As the city that never sleeps, New York City is home to millions of individuals and businesses, each with their own unique tax obligations. When it comes to filing taxes, the deadline can sometimes sneak up on you, leaving you scrambling to gather necessary documents and submit your return on time. However, with the New York City tax extension form, you can breathe a sigh of relief and gain some extra time to get your affairs in order.

But what exactly is the New York City tax extension form, and how can you use it to your advantage? In this article, we'll delve into the world of tax extensions, exploring the benefits, eligibility requirements, and steps to follow when filing for an extension in New York City.

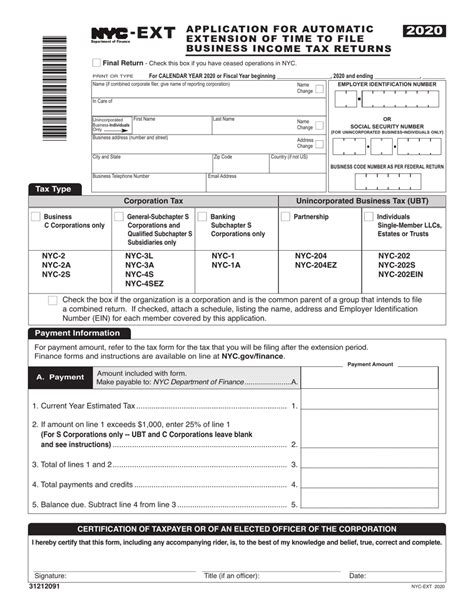

Understanding the New York City Tax Extension Form

The New York City tax extension form is a request for additional time to file your tax return. By submitting this form, you can extend the deadline for filing your taxes by up to six months. This can be a lifesaver for individuals and businesses that need more time to gather necessary documents, resolve disputes with the IRS, or simply get their financial affairs in order.

Benefits of Filing a Tax Extension in New York City

While filing a tax extension may seem like a simple solution, it can have significant benefits for individuals and businesses in New York City. Some of the advantages of filing a tax extension include:

- Avoiding late fees and penalties

- Gaining extra time to gather necessary documents and information

- Reducing stress and anxiety associated with meeting a tight deadline

- Providing more time to resolve disputes with the IRS or other tax authorities

- Allowing for a more accurate and thorough tax return

Eligibility Requirements for Filing a Tax Extension in New York City

To be eligible for a tax extension in New York City, you must meet certain requirements. These include:

- Being a resident of New York City

- Having a valid reason for requesting an extension (e.g., illness, financial hardship, etc.)

- Filing the extension form on or before the original deadline

- Paying any estimated taxes due by the original deadline

Steps to Follow When Filing a Tax Extension in New York City

Filing a tax extension in New York City is a relatively straightforward process. Here are the steps to follow:

- Determine your eligibility for a tax extension

- Gather necessary documents and information

- Fill out the tax extension form (Form IT-370 or Form IT-370-E)

- Submit the form on or before the original deadline

- Pay any estimated taxes due by the original deadline

- File your tax return by the extended deadline

Common Mistakes to Avoid When Filing a Tax Extension in New York City

While filing a tax extension can provide much-needed relief, it's essential to avoid common mistakes that can lead to penalties and delays. Some of the most common mistakes to avoid include:

- Missing the original deadline

- Failing to pay estimated taxes due

- Providing inaccurate or incomplete information

- Not filing the tax return by the extended deadline

Consequences of Missing the Tax Extension Deadline in New York City

Missing the tax extension deadline in New York City can have significant consequences. Some of the penalties and fines you may face include:

- Late fees and penalties on unpaid taxes

- Interest on unpaid taxes

- Loss of refund or credit

- Potential audit or examination by the IRS

Tax Extension Form for Businesses in New York City

Businesses in New York City can also file for a tax extension using Form IT-370 or Form IT-370-E. The process is similar to that for individuals, with some additional requirements and considerations.

Steps to Follow When Filing a Business Tax Extension in New York City

Filing a business tax extension in New York City requires the following steps:

- Determine your eligibility for a tax extension

- Gather necessary documents and information

- Fill out the tax extension form (Form IT-370 or Form IT-370-E)

- Submit the form on or before the original deadline

- Pay any estimated taxes due by the original deadline

- File your business tax return by the extended deadline

Conclusion

Filing a tax extension in New York City can provide much-needed relief for individuals and businesses struggling to meet the original deadline. By understanding the benefits, eligibility requirements, and steps to follow, you can navigate the process with confidence and avoid common mistakes. Remember to file your tax return by the extended deadline to avoid penalties and fines.

What is the deadline for filing a tax extension in New York City?

+The deadline for filing a tax extension in New York City is typically April 15th for individual taxpayers and March 15th for businesses.

Can I file a tax extension online in New York City?

+What happens if I miss the tax extension deadline in New York City?

+If you miss the tax extension deadline in New York City, you may face penalties and fines, including late fees and interest on unpaid taxes.