As a small business owner, accessing capital quickly and efficiently can be a game-changer for your operations. The SBA Express Loan is a popular financing option that provides expedited processing and reduced paperwork, making it an attractive choice for many entrepreneurs. In this comprehensive guide, we will delve into the details of the SBA Express Loan Form 1919, covering its benefits, eligibility criteria, application process, and more.

What is an SBA Express Loan?

The SBA Express Loan is a type of loan offered by the Small Business Administration (SBA), a federal agency that provides support to small businesses. This loan program is designed to provide quick access to capital, with a streamlined application process and faster approval times. SBA Express Loans are available through participating lenders, such as banks, credit unions, and other financial institutions.

Benefits of SBA Express Loans

SBA Express Loans offer several benefits to small business owners, including:

- Faster Processing Times: The SBA Express Loan program provides expedited processing, with approval times typically ranging from 24 to 36 hours.

- Reduced Paperwork: The application process is streamlined, requiring fewer documents and less paperwork compared to traditional SBA loans.

- Higher Loan Limits: SBA Express Loans have higher loan limits, with a maximum amount of $500,000.

- Flexible Repayment Terms: Repayment terms can range from 5 to 25 years, depending on the loan amount and type.

Eligibility Criteria for SBA Express Loans

To be eligible for an SBA Express Loan, small businesses must meet the following criteria:

- Business Size: The business must be a small business, as defined by the SBA.

- Business Type: The business must be a for-profit business.

- Location: The business must be located in the United States or its territories.

- Creditworthiness: The business must have a good credit history and demonstrate the ability to repay the loan.

- Use of Funds: The loan funds must be used for business purposes, such as expansion, modernization, or refinancing debt.

What is the SBA Express Loan Form 1919?

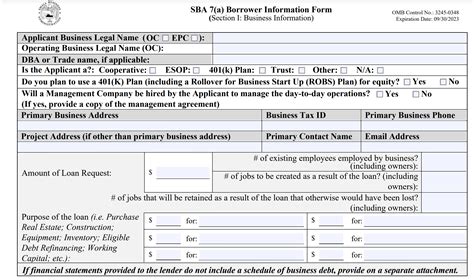

The SBA Express Loan Form 1919 is the application form used for SBA Express Loans. This form is used to gather information about the borrower, the business, and the loan request. The form requires the borrower to provide detailed information, including:

- Business Information: Business name, address, phone number, and tax ID number.

- Borrower Information: Borrower name, address, phone number, and social security number.

- Loan Information: Loan amount, interest rate, and repayment terms.

- Collateral Information: Information about collateral offered to secure the loan.

How to Apply for an SBA Express Loan

To apply for an SBA Express Loan, follow these steps:

- Find a Participating Lender: Locate a lender that participates in the SBA Express Loan program.

- Gather Required Documents: Collect the necessary documents, including financial statements, tax returns, and business plans.

- Complete the SBA Express Loan Form 1919: Fill out the application form, providing detailed information about the borrower, business, and loan request.

- Submit the Application: Submit the completed application to the lender for review and approval.

- Wait for Approval: Wait for the lender to review and approve the application, typically within 24 to 36 hours.

Additional Requirements for SBA Express Loans

In addition to the SBA Express Loan Form 1919, borrowers may be required to provide additional documentation, such as:

- Business Plan: A comprehensive business plan outlining the business's goals, strategies, and financial projections.

- Financial Statements: Financial statements, including balance sheets, income statements, and cash flow statements.

- Tax Returns: Business and personal tax returns for the past three years.

- Collateral Documents: Documents related to collateral offered to secure the loan, such as property deeds or equipment titles.

Common Mistakes to Avoid When Applying for an SBA Express Loan

When applying for an SBA Express Loan, avoid the following common mistakes:

- Incomplete Application: Failing to provide complete and accurate information on the application form.

- Insufficient Collateral: Failing to offer sufficient collateral to secure the loan.

- Poor Credit History: Having a poor credit history, which can negatively impact the loan application.

- Inadequate Business Plan: Failing to provide a comprehensive business plan that outlines the business's goals and strategies.

Conclusion

The SBA Express Loan Form 1919 is a critical component of the SBA Express Loan application process. By understanding the benefits, eligibility criteria, and application process, small business owners can increase their chances of approval and access the capital they need to grow and succeed. Remember to carefully review the application form, gather required documents, and avoid common mistakes to ensure a smooth and successful application process.

Frequently Asked Questions

What is the maximum loan amount for an SBA Express Loan?

+The maximum loan amount for an SBA Express Loan is $500,000.

What is the typical interest rate for an SBA Express Loan?

+The typical interest rate for an SBA Express Loan ranges from 6.5% to 9.75%.

How long does it take to get approved for an SBA Express Loan?

+Approval times for SBA Express Loans typically range from 24 to 36 hours.

Call to Action

Don't miss out on the opportunity to access capital quickly and efficiently with an SBA Express Loan. Apply today and take the first step towards growing and succeeding in your small business.