Are you ready to embark on a new journey with the National Credit Union Administration (NCUA)? The NCUA 101 form is an essential document for credit unions to register and obtain a charter. In this article, we will break down the process into 5 easy steps, making it simple for you to fill out the NCUA 101 form.

What is the NCUA 101 Form?

The NCUA 101 form is a crucial document required for credit unions to register and obtain a charter from the National Credit Union Administration (NCUA). The form collects essential information about the credit union, its members, and its operations.

Step 1: Gather Required Information

Before you start filling out the NCUA 101 form, make sure you have all the necessary information readily available. This includes:

- Credit union name and address

- Date of formation

- Purpose and objectives of the credit union

- Membership information, including the number of members and their demographics

- Financial information, including the credit union's assets, liabilities, and capital

- Information about the credit union's management and leadership

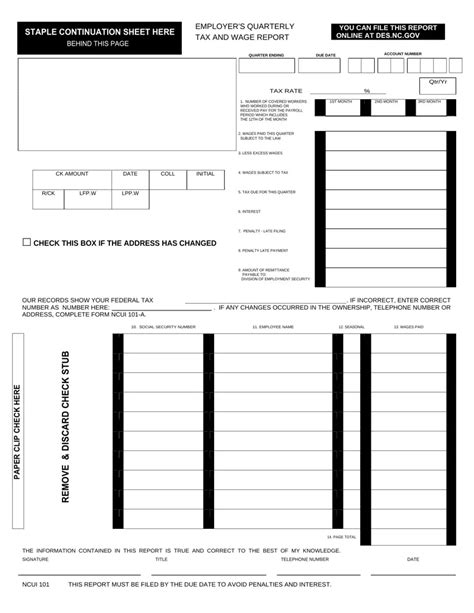

Step 2: Understand the Form Structure

The NCUA 101 form is divided into several sections, each collecting specific information about the credit union. The form consists of:

- Section 1: General Information

- Section 2: Membership Information

- Section 3: Financial Information

- Section 4: Management and Leadership Information

- Section 5: Additional Information

Step 3: Fill Out Section 1 - General Information

In this section, you will provide general information about the credit union, including its name, address, date of formation, and purpose. Make sure to provide accurate and up-to-date information.

- Section 1.1: Credit Union Name and Address

- Section 1.2: Date of Formation

- Section 1.3: Purpose and Objectives

Step 4: Complete Sections 2-5

In these sections, you will provide more detailed information about the credit union's membership, finances, management, and leadership.

- Section 2: Membership Information

- Number of members

- Demographics (age, income, occupation, etc.)

- Section 3: Financial Information

- Assets

- Liabilities

- Capital

- Section 4: Management and Leadership Information

- Board of Directors

- Management team

- Section 5: Additional Information

- Any additional information relevant to the credit union's operations

Step 5: Review and Submit the Form

Once you have completed all sections of the NCUA 101 form, review it carefully to ensure accuracy and completeness. Make sure to sign and date the form, and submit it to the NCUA along with any required supporting documentation.

By following these 5 easy steps, you can fill out the NCUA 101 form with confidence. Remember to review the form carefully and submit it along with any required supporting documentation to ensure a smooth registration process.

Still Have Questions?

Check out our FAQ section below for answers to common questions about the NCUA 101 form.

What is the purpose of the NCUA 101 form?

+The NCUA 101 form is used to register and obtain a charter from the National Credit Union Administration (NCUA).

How long does it take to fill out the NCUA 101 form?

+The time it takes to fill out the NCUA 101 form varies depending on the complexity of the information required. On average, it takes around 2-3 hours to complete the form.

What documents are required to submit with the NCUA 101 form?

+The required documents vary depending on the credit union's specific situation. Common documents required include financial statements, membership lists, and management information.

We hope this article has been helpful in guiding you through the process of filling out the NCUA 101 form. If you have any further questions or concerns, please don't hesitate to reach out to us.