The NJ Form 1040-ES is a crucial document for individuals and businesses in New Jersey, as it is used to make estimated tax payments throughout the year. Filing this form accurately and on time is essential to avoid penalties and interest. In this article, we will provide you with 7 essential filing tips to help you navigate the process.

Understanding the NJ Form 1040-ES

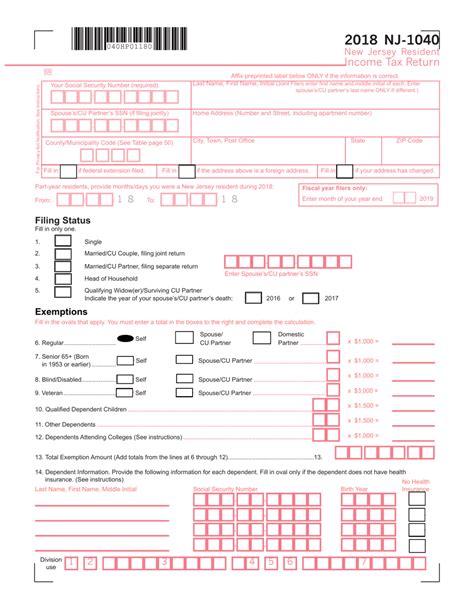

The NJ Form 1040-ES is a quarterly estimated tax payment form used by the New Jersey Division of Taxation. It is required for individuals and businesses that expect to owe more than $500 in taxes for the year. The form is used to make estimated tax payments in April, June, September, and January of each year.

Tip 1: Determine if You Need to File

Before filing the NJ Form 1040-ES, you need to determine if you are required to make estimated tax payments. You can use the New Jersey Estimated Tax Worksheet to calculate your estimated tax liability. If you expect to owe more than $500 in taxes for the year, you will need to file the NJ Form 1040-ES.

Calculating Your Estimated Tax Liability

To calculate your estimated tax liability, you will need to estimate your income and deductions for the year. You can use your previous year's tax return as a guide, but be sure to take into account any changes in your income or deductions.

Tip 2: File on Time

The NJ Form 1040-ES is due on a quarterly basis, with the following due dates:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

It is essential to file the NJ Form 1040-ES on time to avoid penalties and interest.

Filing Options

You can file the NJ Form 1040-ES online, by phone, or by mail.

Tip 3: File Online

Filing online is the fastest and most convenient way to file the NJ Form 1040-ES. You can file online through the New Jersey Division of Taxation website. You will need to create an account and provide your tax information.

Tip 4: Pay by Credit Card

You can pay your estimated tax payment by credit card. The New Jersey Division of Taxation accepts Visa, Mastercard, Discover, and American Express.

Tip 5: Keep Records

It is essential to keep records of your estimated tax payments, including the date and amount of each payment. You will need this information to complete your annual tax return.

Estimated Tax Payment Methods

You can make estimated tax payments by:

- Check or money order

- Credit card

- Electronic funds transfer (EFT)

- Online payment through the New Jersey Division of Taxation website

Tip 6: Avoid Penalties and Interest

To avoid penalties and interest, you need to make estimated tax payments on time and in the correct amount. If you fail to make a payment or make a payment that is less than the required amount, you may be subject to penalties and interest.

Tip 7: Seek Professional Help

If you are unsure about how to file the NJ Form 1040-ES or need help with the filing process, consider seeking the help of a tax professional. A tax professional can help you navigate the process and ensure that you are in compliance with all tax laws and regulations.

By following these 7 essential filing tips, you can ensure that you file the NJ Form 1040-ES accurately and on time, avoiding penalties and interest. Remember to keep records of your estimated tax payments and seek professional help if needed.

We encourage you to share your thoughts and experiences with filing the NJ Form 1040-ES in the comments section below. If you have any questions or need further clarification on any of the topics discussed in this article, please don't hesitate to ask.

What is the NJ Form 1040-ES?

+The NJ Form 1040-ES is a quarterly estimated tax payment form used by the New Jersey Division of Taxation.

Who needs to file the NJ Form 1040-ES?

+Individuals and businesses that expect to owe more than $500 in taxes for the year need to file the NJ Form 1040-ES.

What are the due dates for the NJ Form 1040-ES?

+The due dates for the NJ Form 1040-ES are April 15th, June 15th, September 15th, and January 15th of the following year.