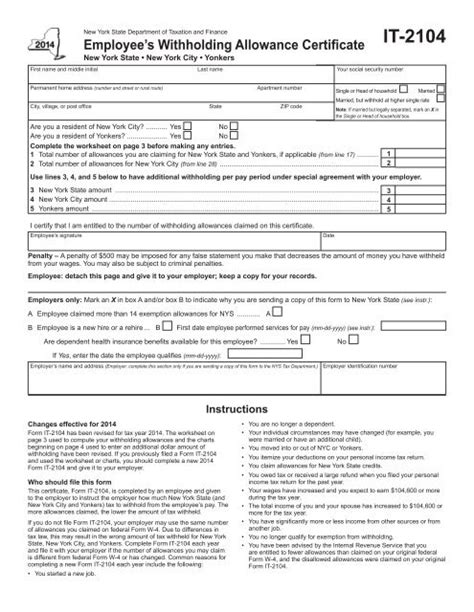

The New York State tax withholding form, also known as Form IT-2104, is a crucial document that allows employees to determine how much state income tax their employer should withhold from their wages. Filling out this form accurately is essential to avoid underpayment or overpayment of taxes. In this article, we will discuss five ways to fill out the NY tax withholding form, ensuring that you comply with the state's tax regulations.

Filling out the NY tax withholding form can be a bit complex, especially for those who are new to the state or have never filed taxes before. However, understanding the process can help you avoid penalties and ensure that you receive the correct refund or make timely payments. The New York State Department of Taxation and Finance provides guidance on filling out the form, but it's essential to know the specific steps involved.

Accurate completion of the NY tax withholding form is vital, as it affects the amount of taxes withheld from your wages. If you underpay your taxes, you may face penalties and interest when you file your tax return. On the other hand, overpaying your taxes can result in a larger refund, but it may also mean that you're giving the state an interest-free loan. Therefore, it's crucial to fill out the form correctly to ensure that the right amount of taxes is withheld.

Understanding the NY Tax Withholding Form

Before we dive into the five ways to fill out the NY tax withholding form, let's take a look at the different sections of the form. The IT-2104 form consists of three main sections:

- Section 1: Employee Information

- Section 2: Claim of Exemption

- Section 3: Number of Allowances

Each section requires specific information, which we will discuss in detail later.

Section 1: Employee Information

In this section, you need to provide your name, address, and social security number. You also need to indicate whether you are single or married and claim the standard deduction. If you have a dependent, you should list their name and relationship to you.

5 Ways to Fill Out the NY Tax Withholding Form

Now that we have a basic understanding of the form, let's discuss the five ways to fill out the NY tax withholding form:

Method 1: Use the NY State Tax Withholding Calculator

The New York State Department of Taxation and Finance provides an online calculator to help you determine the correct number of allowances. The calculator takes into account your income, filing status, and number of dependents to provide an accurate estimate.

Method 2: Review Your Previous Year's Tax Return

If you filed a tax return last year, you can review it to determine the correct number of allowances. Look for the "Allowances" section on your return and use that number as a starting point.

Method 3: Consult with Your Employer

Your employer may be able to provide guidance on filling out the NY tax withholding form. They may have experience with the form and can offer advice on how to complete it accurately.

Method 4: Use the NY State Tax Withholding Tables

The NY State Tax Withholding Tables provide a detailed guide to determining the correct number of allowances based on your income and filing status. You can use these tables to calculate your allowances and complete the form.

Method 5: Seek Professional Advice

If you're unsure about how to fill out the NY tax withholding form, you can seek professional advice from a tax professional or accountant. They can provide personalized guidance and ensure that you complete the form accurately.

Common Mistakes to Avoid

When filling out the NY tax withholding form, it's essential to avoid common mistakes that can lead to penalties and interest. Some common mistakes include:

- Underreporting income

- Claiming too many allowances

- Failing to report dependents

- Not signing the form

By avoiding these mistakes, you can ensure that your NY tax withholding form is accurate and complete.

Conclusion

Filling out the NY tax withholding form can be a complex process, but by following the five methods outlined in this article, you can ensure that you complete the form accurately. Remember to avoid common mistakes and seek professional advice if you're unsure about any aspect of the form. By taking the time to fill out the form correctly, you can avoid penalties and interest and ensure that you receive the correct refund or make timely payments.

Get Started Today

Don't wait until it's too late. Fill out the NY tax withholding form today and ensure that you're in compliance with the state's tax regulations. Remember to review and update your form regularly to reflect any changes in your income, filing status, or number of dependents.

Share Your Thoughts

Have you filled out the NY tax withholding form before? Share your experience in the comments below. If you have any questions or concerns, feel free to ask, and we'll do our best to help.

What is the NY tax withholding form?

+The NY tax withholding form, also known as Form IT-2104, is a document that allows employees to determine how much state income tax their employer should withhold from their wages.

How do I fill out the NY tax withholding form?

+There are five ways to fill out the NY tax withholding form: using the NY State Tax Withholding Calculator, reviewing your previous year's tax return, consulting with your employer, using the NY State Tax Withholding Tables, and seeking professional advice.

What are the common mistakes to avoid when filling out the NY tax withholding form?

+Common mistakes to avoid include underreporting income, claiming too many allowances, failing to report dependents, and not signing the form.