Filling out tax forms can be a daunting task, especially for those who are new to the process or have complex tax situations. The New Jersey Form BA-49, also known as the "Form BA-49 - Employee's Report of Income Tax Withholding," is a form used by New Jersey residents to report their income tax withholding. In this article, we will provide a comprehensive guide on how to fill out the New Jersey Form BA-49, including five different ways to complete the form accurately.

Understanding the New Jersey Form BA-49

Before we dive into the different ways to fill out the form, it's essential to understand what the New Jersey Form BA-49 is and what it's used for. The Form BA-49 is used by New Jersey residents to report their income tax withholding from their employers. The form is typically used by employees who have had taxes withheld from their wages and want to report the amount of taxes withheld to the state.

Why is the Form BA-49 Important?

The Form BA-49 is crucial because it helps the state of New Jersey keep track of the amount of taxes withheld from employees' wages. This information is used to calculate the employee's tax liability and to ensure that the correct amount of taxes is being withheld. Without this form, employees may end up owing more taxes than they should, or they may not receive the correct refund.

Method 1: Filling Out the Form BA-49 Manually

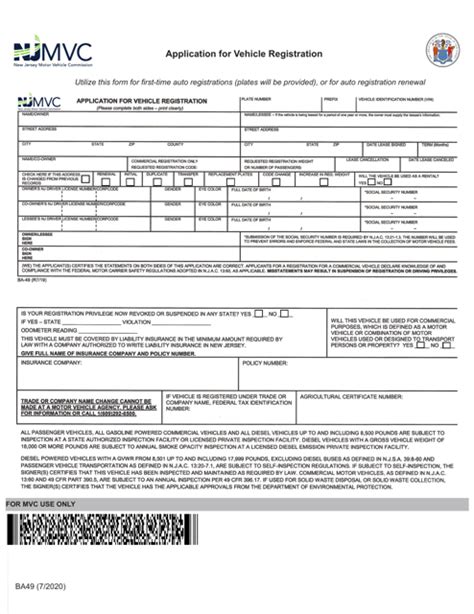

One way to fill out the New Jersey Form BA-49 is to do it manually. This involves printing out the form from the New Jersey Department of Treasury's website or picking one up from a local library or post office. Once you have the form, you will need to fill it out using a pen or pencil. Make sure to follow the instructions carefully and fill out all the required fields.

Here are the steps to follow:

- Start by filling out your name, address, and social security number in the top section of the form.

- Next, fill out the employer's name, address, and federal employer identification number (FEIN) in the section below.

- In the "Gross Income" section, fill out the total amount of income you earned from your employer.

- In the "Tax Withheld" section, fill out the total amount of taxes withheld from your wages.

- Finally, sign and date the form in the bottom section.

Method 2: Using Tax Preparation Software

Another way to fill out the New Jersey Form BA-49 is to use tax preparation software. This software can guide you through the process of filling out the form and ensure that you don't miss any required fields. Some popular tax preparation software includes TurboTax, H&R Block, and TaxAct.

Here are the steps to follow:

- Choose the tax preparation software you want to use and follow the prompts to create an account.

- Once you have created an account, select the New Jersey Form BA-49 as the form you want to fill out.

- Follow the software's prompts to fill out the form, answering all the required questions.

- Once you have completed the form, review it carefully to ensure that all the information is accurate.

- Finally, submit the form electronically or print it out and mail it to the state.

Method 3: Hiring a Tax Professional

If you are not comfortable filling out the New Jersey Form BA-49 on your own, you can hire a tax professional to do it for you. A tax professional can guide you through the process and ensure that the form is filled out accurately.

Here are the steps to follow:

- Choose a tax professional you want to work with, such as a certified public accountant (CPA) or an enrolled agent (EA).

- Provide the tax professional with all the necessary documentation, including your W-2 forms and any other relevant tax documents.

- The tax professional will fill out the form for you, answering all the required questions and ensuring that all the information is accurate.

- Once the form is complete, review it carefully to ensure that all the information is accurate.

- Finally, sign and date the form, and submit it to the state.

Method 4: Using the New Jersey Online Tax Filing System

The state of New Jersey offers an online tax filing system that allows you to fill out and submit the Form BA-49 electronically. This system is free and easy to use, and it can help you avoid errors and ensure that your form is filed on time.

Here are the steps to follow:

- Go to the New Jersey Department of Treasury's website and select the "Online Tax Filing" option.

- Follow the prompts to create an account and select the Form BA-49 as the form you want to fill out.

- Fill out the form electronically, answering all the required questions and ensuring that all the information is accurate.

- Once you have completed the form, review it carefully to ensure that all the information is accurate.

- Finally, submit the form electronically and print out a copy for your records.

Method 5: Filling Out the Form BA-49 by Phone

Finally, you can also fill out the New Jersey Form BA-49 by phone. This involves calling the New Jersey Department of Treasury's customer service number and answering a series of questions over the phone.

Here are the steps to follow:

- Call the New Jersey Department of Treasury's customer service number and let the representative know that you want to fill out the Form BA-49.

- Answer the representative's questions, providing all the necessary information, including your name, address, and social security number.

- The representative will fill out the form for you, answering all the required questions and ensuring that all the information is accurate.

- Once the form is complete, review it carefully to ensure that all the information is accurate.

- Finally, confirm that the form has been submitted and print out a copy for your records.

Conclusion: Choosing the Best Method for You

Filling out the New Jersey Form BA-49 can be a daunting task, but it doesn't have to be. By choosing the right method for you, you can ensure that the form is filled out accurately and on time. Whether you choose to fill out the form manually, use tax preparation software, hire a tax professional, use the New Jersey online tax filing system, or fill out the form by phone, the most important thing is to ensure that the form is accurate and complete.

What is the New Jersey Form BA-49?

+The New Jersey Form BA-49 is a form used by New Jersey residents to report their income tax withholding from their employers.

Why is the Form BA-49 important?

+The Form BA-49 is crucial because it helps the state of New Jersey keep track of the amount of taxes withheld from employees' wages.

How do I fill out the Form BA-49?

+You can fill out the Form BA-49 manually, use tax preparation software, hire a tax professional, use the New Jersey online tax filing system, or fill out the form by phone.