Filling out the EDD Form DE1000A, also known as the "Report of New Employee(s)" form, is a crucial step for employers in California to report new hires to the Employment Development Department (EDD). This form is used to provide information about newly hired employees, which helps the EDD to administer various programs, including unemployment insurance, disability insurance, and paid family leave.

Understanding the Importance of Accurate Reporting

Accurate and timely reporting of new hires is essential to ensure that employers comply with California's labor laws and regulations. Failure to report new hires or providing inaccurate information can result in penalties and fines. In this article, we will provide a step-by-step guide on how to fill out the EDD Form DE1000A accurately and efficiently.

Method 1: Online Reporting through the EDD Website

The EDD website provides an online portal for employers to report new hires electronically. This method is convenient, fast, and reduces the risk of errors. To report new hires online, follow these steps:

- Go to the EDD website at

- Click on the "Employer Services" tab

- Select "Report of New Employee(s)" from the drop-down menu

- Log in to your EDD account or create a new one if you don't have an existing account

- Fill out the online form with the required information, including the employee's name, Social Security number, date of birth, and start date

- Submit the form electronically

Benefits of Online Reporting

- Fast and convenient

- Reduces the risk of errors

- Provides an electronic record of submission

- Allows for easy tracking and verification of submissions

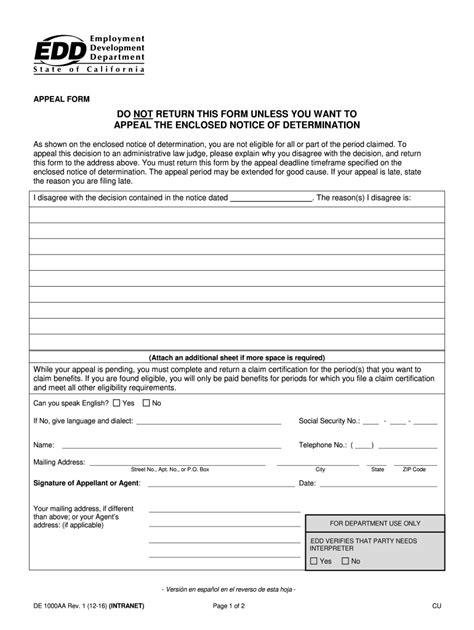

Method 2: Mail or Fax Reporting

If you prefer to report new hires by mail or fax, you can download the EDD Form DE1000A from the EDD website or obtain a copy from your local EDD office. Follow these steps:

- Complete the form accurately and legibly

- Attach any required supporting documentation, such as a copy of the employee's Social Security card or birth certificate

- Mail or fax the form to the EDD address or fax number listed on the form

Benefits of Mail or Fax Reporting

- Provides a paper trail of submission

- Allows for easy tracking and verification of submissions

- Can be used for employers who do not have access to the internet or prefer a paper-based method

Method 3: Reporting through a Third-Party Agent

Some employers may choose to report new hires through a third-party agent, such as a payroll service provider or a professional employer organization (PEO). Follow these steps:

- Ensure that the third-party agent is authorized to report new hires on your behalf

- Provide the required information to the third-party agent, including the employee's name, Social Security number, date of birth, and start date

- Verify that the third-party agent submits the report accurately and timely

Benefits of Reporting through a Third-Party Agent

- Convenience and time-saving

- Expertise in labor laws and regulations

- Reduced risk of errors and penalties

Method 4: Electronic Data Interchange (EDI) Reporting

EDI reporting is an electronic method of reporting new hires that uses standardized formats and protocols. This method is suitable for large employers or those with high-volume hiring needs. Follow these steps:

- Ensure that your payroll system or HR software is compatible with EDI reporting

- Set up an EDI account with the EDD

- Transmit the new hire data electronically through the EDI system

Benefits of EDI Reporting

- Fast and efficient

- Reduces the risk of errors

- Provides an electronic record of submission

- Allows for easy tracking and verification of submissions

Method 5: Phone Reporting

Phone reporting is available for employers who need to report new hires over the phone. Follow these steps:

- Call the EDD's New Hire Reporting hotline at (888) 881-0443

- Provide the required information to the EDD representative, including the employee's name, Social Security number, date of birth, and start date

- Verify that the EDD representative accurately records the information

Benefits of Phone Reporting

- Convenient for small employers or those with limited access to technology

- Provides a personal touch and opportunity to ask questions

- Allows for easy tracking and verification of submissions

In conclusion, filling out the EDD Form DE1000A accurately and efficiently is crucial for employers in California. By choosing the right reporting method, employers can ensure compliance with labor laws and regulations, reduce the risk of errors and penalties, and provide timely and accurate information to the EDD.

What is the deadline for reporting new hires to the EDD?

+The deadline for reporting new hires to the EDD is within 20 days of the employee's start date.

Can I report new hires online if I don't have an EDD account?

+No, you need to create an EDD account to report new hires online. You can create an account on the EDD website.

What information do I need to provide when reporting new hires?

+You need to provide the employee's name, Social Security number, date of birth, and start date, as well as your employer identification number and business name.