Filling out tax forms can be a daunting task, especially for those who are not familiar with the process. The New Jersey Form CBT-2553, also known as the Business Tax Certificate of Registration, is a required document for businesses operating in the state of New Jersey. In this article, we will discuss five ways to fill out the New Jersey Form CBT-2553 accurately and efficiently.

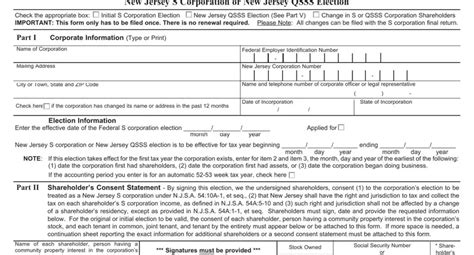

The New Jersey Form CBT-2553 is used to register a business with the New Jersey Division of Taxation. It is a crucial step in obtaining a Business Tax Certificate of Registration, which is required for businesses to operate in the state. The form requires various pieces of information, including the business's name, address, and type of ownership.

1. Manual Filing

One way to fill out the New Jersey Form CBT-2553 is to do it manually. This involves downloading the form from the New Jersey Division of Taxation website, printing it out, and filling it out by hand. This method can be time-consuming and prone to errors, but it is a viable option for those who prefer to work with paper documents.

To fill out the form manually, start by gathering all the necessary information, including the business's name, address, and federal tax identification number. Then, carefully read through the instructions and fill out each section accordingly.

2. Online Filing through the New Jersey Division of Taxation Website

Another way to fill out the New Jersey Form CBT-2553 is to use the online filing system provided by the New Jersey Division of Taxation. This method is more convenient and efficient than manual filing, as it allows businesses to fill out the form electronically and submit it online.

To file online, businesses must first create an account on the New Jersey Division of Taxation website. Once logged in, they can access the online form and fill it out using the provided fields and instructions.

Benefits of Online Filing

Online filing offers several benefits, including:

- Convenience: Businesses can fill out the form from anywhere with an internet connection.

- Efficiency: The online system automatically checks for errors and completeness, reducing the risk of mistakes.

- Speed: Online submissions are processed faster than manual filings.

3. Tax Preparation Software

A third way to fill out the New Jersey Form CBT-2553 is to use tax preparation software. This type of software is designed to guide businesses through the tax preparation process, including filling out forms like the CBT-2553.

Some popular tax preparation software options include TurboTax, QuickBooks, and Xero. These programs offer a range of features, including automatic calculations, error checking, and electronic filing.

To use tax preparation software, businesses must first purchase and install the program. Then, they can follow the prompts to fill out the New Jersey Form CBT-2553 and other required tax forms.

4. Professional Tax Preparation Services

Another option for filling out the New Jersey Form CBT-2553 is to hire a professional tax preparation service. This type of service is provided by certified public accountants (CPAs) or enrolled agents (EAs) who specialize in tax preparation.

Professional tax preparation services can be more expensive than other options, but they offer several benefits, including:

- Expertise: Professional tax preparers have extensive knowledge of tax laws and regulations.

- Accuracy: Professional tax preparers can ensure that the form is filled out accurately and completely.

- Time-saving: Businesses can save time by letting a professional handle the tax preparation process.

How to Choose a Professional Tax Preparation Service

When choosing a professional tax preparation service, businesses should consider the following factors:

- Experience: Look for a service that has experience working with businesses similar to yours.

- Credentials: Make sure the service is provided by a certified public accountant (CPA) or enrolled agent (EA).

- Reviews: Check online reviews to see what other clients have to say about the service.

5. Online Tax Filing Platforms

A final way to fill out the New Jersey Form CBT-2553 is to use an online tax filing platform. This type of platform is designed specifically for tax preparation and offers a range of features, including automatic calculations, error checking, and electronic filing.

Some popular online tax filing platforms include TaxSlayer, Credit Karma Tax, and FreeTaxUSA. These platforms offer a convenient and affordable way to fill out tax forms, including the New Jersey Form CBT-2553.

To use an online tax filing platform, businesses must first create an account on the platform's website. Then, they can follow the prompts to fill out the New Jersey Form CBT-2553 and other required tax forms.

In conclusion, there are several ways to fill out the New Jersey Form CBT-2553, each with its own benefits and drawbacks. By considering the options outlined above, businesses can choose the method that best suits their needs and ensure that they are in compliance with New Jersey tax laws.

We hope this article has been informative and helpful. If you have any questions or need further assistance, please don't hesitate to comment below.

What is the New Jersey Form CBT-2553?

+The New Jersey Form CBT-2553, also known as the Business Tax Certificate of Registration, is a required document for businesses operating in the state of New Jersey.

How do I file the New Jersey Form CBT-2553?

+The New Jersey Form CBT-2553 can be filed manually, online through the New Jersey Division of Taxation website, or using tax preparation software or a professional tax preparation service.

What are the benefits of online filing?

+Online filing offers several benefits, including convenience, efficiency, and speed.