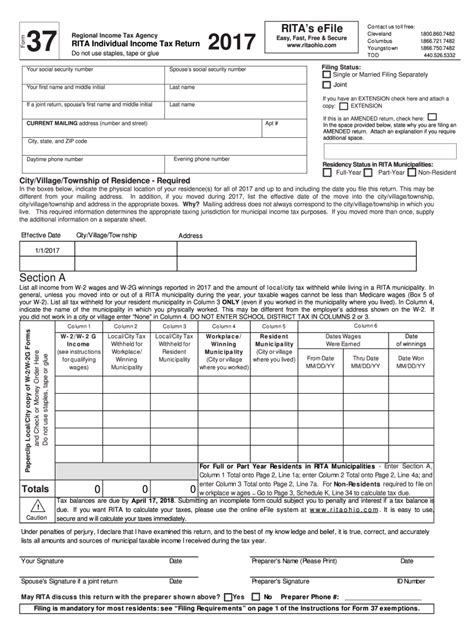

Ohio Rita Form 37 is a critical document for individuals and businesses alike, as it pertains to the state's municipal income tax returns. In this article, we will delve into the world of Ohio Rita Form 37, exploring its significance, filing requirements, and key considerations. Whether you're a resident, non-resident, or business owner, understanding the intricacies of this form is essential to ensure compliance with Ohio's tax laws.

The Ohio Department of Taxation requires individuals and businesses to file Form 37 annually, reporting their municipal income tax liability. The form is used to calculate tax owed to the state, and it's crucial to submit accurate and complete information to avoid penalties and fines.

Who Needs to File Ohio Rita Form 37?

Not everyone needs to file Ohio Rita Form 37. The requirement to file depends on your residency status, income level, and business activities within the state. Here are some scenarios that require filing:

- Residents: If you're a resident of Ohio, you need to file Form 37 if you have taxable income exceeding $10,000 or if you have municipal income tax withheld.

- Non-Residents: If you're not a resident of Ohio but have income earned within the state, you may need to file Form 37.

- Businesses: Businesses operating within Ohio, including corporations, partnerships, and sole proprietorships, must file Form 37.

Income Types Subject to Ohio Rita Tax

Not all income types are subject to Ohio Rita tax. The following income types are taxable:

- Wages and salaries

- Business income

- Rental income

- Royalties

- Interest and dividends

On the other hand, the following income types are exempt from Ohio Rita tax:

- Social Security benefits

- Retirement income

- Certain types of investment income

7 Essential Filing Requirements for Ohio Rita Form 37

To ensure accurate and timely filing, follow these essential requirements:

- File by the Deadline: The filing deadline for Ohio Rita Form 37 is typically April 15th of each year. However, if you're filing electronically, the deadline may be later.

- Use the Correct Form: Make sure to use the correct version of Form 37 for the tax year you're reporting.

- Report All Income: Report all taxable income earned within the state, including wages, business income, and rental income.

- Claim Credits and Deductions: Claim any eligible credits and deductions, such as the Ohio small business investor income deduction.

- Pay Any Tax Due: Pay any tax due by the filing deadline to avoid penalties and interest.

- Attach Supporting Documents: Attach supporting documents, such as W-2s and 1099s, to your return.

- Sign and Date the Return: Sign and date the return, as it's a required field for processing.

Consequences of Late or Inaccurate Filing

Failure to file or inaccurate filing can result in severe consequences, including:

- Penalties and fines

- Interest on unpaid tax

- Delayed refunds

- Potential audit

To avoid these consequences, it's essential to file accurately and on time.

Electronic Filing Options for Ohio Rita Form 37

The Ohio Department of Taxation offers electronic filing options for Form 37. These options include:

- Ohio Business Gateway: A secure online portal for businesses to file and pay taxes.

- Ohio e-File: A free online filing system for individuals and businesses.

- Tax Preparation Software: Commercial tax preparation software, such as TurboTax or H&R Block, can also be used to file Form 37 electronically.

Additional Resources for Ohio Rita Form 37

For more information on Ohio Rita Form 37, refer to the following resources:

- Ohio Department of Taxation Website: Visit the Ohio Department of Taxation website for the latest forms, instructions, and guidelines.

- Taxpayer Service Centers: Contact a taxpayer service center for assistance with filing and paying taxes.

- Tax Professionals: Consult with a tax professional or accountant for personalized guidance on filing Form 37.

In conclusion, Ohio Rita Form 37 is a critical document for individuals and businesses operating within the state. By understanding the filing requirements and consequences of late or inaccurate filing, you can ensure compliance with Ohio's tax laws. Take advantage of electronic filing options and additional resources to make the filing process smoother and more efficient.

We hope this article has been informative and helpful. If you have any questions or concerns about Ohio Rita Form 37, please don't hesitate to comment below. Share this article with others who may benefit from this information.

What is the deadline for filing Ohio Rita Form 37?

+The filing deadline for Ohio Rita Form 37 is typically April 15th of each year.

Who needs to file Ohio Rita Form 37?

+Residents, non-residents, and businesses operating within Ohio need to file Form 37 if they have taxable income exceeding $10,000 or if they have municipal income tax withheld.

What are the consequences of late or inaccurate filing?

+Failure to file or inaccurate filing can result in penalties and fines, interest on unpaid tax, delayed refunds, and potential audit.