As a business owner or accountant in New York, understanding the intricacies of the state's tax laws and forms is crucial for compliance and avoiding penalties. One such form is the IT-204-LL, also known as the Partnership and Limited Liability Company (LLC) Return. In this article, we will delve into the 6 essentials of the New York Form IT-204-LL, including its purpose, who needs to file, and what information is required.

What is the Purpose of the IT-204-LL Form?

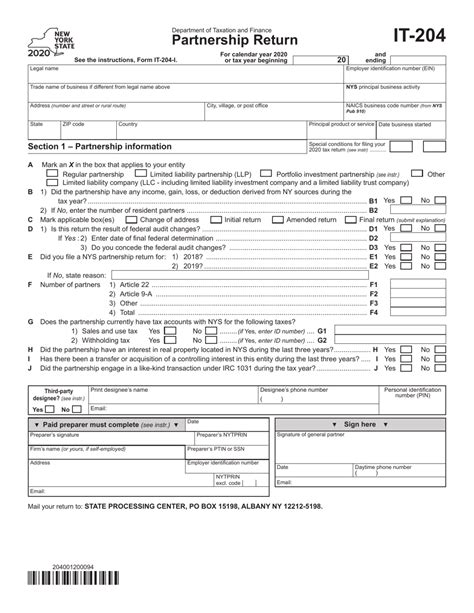

The primary purpose of the IT-204-LL form is to report the income, gains, losses, and credits of partnerships and limited liability companies (LLCs) that are required to file a return with the New York State Department of Taxation and Finance. This form is used to calculate the tax liability of the partnership or LLC and to report the distributive shares of income, gains, losses, and credits to the partners or members.

Who Needs to File the IT-204-LL Form?

Who Needs to File the IT-204-LL Form?

Not all partnerships and LLCs are required to file the IT-204-LL form. The following entities must file this form:

- Partnerships and LLCs that have income, gains, losses, or credits from New York sources

- Partnerships and LLCs that have a partner or member who is a resident of New York

- Partnerships and LLCs that have a partner or member who has income, gains, losses, or credits from New York sources

What Information is Required on the IT-204-LL Form?

Identification Information

The IT-204-LL form requires identification information about the partnership or LLC, including:

- Federal Employer Identification Number (FEIN)

- Business name and address

- Date of formation or incorporation

Business Income and Expenses

The form requires a detailed breakdown of the partnership's or LLC's business income and expenses, including:

- Gross income from all sources

- Cost of goods sold

- Operating expenses

- Depreciation and amortization

Distributive Shares

The form requires the partnership or LLC to report the distributive shares of income, gains, losses, and credits to each partner or member, including:

- Each partner's or member's share of income, gains, losses, and credits

- Each partner's or member's tax basis in the partnership or LLC

Tax Credits and Payments

The form requires the partnership or LLC to report any tax credits and payments made during the tax year, including:

- Any credits claimed, such as the Empire State Child Credit

- Any payments made, such as estimated tax payments

Additional Forms and Schedules

Depending on the specific situation, the partnership or LLC may need to file additional forms and schedules with the IT-204-LL form, including:

- Schedule K-1, Partner's Share of Income, Deductions, Credits, etc.

- Schedule K, Partners' Distributive Share Items

- Form IT-205, Certification of New York Source Income

When is the IT-204-LL Form Due?

When is the IT-204-LL Form Due?

The IT-204-LL form is due on the 15th day of the fourth month following the end of the partnership's or LLC's tax year. For example, if the tax year ends on December 31, the form is due on April 15.

Penalties for Late Filing or Non-Compliance

Failure to file the IT-204-LL form or pay any tax due can result in penalties and interest. The penalty for late filing is $100 per month, up to a maximum of $500. Additionally, interest will accrue on any unpaid tax at a rate of 6% per annum.

Conclusion

In conclusion, the IT-204-LL form is a critical component of New York's tax laws, and partnerships and LLCs must ensure compliance to avoid penalties and interest. By understanding the purpose, who needs to file, and what information is required, business owners and accountants can ensure accurate and timely filing of this form.

FAQ Section

What is the deadline for filing the IT-204-LL form?

+The IT-204-LL form is due on the 15th day of the fourth month following the end of the partnership's or LLC's tax year.

Who needs to file the IT-204-LL form?

+Partnerships and LLCs that have income, gains, losses, or credits from New York sources, as well as those with a partner or member who is a resident of New York or has income, gains, losses, or credits from New York sources.

What is the penalty for late filing of the IT-204-LL form?

+The penalty for late filing is $100 per month, up to a maximum of $500, plus interest on any unpaid tax at a rate of 6% per annum.