New York State Tax Form It-201: A Step-By-Step Guide

Filing taxes can be a daunting task, especially for those who are new to the process. In New York State, the IT-201 form is the primary document used for personal income tax returns. Understanding how to complete this form correctly is crucial to avoid errors, penalties, and delays in receiving your refund. In this article, we will provide a comprehensive guide on how to fill out the New York State Tax Form IT-201, making the tax filing process less overwhelming and more manageable.

Whether you are a resident, non-resident, or part-year resident of New York State, this guide will walk you through the necessary steps to complete your tax return accurately and efficiently. By the end of this article, you will be well-equipped to tackle the IT-201 form and ensure a smooth tax filing experience.

Who Needs to File New York State Tax Form IT-201?

Before we dive into the step-by-step guide, it is essential to determine if you need to file the IT-201 form. You are required to file a New York State income tax return if you meet any of the following conditions:

- You are a resident of New York State and have a federal gross income of $4,000 or more.

- You are a non-resident or part-year resident of New York State and have New York State income of $4,000 or more.

- You have self-employment income of $400 or more.

- You are a beneficiary of an estate or trust and have New York State income.

If you meet any of these conditions, proceed with filling out the IT-201 form.

Gathering Necessary Documents and Information

Before starting the tax filing process, it is crucial to gather all necessary documents and information. This will ensure that you have everything you need to complete the IT-201 form accurately and efficiently. Some of the documents and information you will need include:

- W-2 forms from your employer(s)

- 1099 forms for freelance work, interest, dividends, and capital gains

- Schedule K-1 forms for partnership and S corporation income

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements

- Property tax statements

Having all these documents and information readily available will make the tax filing process much smoother.

Step-by-Step Guide to Filling Out New York State Tax Form IT-201

Now that you have gathered all the necessary documents and information, it's time to start filling out the IT-201 form. Here is a step-by-step guide to help you navigate the process:

- Residency Status: Determine your residency status for the tax year. You can be a resident, non-resident, or part-year resident.

- Filing Status: Choose your filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Name and Address: Enter your name and address as it appears on your federal tax return.

- Social Security Number: Enter your social security number or Individual Taxpayer Identification Number (ITIN).

- Spouse's Information: If filing jointly, enter your spouse's name, social security number, and date of birth.

- Dependents: List the names, social security numbers, and dates of birth for all dependents.

- Income: Report all income from W-2 forms, 1099 forms, and Schedule K-1 forms.

- Adjustments: Claim any adjustments to income, such as alimony paid, student loan interest, and moving expenses.

- Deductions: Choose either the standard deduction or itemize deductions. If itemizing, list all deductions for charitable donations, medical expenses, mortgage interest, and property taxes.

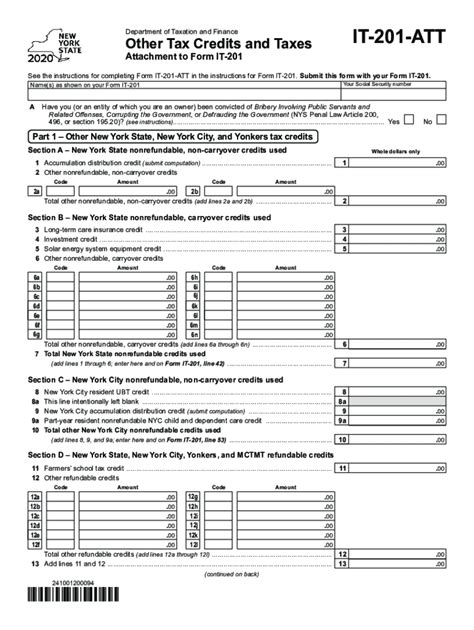

- Credits: Claim any credits, such as the earned income tax credit, child tax credit, and education credits.

- Tax Computation: Calculate your total tax liability using the tax tables or tax calculator.

- Payments and Refunds: Enter any payments made, including withholding and estimated tax payments. If due a refund, enter the amount you want to receive.

Additional Forms and Schedules

Depending on your specific situation, you may need to complete additional forms and schedules. Some common forms and schedules include:

- Schedule A: Itemized Deductions

- Schedule B: Interest and Dividend Income

- Schedule C: Business Income and Expenses

- Schedule D: Capital Gains and Losses

- Form IT-195: New York State Estimated Tax Payments

- Form IT-214: New York State Installment Agreement

E-Filing and Paper Filing Options

Once you have completed the IT-201 form, you can choose to e-file or paper file your tax return. E-filing is a faster and more convenient option, as it allows you to submit your return electronically and receive your refund sooner. Paper filing, on the other hand, requires you to mail your return to the New York State Department of Taxation and Finance.

Benefits of E-Filing

E-filing offers several benefits, including:

- Faster refund processing

- Reduced errors and rejected returns

- Increased security and confidentiality

- Ability to check the status of your return online

Benefits of Paper Filing

Paper filing may be a better option for those who:

- Do not have access to a computer or internet

- Prefer to mail their return

- Need to include additional documentation or forms

Tips and Reminders

Here are some tips and reminders to keep in mind when filing your New York State tax return:

- File on time to avoid penalties and interest

- Keep accurate records and documentation

- Take advantage of tax credits and deductions

- Consider hiring a tax professional if you are unsure about any part of the process

By following this step-by-step guide and taking advantage of the tips and reminders, you can ensure a smooth and accurate tax filing experience.

What is the deadline for filing the IT-201 form?

+The deadline for filing the IT-201 form is typically April 15th of each year. However, if you need an extension, you can file Form IT-370 by the original deadline to receive a six-month extension.

Can I e-file my IT-201 form?

+Yes, you can e-file your IT-201 form through the New York State Department of Taxation and Finance website or through a tax preparation software.

What is the penalty for late filing of the IT-201 form?

+The penalty for late filing of the IT-201 form is 5% of the unpaid tax due for each month or part of a month, up to a maximum of 25%.

We hope this article has provided you with a comprehensive guide on how to fill out the New York State Tax Form IT-201. Remember to gather all necessary documents and information, follow the step-by-step guide, and take advantage of e-filing and paper filing options. If you have any further questions or concerns, please do not hesitate to comment below.