Filing taxes can be a daunting task, especially when it comes to navigating complex forms and eligibility requirements. One form that often causes confusion is Form 8862, also known as the Information to Claim Earned Income Tax Credit (EITC) After Disallowance. If you're using TurboTax to file your taxes, filling out Form 8862 might seem like a challenging task. However, with the right guidance, you can easily navigate this process and ensure you receive the earned income tax credit you're eligible for.

Filling out Form 8862 on TurboTax requires attention to detail and a clear understanding of the eligibility requirements for the earned income tax credit. In this article, we'll break down the steps involved in completing Form 8862 on TurboTax, highlight common mistakes to avoid, and provide valuable tips to ensure a smooth and successful filing process.

What is Form 8862, and Why Do You Need It?

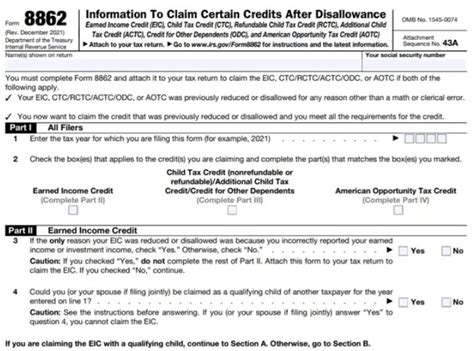

Form 8862 is a supplemental form required by the Internal Revenue Service (IRS) for taxpayers who claim the earned income tax credit (EITC) after it has been disallowed or denied. The EITC is a refundable tax credit designed to help low-to-moderate-income working individuals and families. If you've claimed the EITC in the past and were denied or had your credit reduced, you'll need to file Form 8862 to reapply for the credit.

Why Was Your EITC Disallowed?

There are several reasons why your EITC might have been disallowed or reduced. Some common reasons include:

- Inaccurate or incomplete information on your tax return

- Failure to meet the eligibility requirements for the EITC

- Claiming the credit for a qualifying child who doesn't meet the IRS's definition of a qualifying child

- Claiming the credit without having a valid Social Security number

If your EITC was disallowed, you'll receive a notice from the IRS explaining the reason for the disallowance. You can appeal this decision by filing Form 8862 and providing additional information to support your claim.

Step-by-Step Guide to Filling Out Form 8862 on TurboTax

Filling out Form 8862 on TurboTax is a relatively straightforward process. Here's a step-by-step guide to help you navigate the process:

- Log in to your TurboTax account: Start by logging in to your TurboTax account and selecting the tax year for which you're filing Form 8862.

- Select the "Forms" tab: Once you're logged in, click on the "Forms" tab and select "Form 8862" from the list of available forms.

- Answer the eligibility questions: TurboTax will guide you through a series of questions to determine if you're eligible to claim the EITC. Answer these questions accurately and truthfully.

- Provide required documentation: You'll need to provide documentation to support your claim, such as proof of income, Social Security numbers, and birth dates for qualifying children.

- Complete the form: TurboTax will populate the form with the information you've provided. Review the form carefully to ensure accuracy and completeness.

- Submit the form: Once you've completed the form, submit it to the IRS through TurboTax.

Tips for Filling Out Form 8862 on TurboTax

To ensure a smooth and successful filing process, keep the following tips in mind:

- Gather all required documentation: Make sure you have all the necessary documentation to support your claim, including proof of income, Social Security numbers, and birth dates for qualifying children.

- Answer questions accurately: Answer the eligibility questions truthfully and accurately to avoid delays or rejection of your claim.

- Review the form carefully: Review the completed form carefully to ensure accuracy and completeness.

- Seek help if needed: If you're unsure about any aspect of the process, don't hesitate to seek help from a tax professional or the TurboTax support team.

Common Mistakes to Avoid When Filling Out Form 8862

When filling out Form 8862, it's essential to avoid common mistakes that can delay or reject your claim. Here are some common mistakes to avoid:

- Inaccurate or incomplete information: Ensure that all information provided is accurate and complete to avoid delays or rejection of your claim.

- Failure to provide required documentation: Make sure you provide all required documentation to support your claim, including proof of income, Social Security numbers, and birth dates for qualifying children.

- Claiming the credit for an ineligible child: Ensure that any qualifying child you claim meets the IRS's definition of a qualifying child.

- Claiming the credit without a valid Social Security number: Ensure that you have a valid Social Security number to claim the EITC.

Conclusion

Filling out Form 8862 on TurboTax might seem like a daunting task, but with the right guidance, you can easily navigate the process and ensure you receive the earned income tax credit you're eligible for. Remember to gather all required documentation, answer questions accurately, and review the form carefully to avoid delays or rejection of your claim. If you're unsure about any aspect of the process, don't hesitate to seek help from a tax professional or the TurboTax support team.

What is Form 8862, and why do I need it?

+Form 8862 is a supplemental form required by the IRS for taxpayers who claim the earned income tax credit (EITC) after it has been disallowed or denied. You'll need to file Form 8862 to reapply for the credit.

How do I fill out Form 8862 on TurboTax?

+Filling out Form 8862 on TurboTax involves answering a series of questions to determine eligibility, providing required documentation, and completing the form. TurboTax will guide you through the process and populate the form with the information you provide.

What are common mistakes to avoid when filling out Form 8862?

+Common mistakes to avoid when filling out Form 8862 include providing inaccurate or incomplete information, failing to provide required documentation, claiming the credit for an ineligible child, and claiming the credit without a valid Social Security number.