each year.

Can I file Form 50-244 electronically?

+Yes, you can file Form 50-244 electronically through the Texas Comptroller's website.

What happens if I fail to update my application?

+If you fail to update your application, you may lose your exemption, resulting in increased property taxes.