Businesses in Nebraska are required to collect and remit sales tax on taxable sales, but certain entities and transactions are exempt from sales tax. To claim a sales tax exemption, a business must obtain a Nebraska sales tax exemption form from the Nebraska Department of Revenue.

What is a Nebraska Sales Tax Exemption Form?

Types of Nebraska Sales Tax Exemption Forms

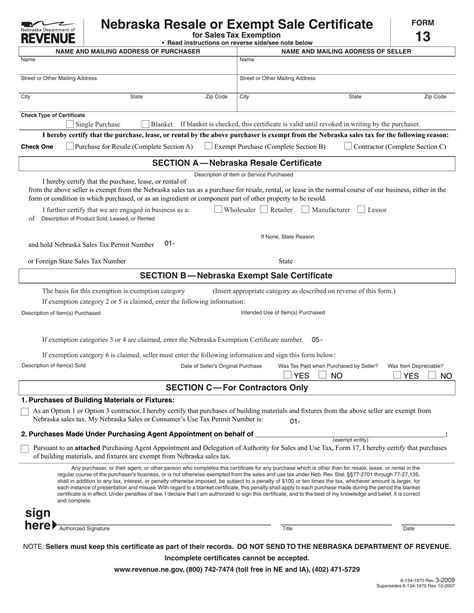

There are several types of Nebraska sales tax exemption forms, each with its own specific requirements and uses. Some of the most common forms include:Form 13:

Form 13 is the most common Nebraska sales tax exemption form. It is used by exempt entities, such as non-profit organizations, government agencies, and certain businesses, to claim an exemption from sales tax.Form 13A:

Form 13A is used by exempt entities that are making purchases for resale. This form is typically used by businesses that are purchasing items that will be resold to customers.Form 13B:

Form 13B is used by exempt entities that are making purchases for use in a manufacturing or processing operation.Who is Eligible for a Nebraska Sales Tax Exemption?

Not all businesses or organizations are eligible for a Nebraska sales tax exemption. To qualify for an exemption, an entity must meet certain requirements, such as:- Being a non-profit organization

- Being a government agency

- Being a certain type of business, such as a manufacturer or a farmer

- Meeting specific income or asset requirements

Examples of Eligible Entities:

* Non-profit organizations, such as charities and educational institutions * Government agencies, such as state and local governments * Manufacturers and processors * Farmers and agricultural businesses * Certain types of businesses, such as airlines and railroadsHow to Obtain a Nebraska Sales Tax Exemption Form

To obtain a Nebraska sales tax exemption form, an eligible entity must submit an application to the Nebraska Department of Revenue. The application must include certain information, such as:- The entity's name and address

- The entity's federal tax ID number

- A description of the entity's business or activities

- A statement explaining why the entity is eligible for an exemption

Steps to Obtain a Form:

1. Determine if your entity is eligible for an exemption 2. Gather required information and documentation 3. Submit an application to the Nebraska Department of Revenue 4. Wait for the department to review and approve your application 5. Receive your exemption form and use it to claim an exemption on future purchasesRequirements for Completing a Nebraska Sales Tax Exemption Form

When completing a Nebraska sales tax exemption form, certain information and documentation are required. This may include:- The entity's name and address

- The entity's federal tax ID number

- A description of the purchases being made

- A statement explaining why the entity is eligible for an exemption

- The seller's name and address

Important Information:

* The exemption form must be completed in its entirety and signed by an authorized representative of the exempt entity * The form must be provided to the seller at the time of purchase * The form is only valid for a specific period, usually one yearPenalties for Failure to Comply

Failure to comply with Nebraska sales tax exemption form requirements can result in penalties and fines. This may include:- Payment of sales tax on exempt purchases

- Fines and penalties for failure to provide the exemption form

- Loss of exemption privileges

Consequences of Non-Compliance:

* Payment of sales tax on exempt purchases can be costly and may impact a business's bottom line * Fines and penalties can be significant and may impact a business's reputation * Loss of exemption privileges can impact a business's ability to make exempt purchases in the futureWhat is the purpose of a Nebraska sales tax exemption form?

+The purpose of a Nebraska sales tax exemption form is to certify that a business or organization is exempt from paying sales tax on certain purchases.

Who is eligible for a Nebraska sales tax exemption?

+Eligible entities include non-profit organizations, government agencies, manufacturers, farmers, and certain types of businesses.

How do I obtain a Nebraska sales tax exemption form?

+To obtain a Nebraska sales tax exemption form, an eligible entity must submit an application to the Nebraska Department of Revenue.

In conclusion, a Nebraska sales tax exemption form is a crucial document for businesses and organizations that are exempt from paying sales tax on certain purchases. To obtain a form, an entity must meet specific requirements and follow the necessary steps. Failure to comply with the requirements can result in penalties and fines. It is essential to understand the rules and regulations surrounding Nebraska sales tax exemption forms to ensure compliance and avoid any issues.