In today's digital age, the process of applying for a loan or any financial assistance has become more streamlined and convenient. The National Housing Trust (NHT) has made it possible for individuals to apply for a loan online, making it easier for people to access affordable housing. In this article, we will guide you through the NHT application form process in 5 easy steps.

Applying for a loan online can be a daunting task, especially for those who are not tech-savvy. However, with the NHT's online application system, you can apply for a loan from the comfort of your own home. The online application process is designed to be user-friendly and efficient, allowing you to submit your application quickly and easily.

Understanding the NHT Application Form Process

Before we dive into the 5 easy steps to apply online, it's essential to understand the overall application process. The NHT application form process typically involves the following steps:

- Checking your eligibility for a loan

- Gathering required documents

- Filling out the online application form

- Submitting your application

- Receiving a response from the NHT

Step 1: Checking Your Eligibility for a Loan

Before you start the online application process, it's crucial to check if you're eligible for a loan. The NHT has specific requirements for loan applicants, including:

- Age: You must be at least 18 years old

- Income: You must have a steady income

- Employment: You must be employed or have a stable source of income

- Credit history: You must have a good credit history

You can check the NHT's website for the full list of eligibility criteria.

What to Do If You're Not Eligible

If you're not eligible for a loan, don't worry! You can still explore other options, such as:

- Checking with other lenders

- Improving your credit score

- Seeking financial assistance from non-profit organizations

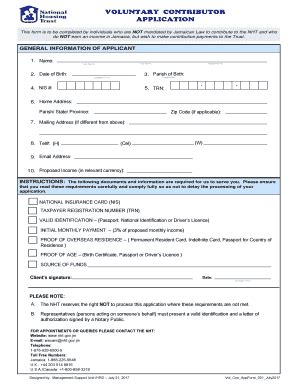

Step 2: Gathering Required Documents

Once you've checked your eligibility, it's time to gather the required documents. The NHT typically requires the following documents:

- Identification: A valid government-issued ID

- Income proof: Pay stubs or a letter from your employer

- Bank statements: Recent bank statements

- Credit report: A copy of your credit report

Make sure you have all the required documents before proceeding with the online application.

Tips for Gathering Documents

- Make sure all documents are up-to-date and valid

- Use a scanner or photocopier to ensure clear copies

- Keep all documents organized and easily accessible

Step 3: Filling Out the Online Application Form

Now it's time to fill out the online application form. The NHT's online application system is designed to be user-friendly and efficient. Make sure you have all the required documents ready before starting the application process.

- Fill out the form accurately and completely

- Use a secure internet connection to protect your personal data

- Take your time and review your application carefully before submitting

Common Mistakes to Avoid

- Incomplete or inaccurate information

- Failure to provide required documents

- Not reviewing your application carefully before submitting

Step 4: Submitting Your Application

Once you've completed the online application form, it's time to submit your application. Make sure you review your application carefully before submitting to avoid any errors or omissions.

- Submit your application through the NHT's online portal

- Receive a confirmation email or notification

- Wait for a response from the NHT

What to Expect After Submitting Your Application

- A response from the NHT within a few days or weeks

- A request for additional documentation or information

- A loan offer or rejection letter

Step 5: Receiving a Response from the NHT

After submitting your application, you'll receive a response from the NHT. This can take a few days or weeks, depending on the complexity of your application.

- Review the response carefully and understand the terms and conditions

- Accept or decline the loan offer

- Ask questions or seek clarification if needed

What to Do If Your Application Is Rejected

- Check the reason for rejection

- Improve your credit score or financial situation

- Explore other loan options or seek financial assistance

By following these 5 easy steps, you can apply for an NHT loan online with ease. Remember to check your eligibility, gather required documents, fill out the online application form accurately, submit your application, and receive a response from the NHT. Good luck with your application!

What is the interest rate for an NHT loan?

+The interest rate for an NHT loan varies depending on the type of loan and your credit score. You can check the NHT's website for the latest interest rates.

How long does it take to receive a response from the NHT?

+The response time from the NHT can take a few days or weeks, depending on the complexity of your application. You can check your email or the NHT's online portal for updates.

Can I apply for an NHT loan if I have a bad credit score?

+It may be challenging to get approved for an NHT loan with a bad credit score. However, you can still apply and provide additional documentation to support your application.

We hope this article has helped you understand the NHT application form process in 5 easy steps. Remember to check your eligibility, gather required documents, fill out the online application form accurately, submit your application, and receive a response from the NHT. If you have any questions or need further assistance, feel free to ask in the comments section below.